Telecommunications infrastructure company Lumen Technologies (NYSE: LUMN) reported Q1 CY2026 results exceeding the market’s revenue expectations, but sales fell by 4.4% year on year to $3.04 billion. Its GAAP profit of $0.23 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Lumen? Find out by accessing our full research report, it’s free.

Lumen (LUMN) Q1 CY2026 Highlights:

- Revenue: $3.04 billion vs analyst estimates of $2.95 billion (4.4% year-on-year decline, 2.9% beat)

- EPS (GAAP): $0.23 vs analyst estimates of -$0.18 (significant beat)

- Adjusted EBITDA: $767 million vs analyst estimates of $837.1 million (25.2% margin, 8.4% miss)

- EBITDA guidance for the full year is $3.2 billion at the midpoint, below analyst estimates of $3.37 billion

- Operating Margin: -6.6%, down from 3.4% in the same quarter last year

- Free Cash Flow was -$1.08 billion, down from $354 million in the same quarter last year

- Market Capitalization: $9.16 billion

“The combination of a solid fourth quarter and the close of the AT&T transaction marks a defining moment for Lumen and strengthens our foundation for growth,” said Lumen CEO Kate Johnson.

Company Overview

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Revenue Growth

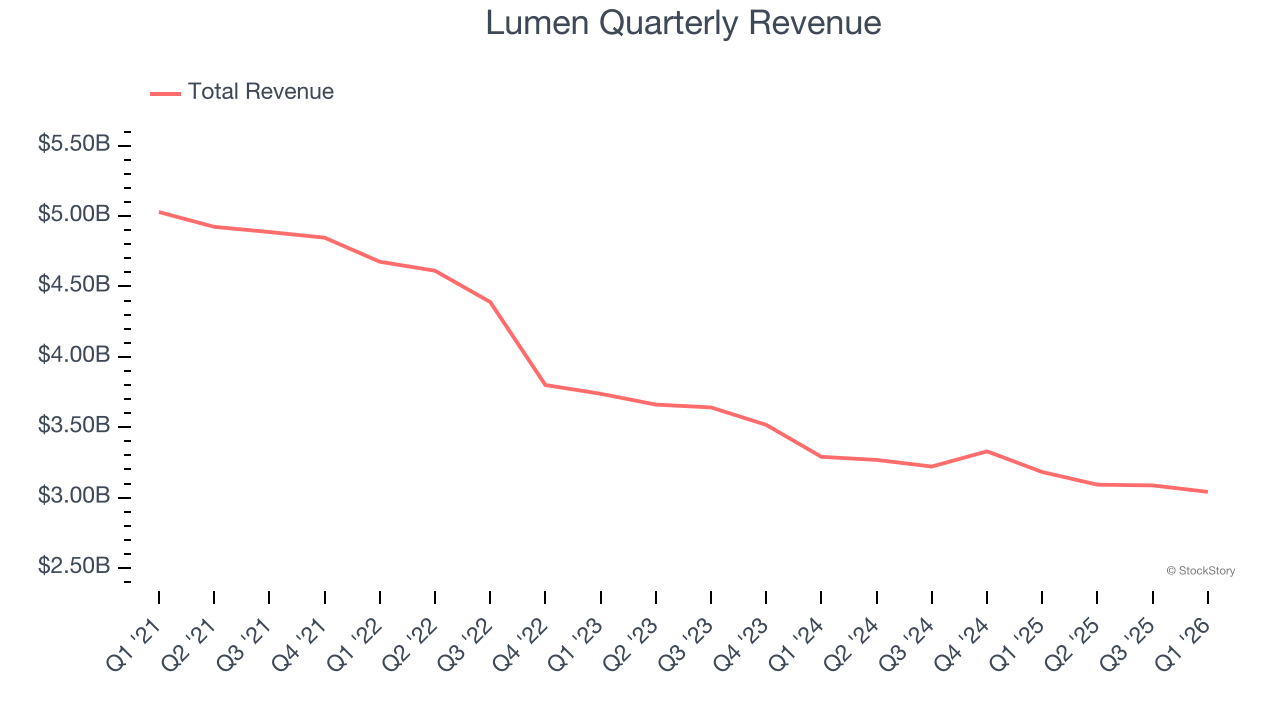

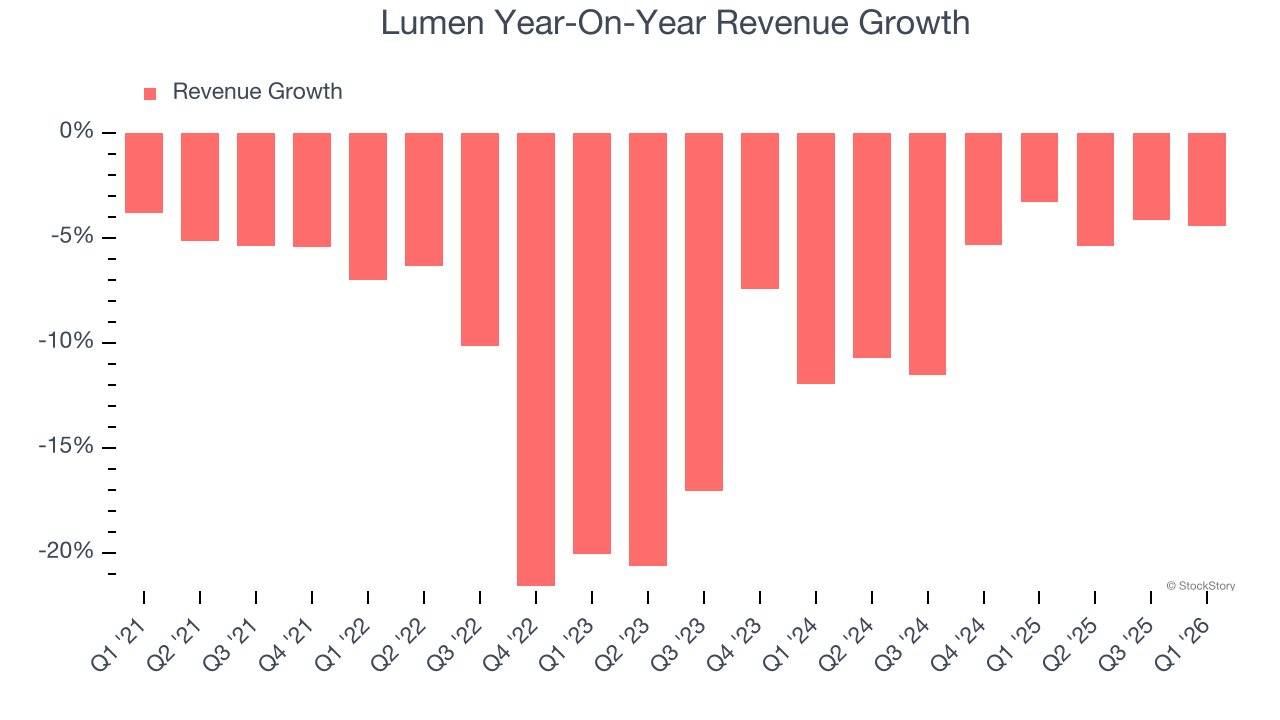

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Lumen’s demand was weak and its revenue declined by 9.7% per year. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Lumen’s annualized revenue declines of 6.7% over the last two years suggest its demand continued shrinking.

