The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how specialty retail stocks fared in Q3, starting with GameStop (NYSE: GME).

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 2.7%.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

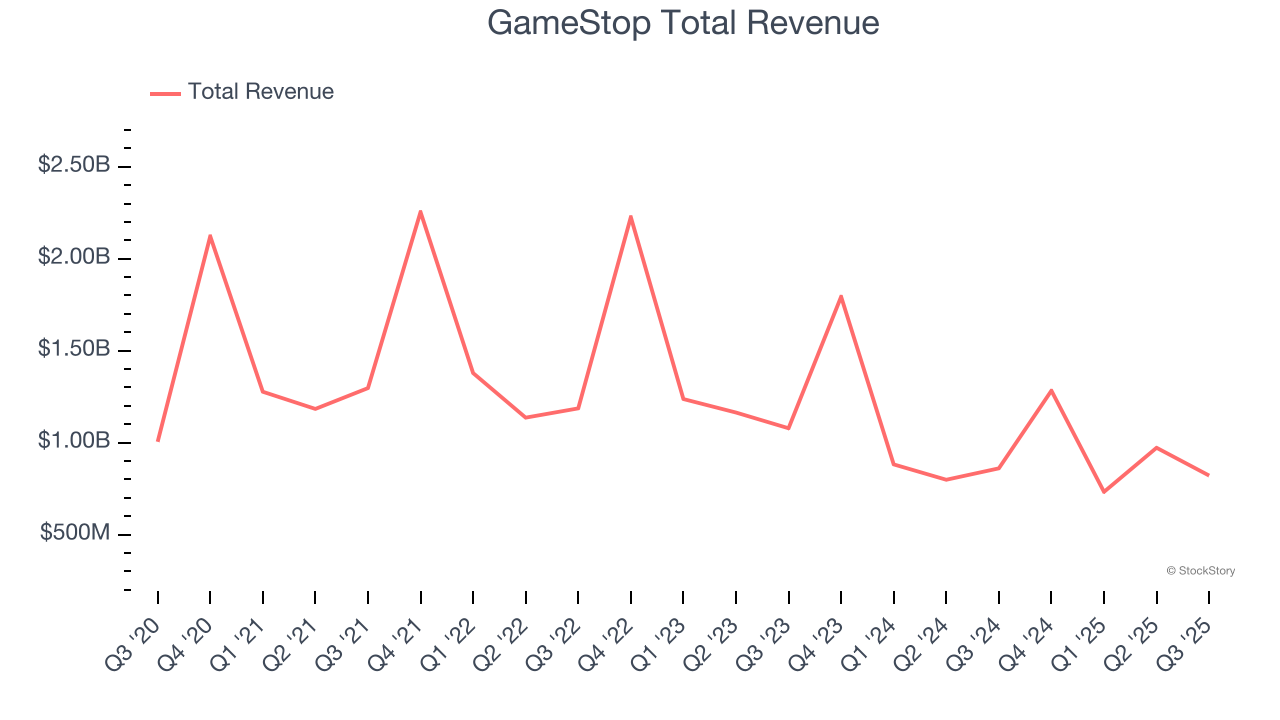

GameStop (NYSE: GME)

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $821 million, down 4.6% year on year. This print fell short of analysts’ expectations by 16.8%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ gross margin estimates but a significant miss of analysts’ revenue estimates.

GameStop delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $22.98.

Read our full report on GameStop here, it’s free.

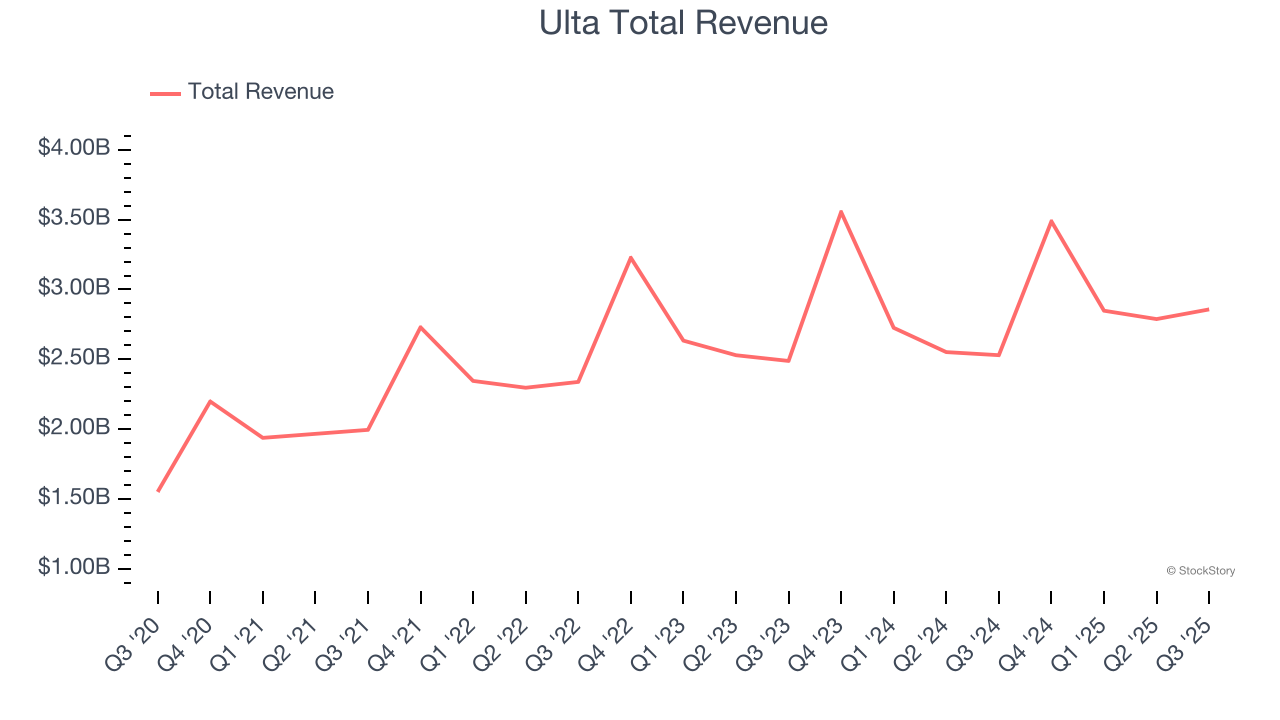

Best Q3: Ulta (NASDAQ: ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ: ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Ulta reported revenues of $2.86 billion, up 12.9% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Ulta achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 27% since reporting. It currently trades at $680.72.

Is now the time to buy Ulta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Dick's (NYSE: DKS)

Started as a hunting supply store, Dick’s Sporting Goods (NYSE: DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Dick's reported revenues of $4.17 billion, up 36.3% year on year, falling short of analysts’ expectations by 10.2%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Dick's delivered the fastest revenue growth but had the weakest full-year guidance update in the group. The stock is flat since the results and currently trades at $207.70.

Read our full analysis of Dick’s results here.

Best Buy (NYSE: BBY)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE: BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy reported revenues of $9.67 billion, up 2.4% year on year. This print beat analysts’ expectations by 1%. It was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The stock is down 11.3% since reporting and currently trades at $67.06.

Read our full, actionable report on Best Buy here, it’s free.

Sally Beauty (NYSE: SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE: SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $947.1 million, up 1.3% year on year. This number topped analysts’ expectations by 1.6%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The stock is up 9.3% since reporting and currently trades at $16.04.

Read our full, actionable report on Sally Beauty here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.