Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Nubank (NYSE: NU) and its peers.

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

The 9 personal loan stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 5.8%.

Thankfully, share prices of the companies have been resilient as they are up 9.1% on average since the latest earnings results.

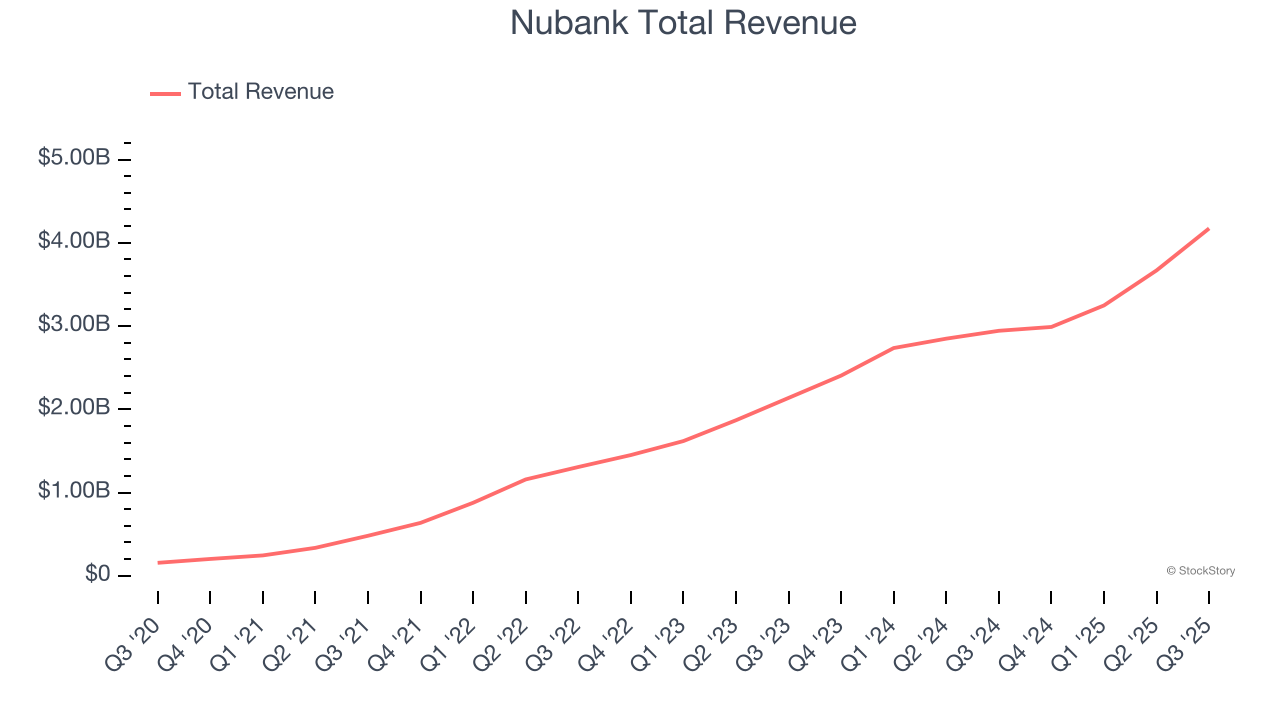

Nubank (NYSE: NU)

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE: NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

Nubank reported revenues of $4.17 billion, up 41.8% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ revenue estimates and EPS in line with analysts’ estimates.

Interestingly, the stock is up 3.6% since reporting and currently trades at $16.22.

Read why we think that Nubank is one of the best personal loan stocks, our full report is free.