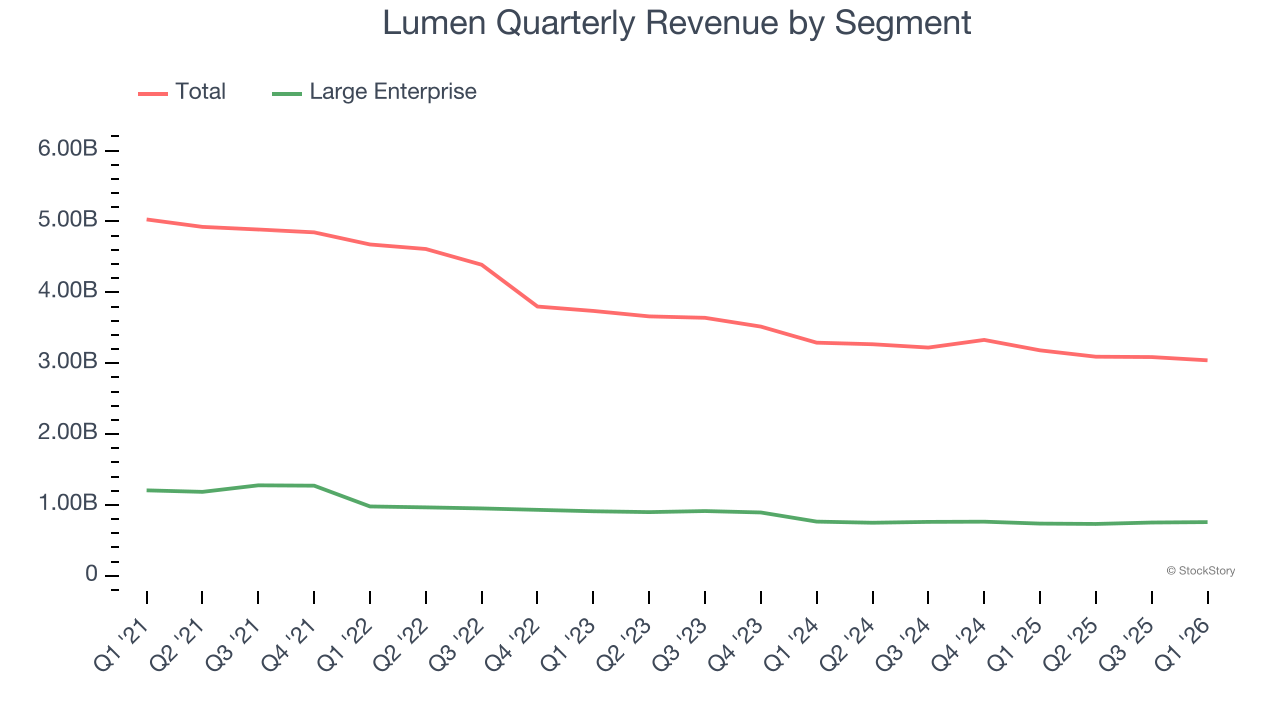

We can better understand the company’s revenue dynamics by analyzing its most important segment, Large Enterprise. Over the last two years, Lumen’s Large Enterprise revenue (services provided to businesses) averaged 7.5% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Lumen’s revenue fell by 4.4% year on year to $3.04 billion but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to decline by 7.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

