Shares of Oracle Corporation (ORCL) have fallen sharply, dropping over 55% from their 52-week high of $345.72. The decline reflects investor concern over the company’s aggressive capital spending plans, its heavy reliance on a single customer, and lingering questions about how it will finance the infrastructure required to meet surging demand.

Oracle is in the midst of a major expansion of its data center footprint to support contracted AI workloads. While these investments align with the secular growth of AI workloads, the near-term financial strain is already evident. In the second quarter of fiscal 2026, it delivered a negative free cash flow of $10 billion. The decline was due to the capital expenditures of $12 billion. That level of investment has materially compressed cash generation and heightened scrutiny around capital allocation discipline.

Oracle is confident that these investments will translate into durable, high-margin cloud and AI revenue streams over time. However, at present, the market is discounting that future payoff. Concerns about a potential AI investment bubble have prompted broader sector-wide de-risking, and Oracle’s heavy spending profile has made it particularly vulnerable to profit-taking.

Turning to customer concentration risk, a significant portion of Oracle’s remaining performance obligation (RPO) growth is due to a large contract with OpenAI, reportedly valued at $300 billion. While the agreement represents a solid growth opportunity, it also concentrates counterparty exposure and raises concerns about return on invested capital and execution risk.

It is important to note that OpenAI is not Oracle’s only major AI customer. The company has disclosed substantial contracted demand from leading Oracle Cloud Infrastructure clients, including Meta Platforms, (META), Nvidia (NVDA), AMD (AMD), and xAI. However, the scale of the OpenAI contract dominates the narrative around Oracle’s AI-related contracted demand and influences how investors assess both its upside potential and its risk profile.

Cloud and AI Infrastructure Growth Are Accelerating

Despite the concerns, Oracle is delivering accelerating growth in cloud services and AI-driven infrastructure. In the second quarter of fiscal 2026, Oracle reported RPO of $523 billion, up 433% year-over-year (YoY) and a $68 billion jump since August 2025. Management attributed much of the sequential growth to large contracts signed with companies such as Meta Platforms and Nvidia, along with other enterprise customers, signaling continued diversification of its backlog.

Importantly, the portion of RPO expected to be recognized as revenue over the next 12 months rose 40% YoY, marking acceleration from 25% growth last quarter and 21% growth a year ago.

Cloud momentum remains the primary driver. Total cloud revenue, spanning applications and infrastructure, reached $8 billion in Q2, up 33% from a year earlier. The business witnessed an acceleration in growth and now accounts for roughly half of Oracle’s total revenue.

Within that segment, Oracle Cloud Infrastructure (OCI) continues to stand out. Infrastructure revenue climbed 66% to $4.1 billion, driven by surging demand for AI compute. GPU-related revenue grew 177%. Database services also performed well, with revenue up 30%. Autonomous Database revenue increased 43%, and multicloud consumption expanded an extraordinary 817%, reflecting rising cross-platform demand from enterprises deploying workloads across multiple cloud environments.

Management also provided clarity on how the record RPO translates into future financial performance. Because many of the recently signed contracts are related to existing capacity rather than projects that require lengthy buildouts, Oracle expects revenue recognition to accelerate. The company now projects an additional $4 billion in revenue for fiscal 2027. However, it reiterated its fiscal 2026 revenue outlook to $67 billion.

Addressing the Funding Question

Oracle addressed funding concerns during the Q2 conference call. Management emphasized a diversified funding strategy spanning bonds, bank facilities, and private debt markets.

In addition, Oracle is exploring alternative structures, including arrangements in which customers bring their own chips for installation in Oracle data centers or suppliers lease chips rather than sell them outright. These approaches help mitigate incremental borrowing needs and counter the bearish thesis that accelerating AI infrastructure investment will excessively pressure the balance sheet.

The Bottom Line: Buy ORCL Stock or Stay Away?

Oracle is performing well. Accelerating OCI growth, faster RPO conversion, a focus on diversifying the customer base, and a diversified funding strategy suggest the market may be over-penalizing Oracle for its near-term free cash flow compression.

In summary, ORCL stock is a buy for investors with a long-term view of at least five years. In the near term, caution is warranted as pressure on free cash flow and concerns around the durability of the AI cycle amid heavy investments could keep the stock volatile.

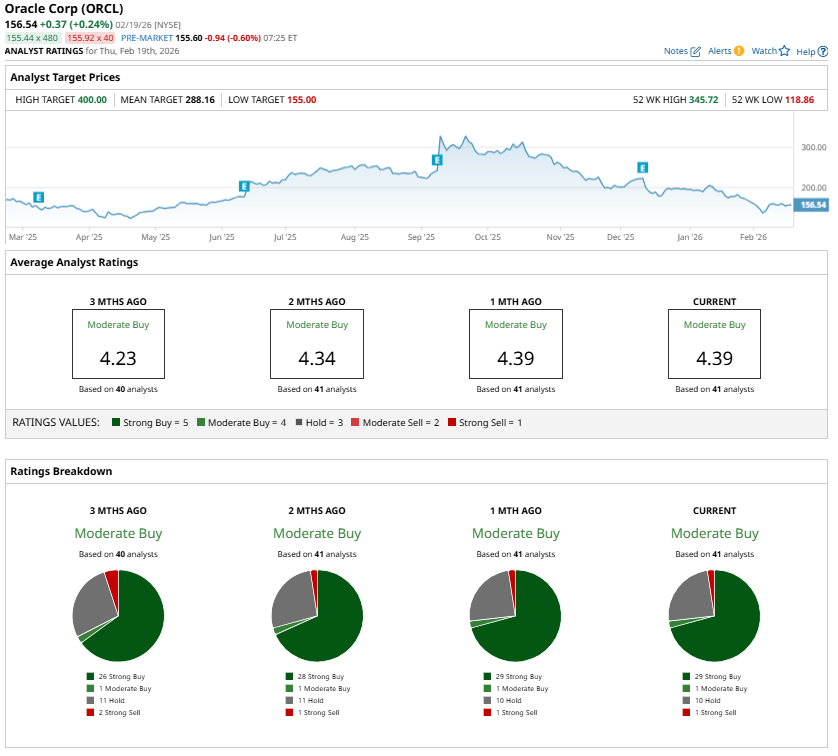

Analysts maintain a “Moderate Buy” consensus rating on ORCL stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump “May Be Required to Refund Billions of Dollars” After Supreme Court Overturns Tariffs, Hurts ‘Trillions of Dollars’ in Trade Deals

- Unusual Options Activity Alert: If You Own These 3 Stocks, It’s Time for a Protective Collar

- Oracle Stock Plunges 55%: Buy the Dip or Stay Away?

- This Indicator Called the Akamai Stock Correction. Now It’s Flashing Buy.