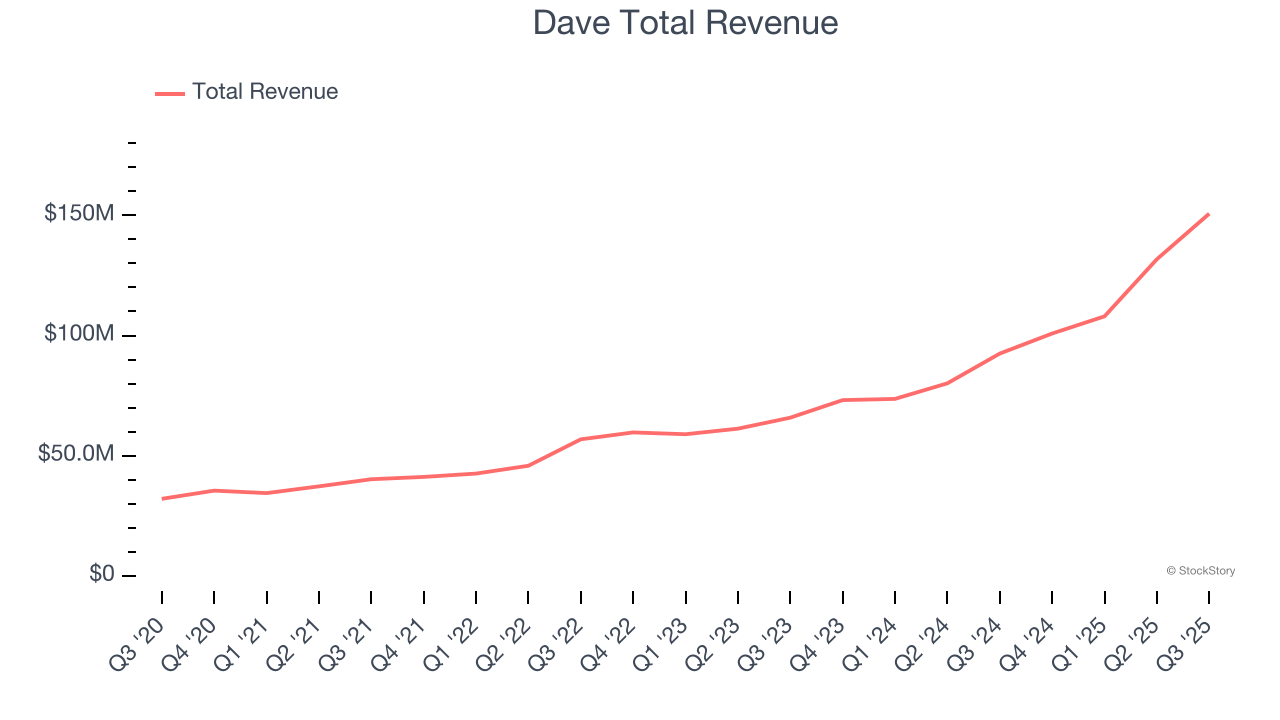

Best Q3: Dave (NASDAQ: DAVE)

Named after the biblical David fighting financial Goliaths, Dave (NASDAQ: DAVE) is a digital financial services platform that helps Americans living paycheck to paycheck with cash advances, banking services, and tools to improve their financial health.

Dave reported revenues of $150.7 million, up 63% year on year, outperforming analysts’ expectations by 12.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

Dave delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.8% since reporting. It currently trades at $195.

Is now the time to buy Dave? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Enova (NYSE: ENVA)

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE: ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

Enova reported revenues of $802.7 million, up 16.3% year on year, in line with analysts’ expectations. Still, its results were good as it locked in an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

Enova delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 39.6% since the results and currently trades at $159.12.

Read our full analysis of Enova’s results here.

FirstCash (NASDAQ: FCFS)

Offering a financial lifeline to the unbanked and credit-constrained since 1988, FirstCash (NASDAQ: FCFS) operates pawn stores across the U.S. and Latin America while also providing retail point-of-sale payment solutions for credit-constrained consumers.

FirstCash reported revenues of $935.6 million, up 11.7% year on year. This print surpassed analysts’ expectations by 9.3%. Overall, it was a stunning quarter as it also produced an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 9.7% since reporting and currently trades at $162.44.

Read our full, actionable report on FirstCash here, it’s free for active Edge members.

LendingClub (NYSE: LC)

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE: LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

LendingClub reported revenues of $266.2 million, up 31.9% year on year. This result beat analysts’ expectations by 3.9%. It was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is up 15% since reporting and currently trades at $19.

Read our full, actionable report on LendingClub here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.