(NewsUSA)

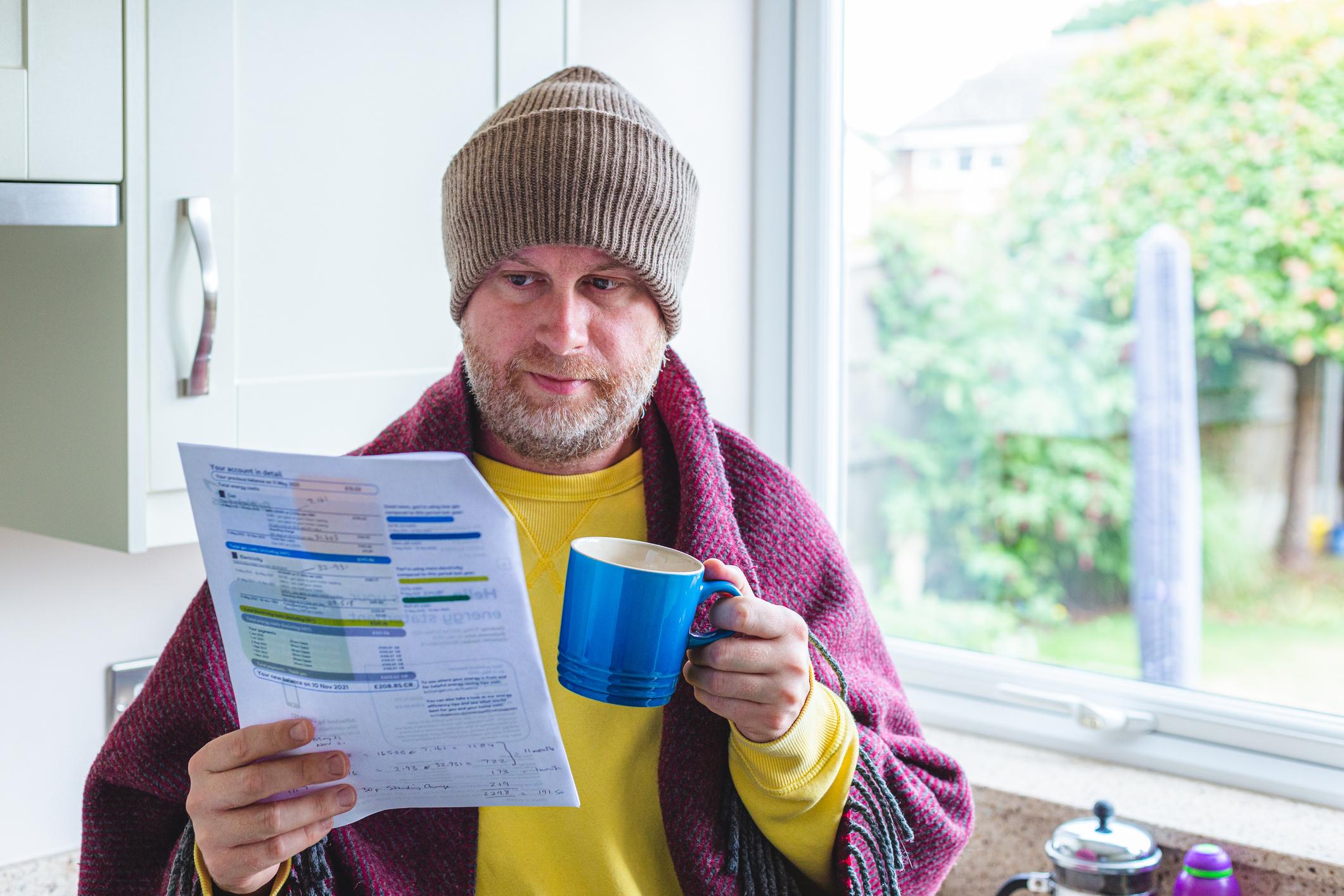

(NewsUSA) - Winter is coming. And so are winter expenses. Planning ahead for inevitable winter expenses, from holiday shopping to home winterization, can save you time and stress as well as money. And it can leave you with a robust nest egg when spring arrives.

- Winter is coming. And so are winter expenses. Planning ahead for inevitable winter expenses, from holiday shopping to home winterization, can save you time and stress as well as money. And it can leave you with a robust nest egg when spring arrives.

Unlike holiday decorations, it’s never too early, or too late, to budget for winter expenses, says Rod Meloni, a CERTIFIED FINANCIAL PLANNERTM professional.

Setting aside funds for winter expenses can help you avoid overspending and make sure that you are covered in case of an emergency, says Meloni. For example, setting aside money in advance for contractors to inspect a furnace or clean gutters means you won’t feel pinched when the cold weather kicks in.

Taking smart steps to winterize your home now can save you money later. Some strategies are simple and free; some are more costly and complicated, but a CERTIFIED FINANCIAL PLANNERTM professional can offer help to develop a budget or fit these expenses into your budget.

Consider inside and outside factors for winterizing your home.

Outside, be sure to turn off external spigots to avoid bursting pipes, and put away hoses and sprinklers. Swap screens for storm doors and windows that allow your home to heat more efficiently. Don’t forget to clean the gutters — a buildup of leaves can keep water from draining and allow ice to accumulate and potentially leak into your home.

Inside, schedule an annual inspection for your furnace, and check for insulation of water pipes. Check areas around the attic, windowsills, and electrical outlets for air leaks, and fill them with insulation as needed.

Avoid the heating bill blues by incorporating some money-saving ideas into your winter plans. Installing a programmable thermostat lets you set temperatures lower at times of day when you aren’t home, or when you are on vacation. If your budget permits, check out investing in alternative heating systems such as pellet stoves or solar heat, which can pay off in savings if you plan to stay in your current home long-term.

Make sure your insurance is ready for winter, too. A CFP® professional can help you review homeowners insurance and determine whether you need to increase your coverage.

Also, be aware that winter can bring a catch-all of potentially unexpected expenses, from the need for snow tires or shovels to backup child care in case of a snow day or winter illness. Setting aside an emergency fund for winter expenses gives you a sense of security, and if you don’t need the funds this year, roll them over to next winter.

Every season involves expenses that should be incorporated into your financial plans. A CFP® professional can help you think through these considerations and build a comprehensive plan that keeps you on track to achieve your goals, no matter the season.