Tyson Foods has been treading water for the past six months, recording a small return of 4.1% while holding steady at $62.30. However, the stock is beating the S&P 500’s 6.9% decline during that period.

Is there a buying opportunity in Tyson Foods, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the strong relative performance, we're cautious about Tyson Foods. Here are three reasons why we avoid TSN and a stock we'd rather own.

Why Do We Think Tyson Foods Will Underperform?

Started as a simple trucking business, Tyson Foods (NYSE: TSN) is one of the world’s largest producers of chicken, beef, and pork.

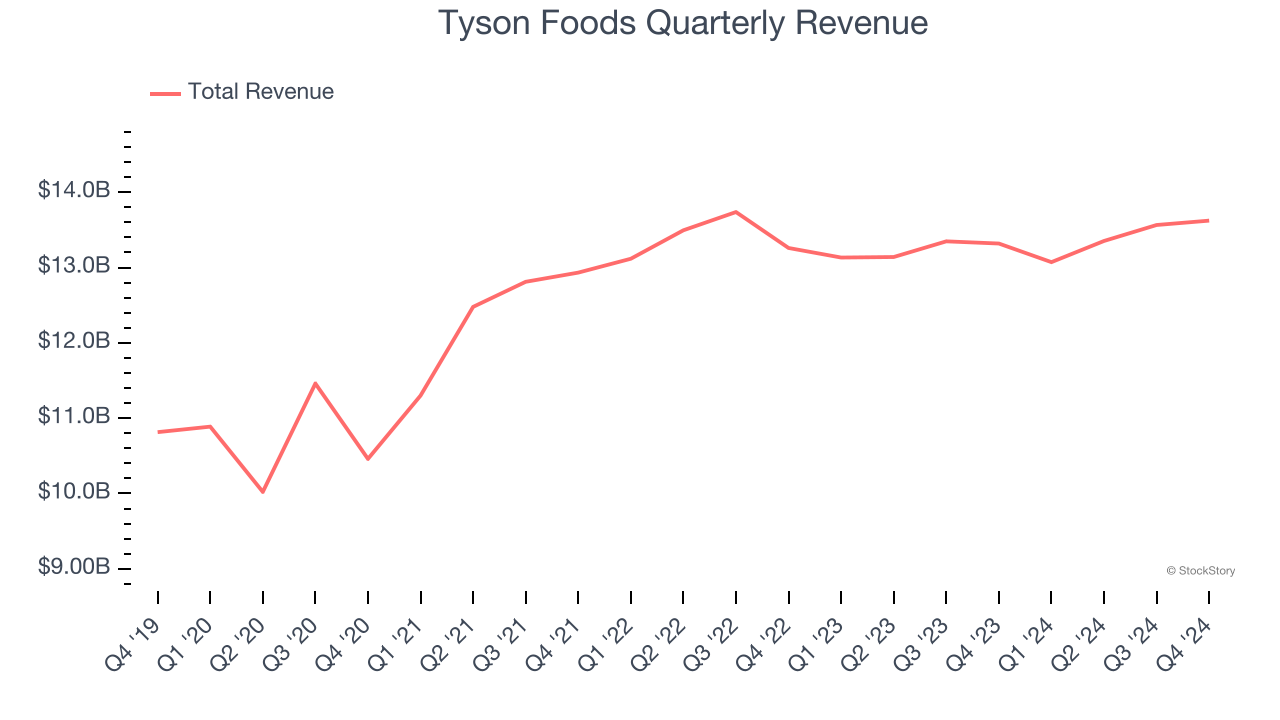

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Tyson Foods’s 2.7% annualized revenue growth over the last three years was sluggish. This fell short of our benchmarks.

