Bedding manufacturer and retailer Sleep Number (NASDAQ: SNBR) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.6% year on year to $342.9 million. The company’s full-year revenue guidance of $1.4 billion at the midpoint came in 2.8% below analysts’ estimates. Its GAAP loss of $1.73 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Sleep Number? Find out by accessing our full research report, it’s free for active Edge members.

Sleep Number (SNBR) Q3 CY2025 Highlights:

- Revenue: $342.9 million vs analyst estimates of $362.5 million (19.6% year-on-year decline, 5.4% miss)

- EPS (GAAP): -$1.73 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $13.25 million vs analyst estimates of $31.4 million (3.9% margin, 57.8% miss)

- The company dropped its revenue guidance for the full year to $1.4 billion at the midpoint from $1.45 billion, a 3.4% decrease

- EBITDA guidance for the full year is $70 million at the midpoint, below analyst estimates of $108.1 million

- Operating Margin: -11.8%, down from 2% in the same quarter last year

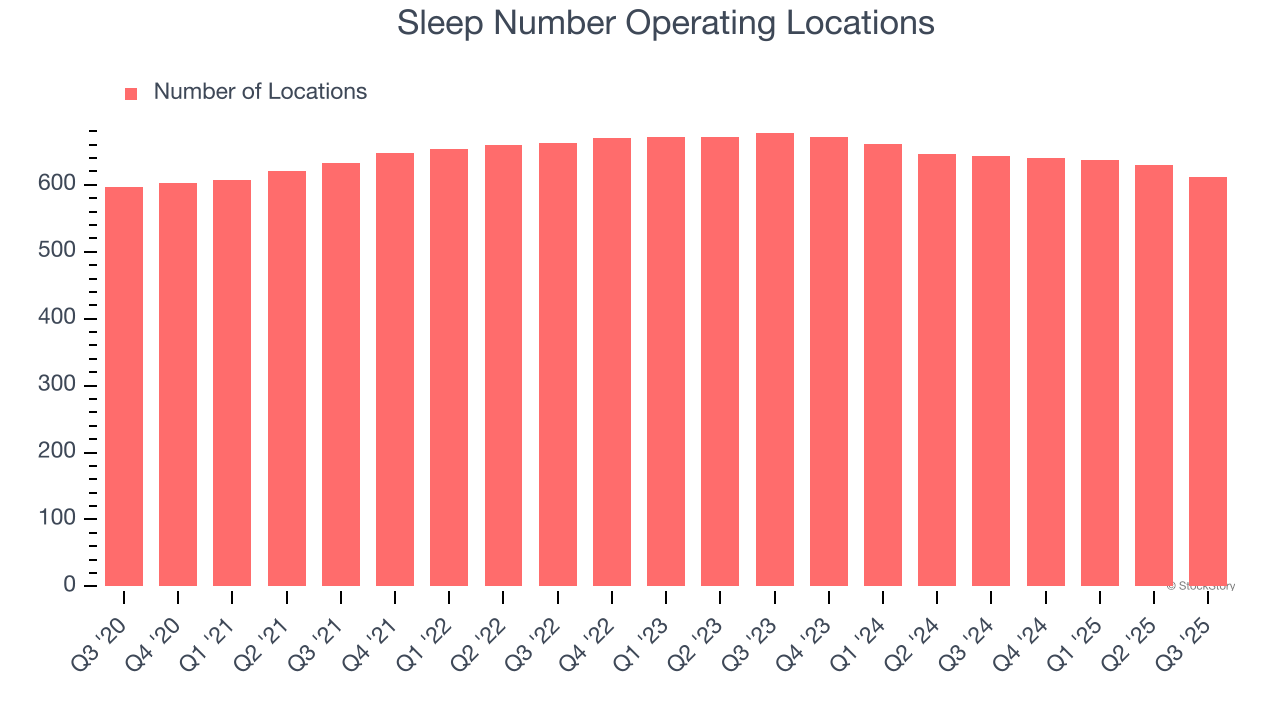

- Locations: 611 at quarter end, down from 643 in the same quarter last year

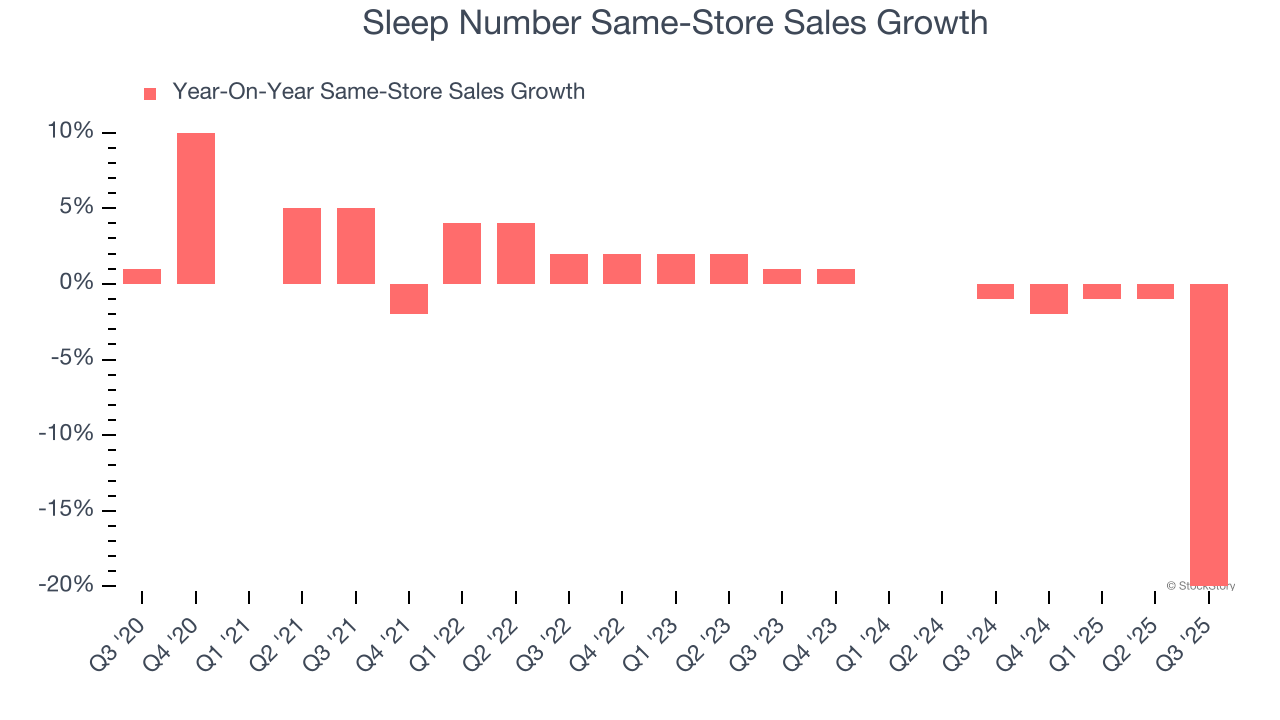

- Same-Store Sales fell 20% year on year (-1% in the same quarter last year)

- Market Capitalization: $125.2 million

Linda Findley, President and CEO, commented, “We have successfully executed an amendment and extension of our bank agreement through 2027, giving us greater flexibility to further our turnaround plans. With this new agreement, combined with meaningful fixed cost reductions achieved in 2025, we will invest in growth in 2026. To drive consumer demand, we are making strategic shifts in three key areas: product, brand positioning and distribution.”

Company Overview

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ: SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.44 billion in revenue over the past 12 months, Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Sleep Number’s revenue declined by 2.4% per year over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores and observed lower sales at existing, established locations.

This quarter, Sleep Number missed Wall Street’s estimates and reported a rather uninspiring 19.6% year-on-year revenue decline, generating $342.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. While this projection implies its newer products will spur better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Sleep Number listed 611 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3.3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Sleep Number’s demand has been shrinking over the last two years as its same-store sales have averaged 3% annual declines. This performance isn’t ideal, and Sleep Number is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sleep Number’s same-store sales fell by 20% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Sleep Number’s Q3 Results

We struggled to find many positives in these results. Same-store sales cratered this quarter. Its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a very bad quarter. The stock traded down 30.1% to $3.86 immediately following the results.

Sleep Number didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.