Cash-back rewards platform Ibotta (NYSE: IBTA) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 2.2% year on year to $86.03 million. Next quarter’s revenue guidance of $82 million underwhelmed, coming in 19.3% below analysts’ estimates. Its GAAP profit of $0.08 per share was 58.5% below analysts’ consensus estimates.

Is now the time to buy Ibotta? Find out by accessing our full research report, it’s free.

Ibotta (IBTA) Q2 CY2025 Highlights:

- Revenue: $86.03 million vs analyst estimates of $90.53 million (2.2% year-on-year decline, 5% miss)

- EPS (GAAP): $0.08 vs analyst expectations of $0.19 (58.5% miss)

- Adjusted EBITDA: $17.88 million vs analyst estimates of $20.07 million (20.8% margin, 10.9% miss)

- Revenue Guidance for Q3 CY2025 is $82 million at the midpoint, below analyst estimates of $101.6 million

- EBITDA guidance for Q3 CY2025 is $11.5 million at the midpoint, below analyst estimates of $31.09 million

- Operating Margin: 1.4%, up from -24.6% in the same quarter last year

- Free Cash Flow Margin: 21.9%, down from 37.2% in the same quarter last year

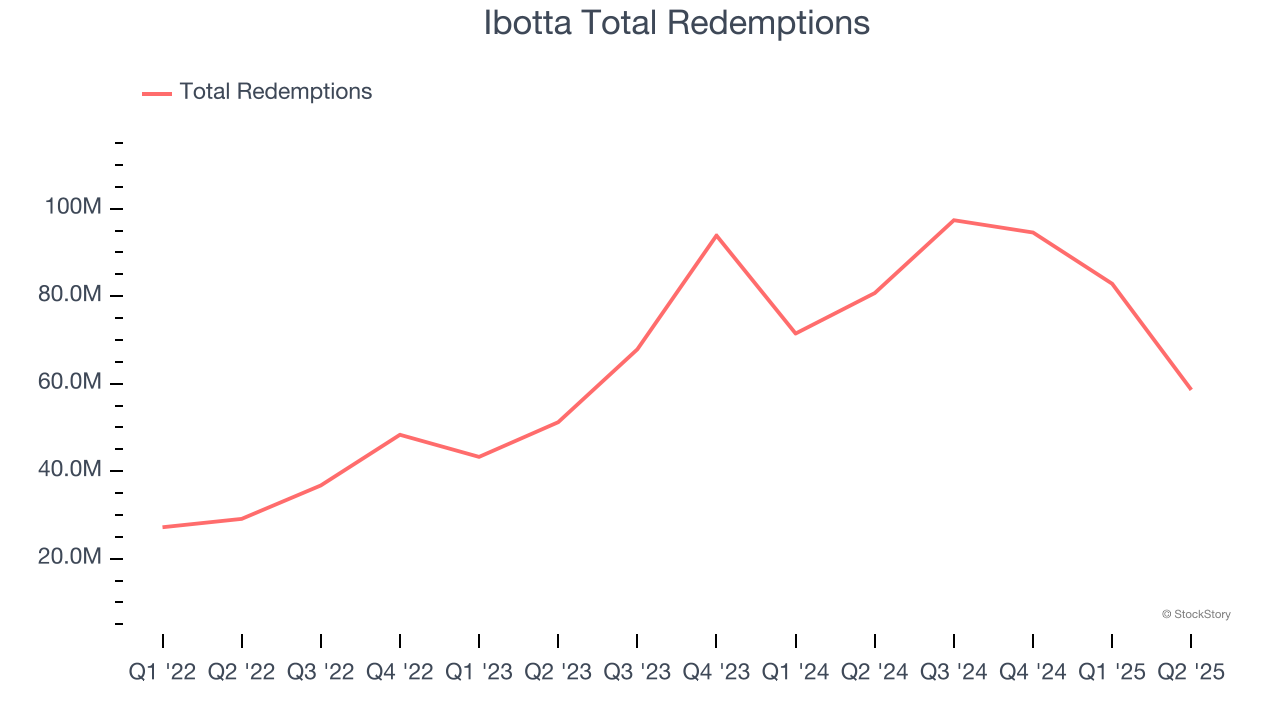

- Total Redemptions: 58.6 million, down 22.12 million year on year

- Market Capitalization: $935.9 million

“Ibotta is working hard to bring the power of performance marketing to the CPG industry, allowing our clients to drive profitable revenue growth at scale,” said Ibotta CEO and founder, Bryan Leach.

Company Overview

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE: IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

Revenue Growth

Reviewing a company’s top-line performance can reveal insights into its business quality. Growth can signal it’s capitalizing on a new product or emerging industry trend.