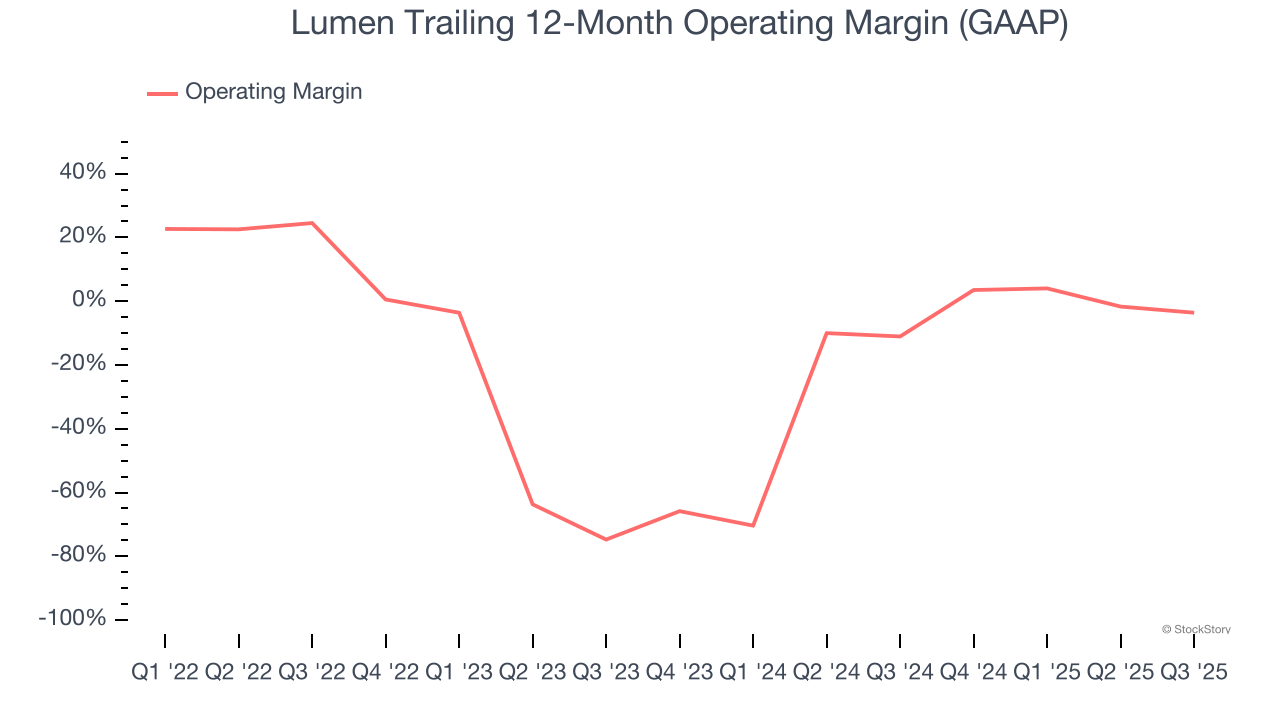

Lumen’s high expenses have contributed to an average operating margin of negative 9.1% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Lumen’s operating margin decreased by 32.2 percentage points over the last five years. Lumen’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Lumen generated a negative 6.6% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

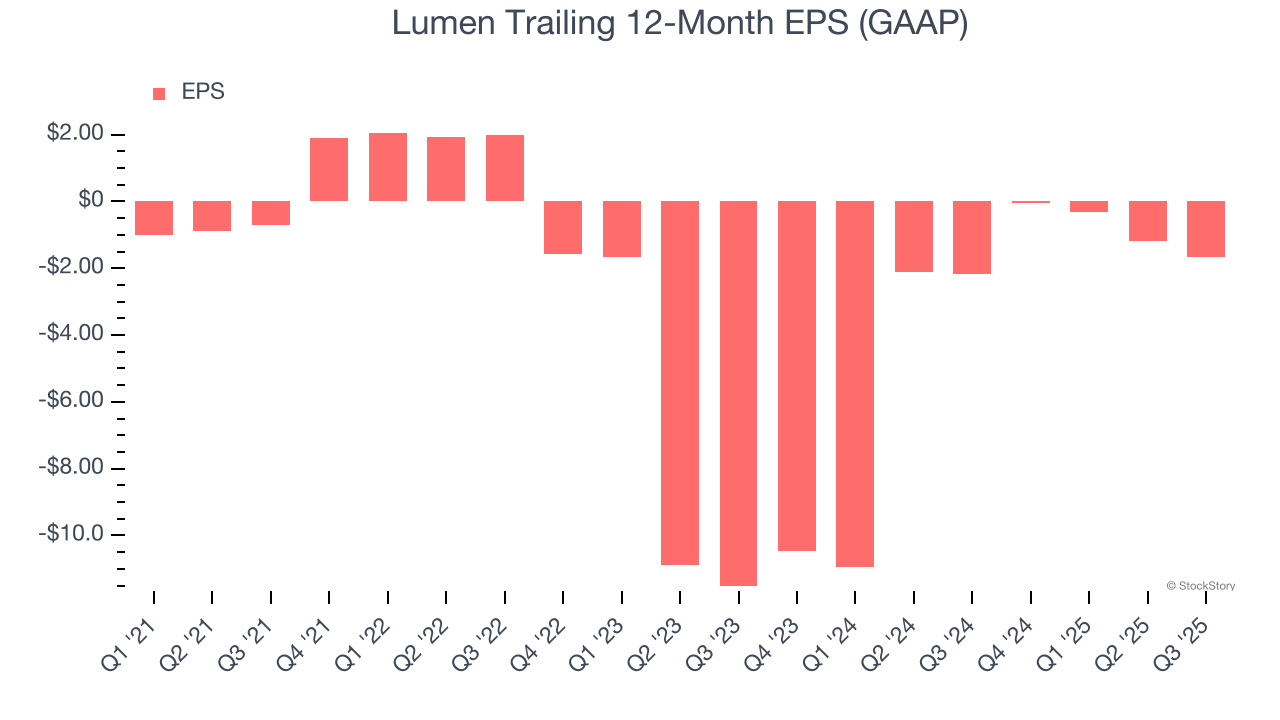

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Lumen’s earnings losses deepened over the last five years as its EPS dropped 26% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Lumen’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Lumen, its two-year annual EPS growth of 61.6% was higher than its five-year trend. Its improving earnings is an encouraging data point.

In Q1, Lumen reported EPS of $0.23, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Lumen’s Q1 Results

It was good to see Lumen beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, EBITDA missed and EBITDA guidance came in below expectations. Zooming out, we think this was a mixed print. The market seemed to be focused on the EBITDA numbers, and the stock traded down 4.6% to $8.07 immediately following the results.

Big picture, is Lumen a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).