Oklo (OKLO) stock inched higher on Tuesday ahead of a pivotal congressional hearing on nuclear energy scheduled for today, Jan. 7.

Investors believe the House Subcommittee on Energy’s hearing – American Energy Dominance: Dawn of the New Era – will prove a meaningful catalyst for the U..S advanced reactor developer.

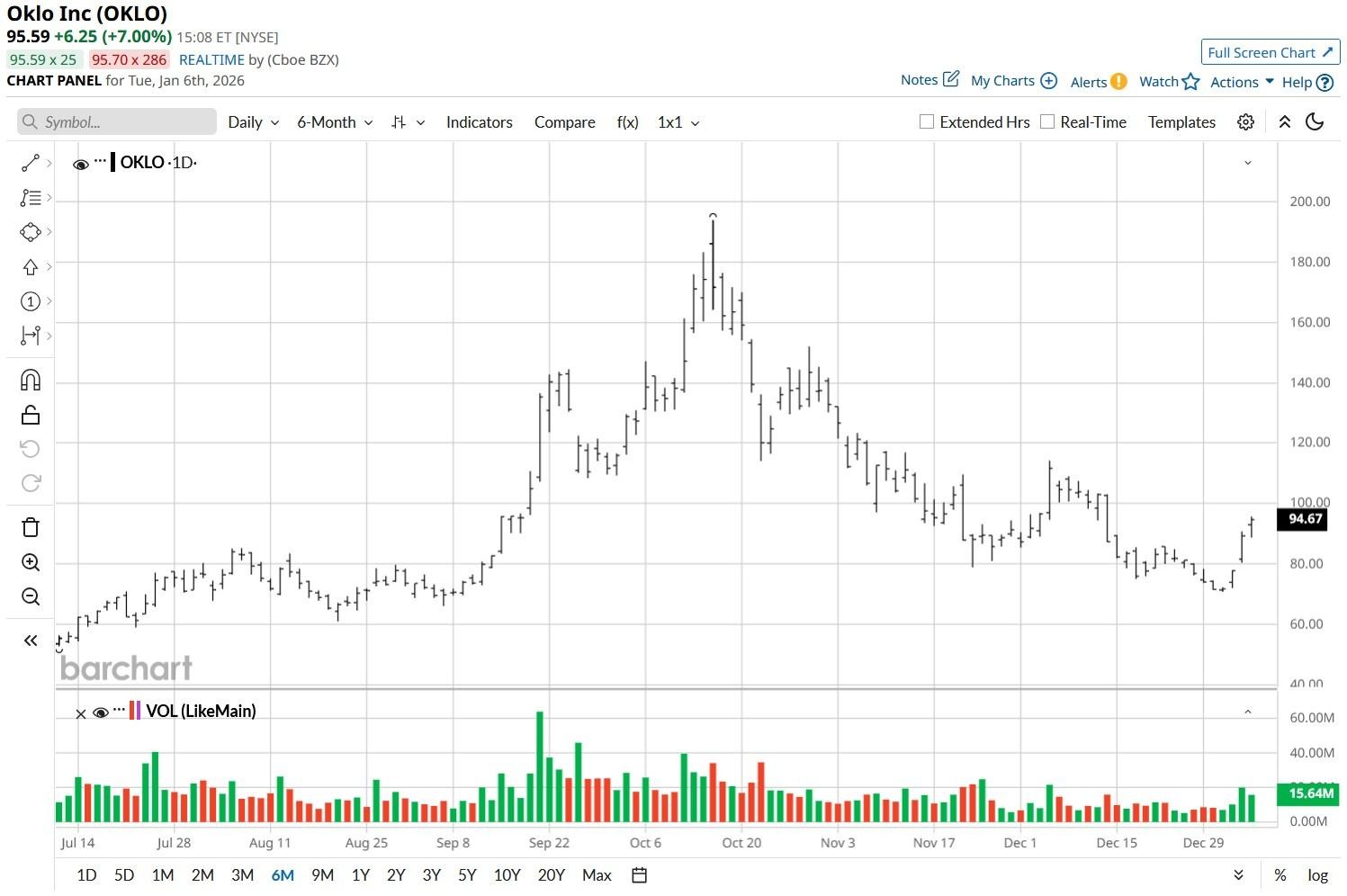

The announcement arrives at a time when Oklo shares are gasping for gains. At the time of writing, they’re down a concerning 45% versus their recent high.

Significance of the Hearing for Oklo Stock

The congressional heading will spotlight licensing, deployment, and the broader policy framework for nuclear power, which is highly relevant for OKLO given it specializes in next-gen reactors.

Investors welcomed the announcement as federal backing for nuclear innovation could accelerate regulatory approvals and unlock funding streams for the NYSE-listed firm.

With U.S. lawmakers emphasizing nuclear’s role in energy security and carbon-free electricity, Oklo stock stands to benefit from heightened visibility and potential policy tailwinds.

Investors are betting that the Jan. 7 hearing will reinforce the strategic importance of nuclear power, strengthening the case for OKLO as the frontrunner in advanced reactor deployment.

Are OKLO Shares Worth Buying Today?

