Angi has gotten torched over the last six months - since June 2025, its stock price has dropped 28.7% to $12.01 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Angi, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Angi Not Exciting?

Even with the cheaper entry price, we're cautious about Angi. Here are three reasons why ANGI doesn't excite us and a stock we'd rather own.

1. Declining Service Requests Reflect Product Weakness

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Angi struggled with new customer acquisition over the last two years as its service requests have declined by 20.6% annually to 4.14 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Angi wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Angi’s revenue to stall. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

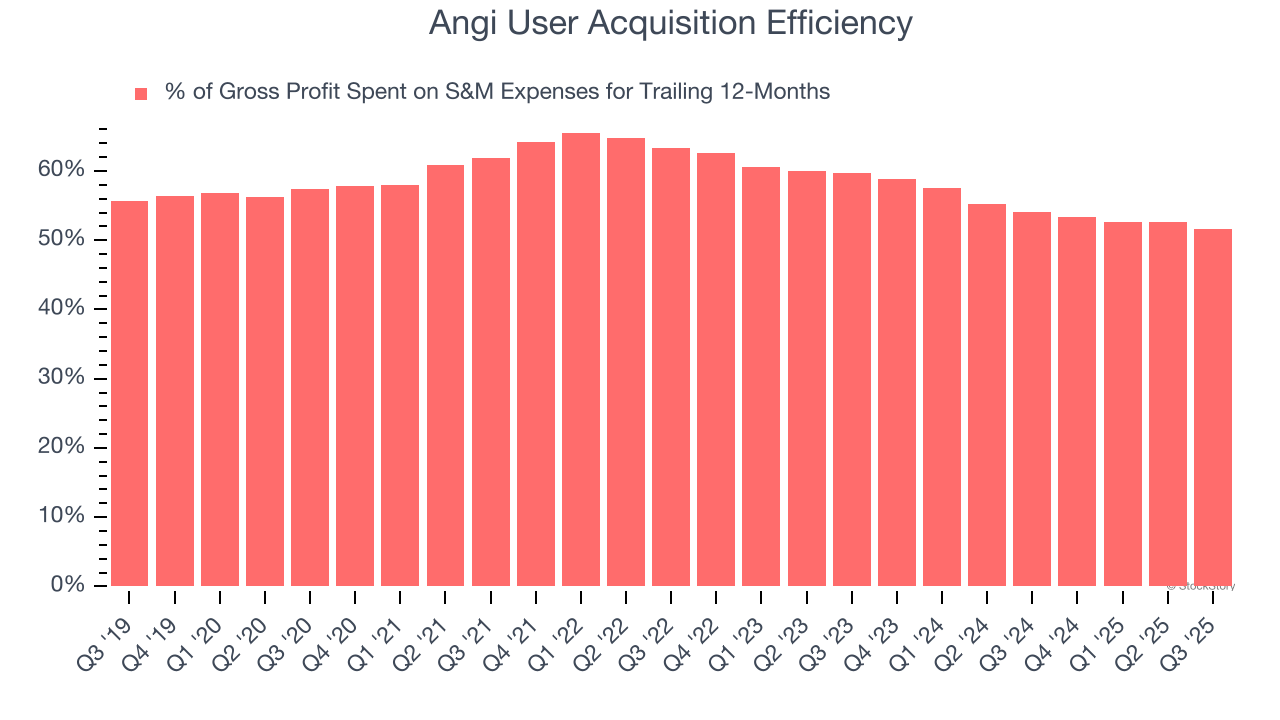

3. Poor Marketing Efficiency Drains Profits

Consumer internet businesses like Angi grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s expensive for Angi to acquire new users as the company has spent 51.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Angi’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

Final Judgment

Angi isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 3.5× forward EV/EBITDA (or $12.01 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Angi

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.