Understanding the stock market requires not only tracking price movements but also knowing the best Stock Strategy that guide profitable trading and investment decisions. In 2025, the U.S. stock market continues to be dominated by technology giants and innovative companies leading global economic growth. Below, we explore effective stock strategies and reveal the top 10 U.S. stocks by market capitalization for 2025.

What Are Stock Strategies?

Stock Strategies are systematic approaches that help traders and investors decide when to buy, hold, or sell stocks. They combine technical analysis, fundamental analysis, and market psychology to identify high-probability opportunities.

Some of the most popular stock strategies include:

1. Trend Trading Strategy

This approach focuses on identifying the direction of the overall market trend — uptrend or downtrend — and trading in that direction. Traders use tools like moving averages and trendines to confirm the momentum.

2. Swing Trading Strategy

Swing traders hold positions for days or weeks, capturing short- to medium-term price swings. This strategy is ideal for traders who prefer not to monitor the market constantly.

3. Breakout Trading Strategy

This method identifies points where stock prices break through established support or resistance levels, often leading to significant price movements.

4. Value Investing Strategy

Pioneered by Warren Buffett, this long-term strategy focuses on buying undervalued companies with strong fundamentals and holding them through market cycles.

5. Momentum Trading Strategy

Momentum traders capitalize on strong stock movements by entering trades after confirmation of volume and trend acceleration.

Each of these approaches can be applied using technical analysis, chart patterns, and stock signals. If you’re looking to receive precise buy and sell alerts, you can explore actionable stock signals provided by professional traders.

Why Stock Strategies Work Better on Top Market Leaders

The stock strategies mentioned above tend to perform more effectively on top market leaders — such as Apple, Microsoft, and NVIDIA — because these stocks consistently have very high trading volume.

With high volume, price movements are more reliable and less prone to manipulation, making it easier to read market psychology through candlestick patterns, trend formations, and support/resistance reactions.

In other words, when millions of shares are traded daily, price action reflects real investor sentiment — fear, greed, and momentum — allowing technical traders to make more accurate decisions based on chart signals and volume behavior.

That’s why professional traders often focus on liquid, large-cap stocks where technical patterns tend to follow through more consistently.

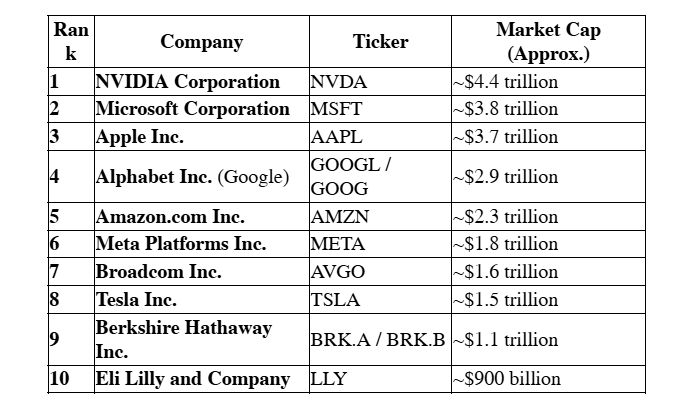

Top 10 U.S. Stocks by Market Capitalization (2025)

As of 2025, the following are the largest U.S. companies by market capitalization, reflecting their dominance and influence in global markets.

Insights from the Top Market Leaders

-

NVIDIA (NVDA) leads the market as artificial intelligence and GPU demand surge, pushing it beyond $4 trillion in valuation.

-

Microsoft (MSFT) continues its dominance in cloud computing, AI integration, and enterprise solutions.

-

Apple (AAPL) remains a key player with strong earnings from iPhone sales, services, and wearables.

-

Alphabet (GOOGL) maintains a robust advertising and AI-driven ecosystem.

-

Amazon (AMZN) benefits from its e-commerce empire and AWS cloud division.

-

Meta (META) grows rapidly through digital advertising and virtual reality investments.

-

Broadcom (AVGO) rides the semiconductor wave with consistent revenue from chips and networking technologies.

-

Tesla (TSLA) continues to shape the EV market and energy innovation sector.

-

Berkshire Hathaway (BRK) reflects Warren Buffett’s timeless value investing principles.

-

Eli Lilly (LLY) represents the healthcare sector’s power, with breakthroughs in obesity and diabetes treatments.

How Market Cap Affects Stock Strategies

Market capitalization influences how traders approach different stocks:

-

Large-cap stocks like Microsoft, Apple, and Amazon are often stable and suitable for long-term trend trading or value investing.

-

Mid-cap stocks offer faster growth potential but come with more volatility — ideal for swing traders.

-

Small-cap stocks are riskier but can yield significant short-term gains through breakout strategies.

Understanding market capitalization helps align your trading strategy with your risk tolerance and investment goals.

Conclusion

The 2025 stock market shows that technology and innovation dominate global valuations, but choosing the right stock strategy remains the key to consistent success.

Top market leaders with high trading volume provide the best environment for applying technical analysis and reading market psychology accurately — making them ideal candidates for strategies based on trend, breakout, and momentum signals.

Whether you prefer long-term investing or active trading, using structured approaches and reliable stock signals can enhance your decision-making and profitability.

For more insights and professional tools, visit Stock Strategy — your source for expert market analysis, trading systems, and proven strategies.

Media Contact

Company Name: Stockstrategy.net

Contact Person: Mohamed

Email: Send Email

City: London

Country: United Kingdom

Website: https://stockstrategy.net/