Long-term investors should consider owning OKLO stock at current levels also because President Donald Trump’s administration announced a $2.7 billion initiative Tuesday to expand domestic uranium-enrichment capacity.

In October, the company based out of Santa Clara, California was picked by the U.S. Department of Energy for advanced nuclear fuel line pilot projects as well.

This confirmed its commitment to commercializing small-scale reactors that can deliver reliable, carbon-free power with lower upfront costs is aligned with federal initiatives.

What’s also worth mentioning is that despite recent pullback, Oklo remains handily above its long-term moving average (200-day), reinforcing that the broader uptrend remains intact.

What’s the Consensus Rating on Oklo?

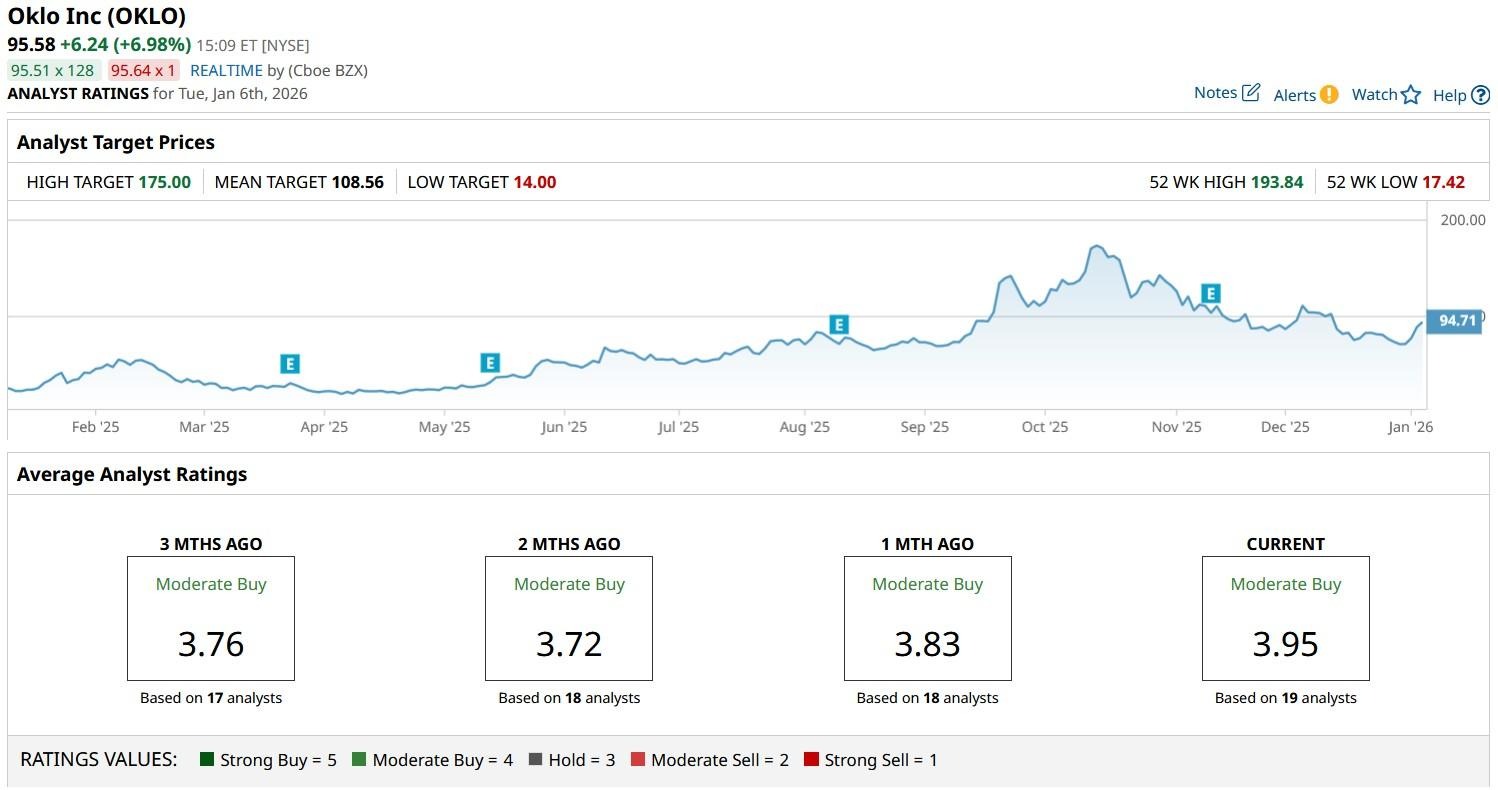

While OKLO is still a pre-revenue company, Wall Street analysts see a big future for it in the years ahead.

According to Barchart, the consensus rating on Oklo stock currently sits at “Moderate Buy” with price targets going as high as $175 indicating potential upside of more than 80% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Is Breaking Below Key Support Ahead of Q4 Earnings. Should You Buy the Dip or Stay Far Away?

- SanDisk Stock Just Became Overbought After 20% Surge in SNDK. How Should You Play the Top S&P 500 Name Here?

- Should You Chase the Rally in Alumis Stock Today?

- Dear Oklo Stock Fans, Mark Your Calendars for January 7