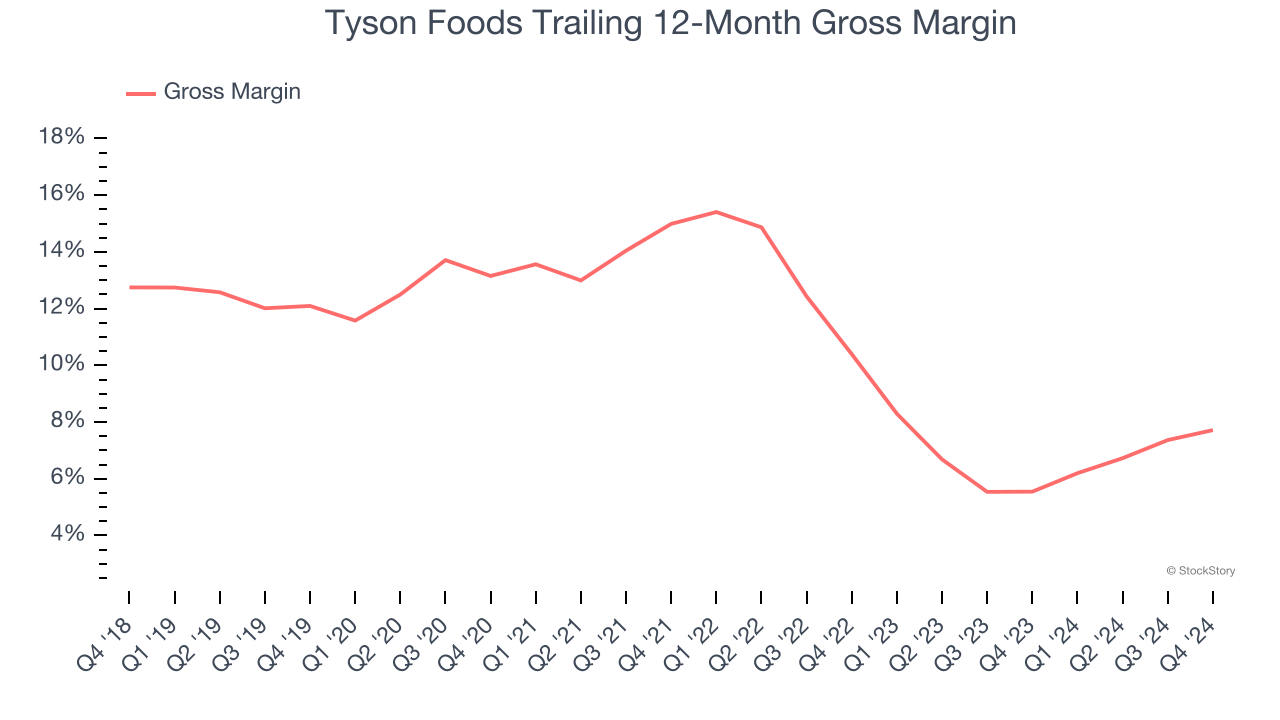

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Tyson Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 6.6% gross margin over the last two years. That means Tyson Foods paid its suppliers a lot of money ($93.36 for every $100 in revenue) to run its business.

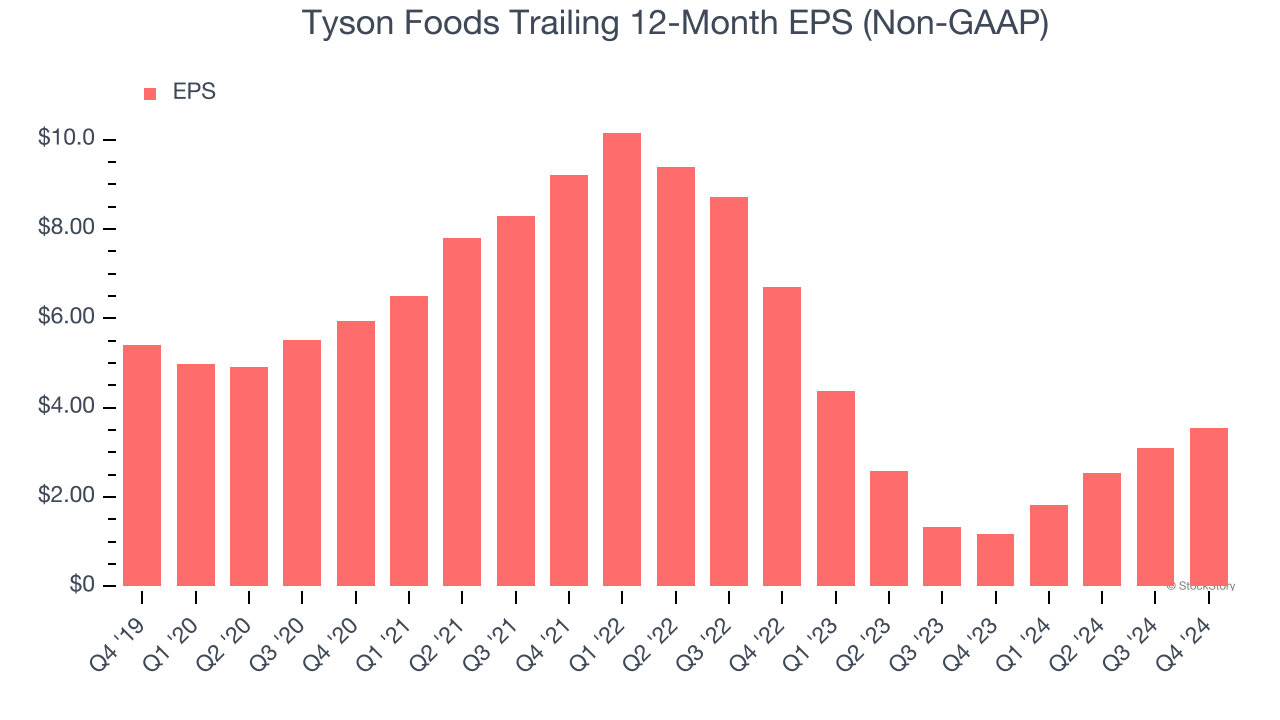

3. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Tyson Foods, its EPS declined by 27.2% annually over the last three years while its revenue grew by 2.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We see the value of companies helping consumers, but in the case of Tyson Foods, we’re out. Following its recent outperformance in a weaker market environment, the stock trades at 16.8× forward price-to-earnings (or $62.30 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Tyson Foods

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.