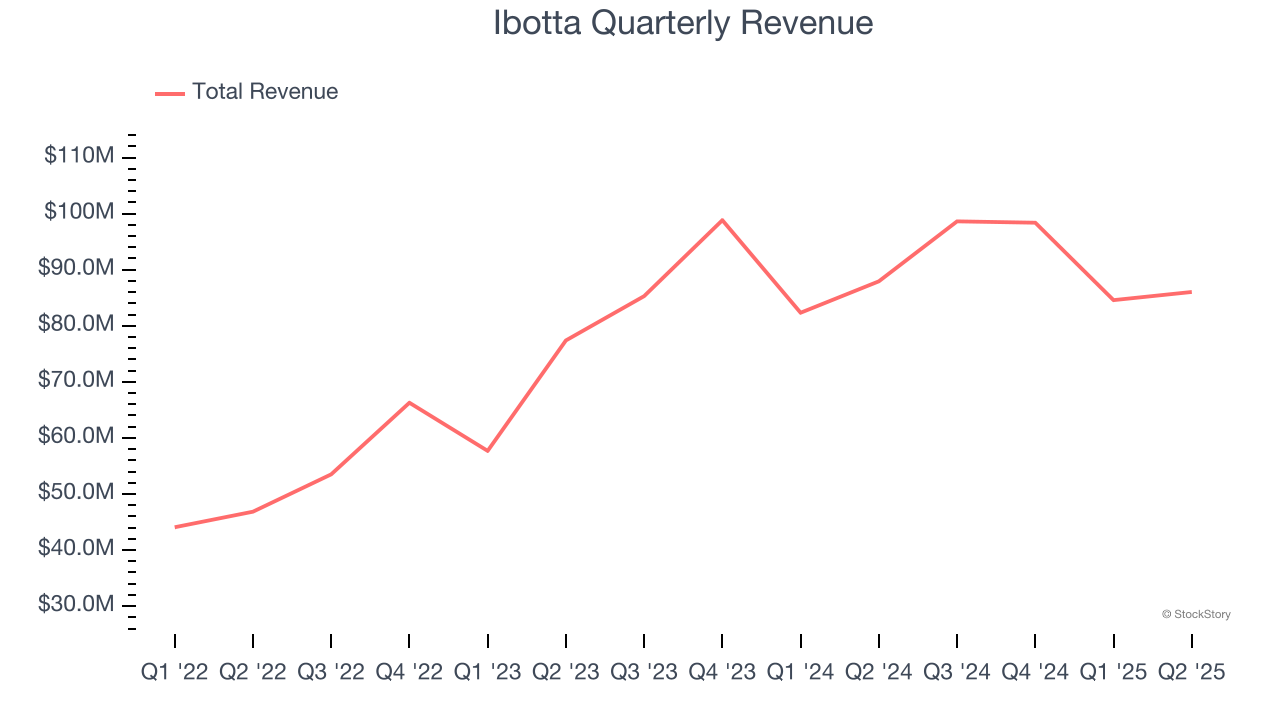

With $367.6 million in revenue over the past 12 months, Ibotta is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

We can dig further into the company’s revenue dynamics by analyzing its number of total redemptions, which reached 58.6 million in the latest quarter. Over the last two years, Ibotta’s total redemptions averaged 41.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Ibotta missed Wall Street’s estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $86.03 million of revenue. Company management is currently guiding for a 16.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and indicates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

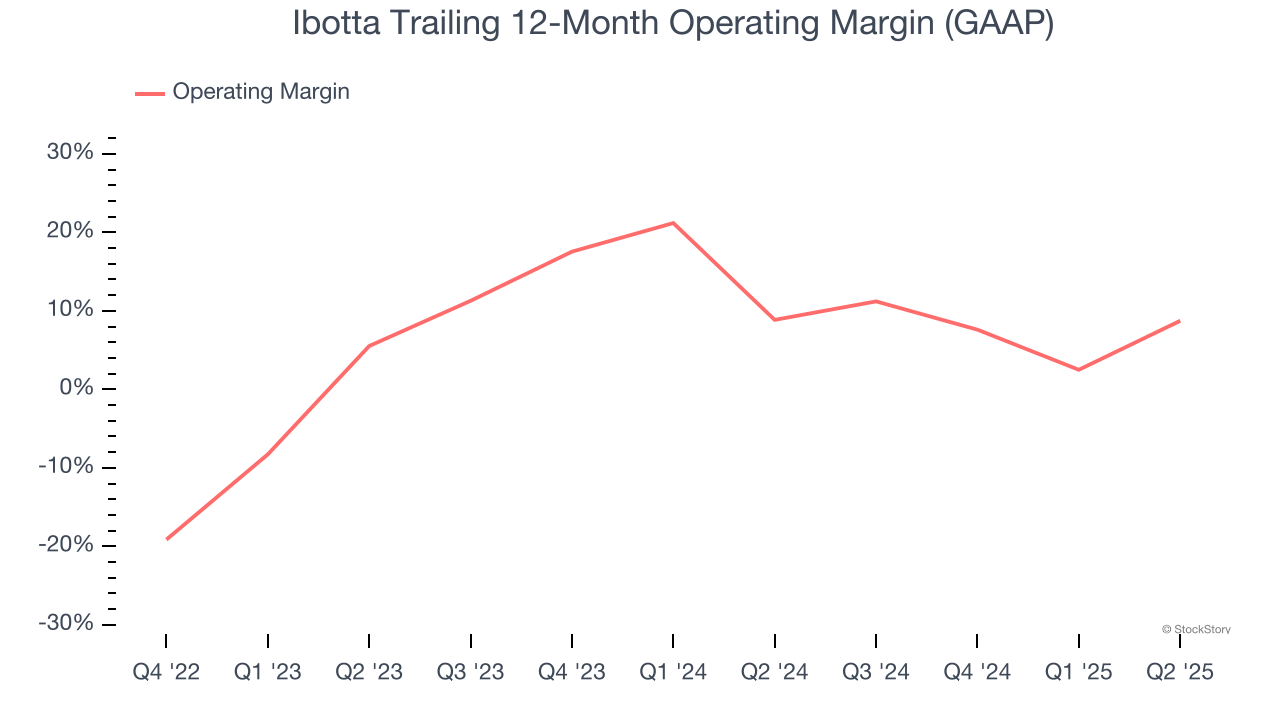

Ibotta was profitable over the last four years but held back by its large cost base. Its average operating margin of 3.9% was weak for a business services business.

On the plus side, Ibotta’s operating margin rose by 38.1 percentage points over the last four years.

This quarter, Ibotta generated an operating margin profit margin of 1.4%, up 26.1 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

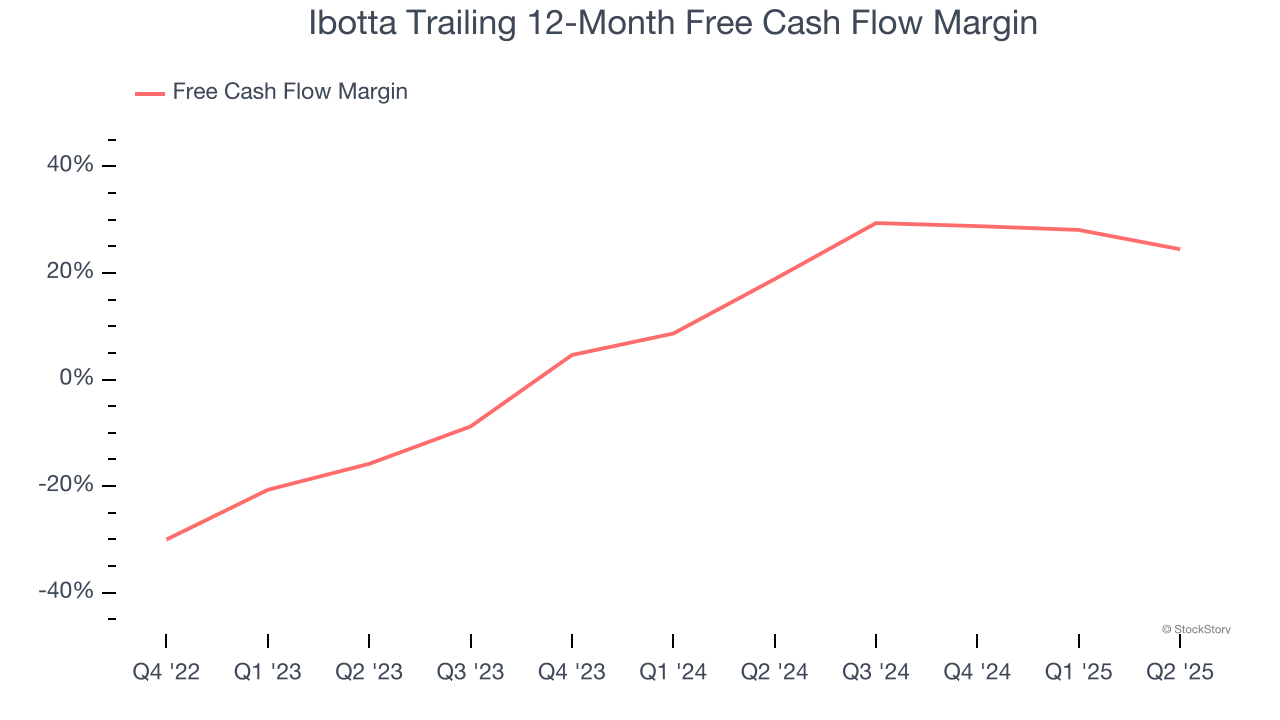

Ibotta has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.5% over the last four years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Ibotta’s margin expanded by 47.7 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Ibotta’s free cash flow clocked in at $18.86 million in Q2, equivalent to a 21.9% margin. The company’s cash profitability regressed as it was 15.3 percentage points lower than in the same quarter last year, but it’s still above its four-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Ibotta’s Q2 Results

We struggled to find many positives in these results. Its revenue guidance for next quarter missed and its revenue fell short of Wall Street’s estimates. Overall, this was a very weak quarter. The stock traded down 29.6% to $24 immediately after reporting.

Ibotta may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.