On Feb. 5, Amazon is expected to post earnings. And if the numbers are as good as they were in October, the stock could explode higher.

When Amazon posted earnings on Oct. 31, its stock rocketed 16% from $222.75 to a high of $258.60. Amazon had just beaten across the board, boosting its spending forecast thanks to growing demand for artificial intelligence. Amazon Web Services (AWS) saw 20% year-over-year (YoY) growth to $33 billion. Revenue in its digital advertising business saw revenues jump 24% to $17.7 billion. Total Amazon sales were up 13% to $180.17 billion, which beat estimates of $177.8 billion. EPS was $1.85, crushing estimates of $1.57.

Amazon even raised its forecast for capex spending for 2025 to $125 billion from earlier estimates of $118 billion. That number, according to CO Brian Olsavsky, was set to increase even more in 2026, as noted by CNBC. Even better, the company forecast revenues of between $206 billion and $213 billion for the current quarter, implying 11.6% growth YoY.

What Does Wall Street Expect to See on Feb. 5?

Wall Street expects Amazon to post EPS of $1.97 a share for the fourth quarter, or about 6% growth YoY. But then again, it could be higher, with the company historically conservative with guidance.

For the full fiscal year 2025, it’s expected to post EPS of $7.17, up about 30% YoY from $5.53 for FY 2024. And for the full fiscal year 2026, Wall Street is looking for EPS of between $7.87 and $7.91, or 10% YoY growth.

Multiple Analysts Named Amazon the Pick of the Year

Wedbush reiterated an outperform rating with a price target of $340 a share, expecting a big year for AWS. They named Amazon as their top e-commerce pick for the year. They also forecast fourth-quarter income of $25.2 billion, with a margin of 11.8, as noted by TipRanks. In the third quarter, Amazon’s operating income was $17.4 billion.

Roth Capital raised its price target on Amazon to $295 from $270, with a buy rating. They also said Amazon was their top pick for the year. They argue Wall Street isn’t factoring in layoffs, adding that if Amazon cloud revenue growth can exceed 22%, “it would be a clear positive,” as quoted by Barron’s.

Bank of America also believes AWS growth numbers will be important to watch. The firm noted, “We believe Amazon’s valuation reflects uncertainty on AWS positioning, which has the potential to improve in 2026 if AWS revenue growth accelerates, and the company strengthens its relative AI capabilities,” as quoted by CNBC.

Analysts at Stifel also reiterated a “Buy” rating on Amazon with a price target of $300 a share. Not only is the firm bullish on AWS growth, but it’s also confident in Amazon’s “healthy” advertising business, as noted on Investing.com.

What Other Analysts Are Saying About AMZN Stock

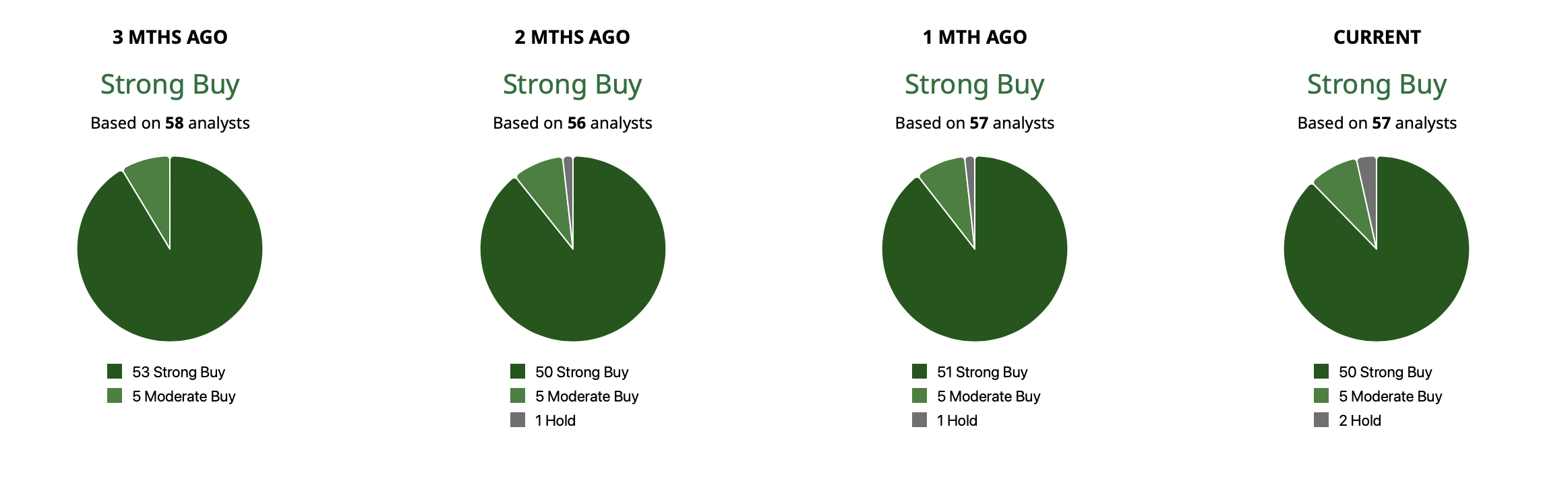

Of the 57 analysts covering AMZN stock, 50 have it rated as a “Strong Buy,” five rate it a “Moderate Buy,” and two rate it a “Hold.” Presently, the mean target price among analysts is $297.67, implying 24% upside. The high-end target is $360, implying 50% upside.

With AWS growth accelerating, analysts turning increasingly bullish, and Amazon’s track record of beating expectations, earnings on Feb. 5 could be the catalyst that sends the stock even higher once again. In fact, investors waiting to see what happens may not get a second chance if Amazon delivers another strong earnings beat, with upside guidance to boot.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart