Let’s dig into the relative performance of Remitly (NASDAQ: RELY) and its peers as we unravel the now-completed Q3 consumer internet earnings season.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 47 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

While some consumer internet stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.3% since the latest earnings results.

Remitly (NASDAQ: RELY)

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

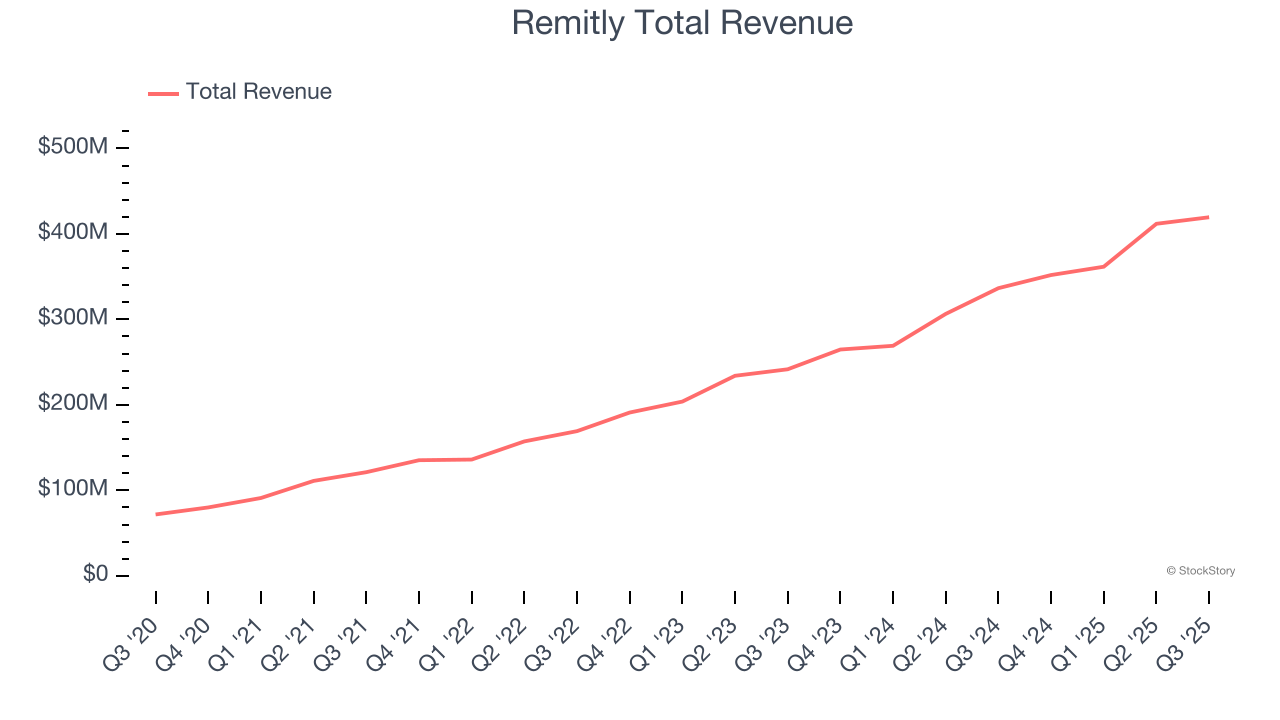

Remitly reported revenues of $419.5 million, up 24.7% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

“In Q3, we built on the momentum from last quarter, delivering innovation across the product portfolio,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Unsurprisingly, the stock is down 22.9% since reporting and currently trades at $12.95.

Is now the time to buy Remitly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 21.2% since reporting. It currently trades at $27.17.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

As expected, the stock is down 8% since the results and currently trades at $7.50.

Read our full analysis of ACV Auctions’s results here.

Uber (NYSE: UBER)

Notoriously funded with $7.7 billion from the Softbank Vision Fund, Uber (NYSE: UBER) operates a platform of on-demand services such as ride-hailing, food delivery, and freight.

Uber reported revenues of $13.47 billion, up 20.4% year on year. This number beat analysts’ expectations by 1.5%. More broadly, it was a satisfactory quarter as it also recorded strong growth in its users but a slight miss of analysts’ EBITDA estimates.

The company reported 189 million users, up 17.4% year on year. The stock is down 12.3% since reporting and currently trades at $87.75.

Read our full, actionable report on Uber here, it’s free for active Edge members.

Alphabet (NASDAQ: GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $102.3 billion, up 15.9% year on year. This print surpassed analysts’ expectations by 2.4%. It was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 14.7% since reporting and currently trades at $316.30.

Read our full, actionable report on Alphabet here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.