Tenet Healthcare currently trades at $201.39 and has been a dream stock for shareholders. It’s returned 667% since November 2020, blowing past the S&P 500’s 98.9% gain. The company has also beaten the index over the past six months as its stock price is up 35.1% thanks to its solid quarterly results.

Following the strength, is THC a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free for active Edge members.

Why Does Tenet Healthcare Spark Debate?

With a network spanning nine states and serving primarily urban and suburban communities, Tenet Healthcare (NYSE: THC) operates a nationwide network of hospitals, ambulatory surgery centers, and outpatient facilities providing acute care and specialty healthcare services.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Tenet Healthcare’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

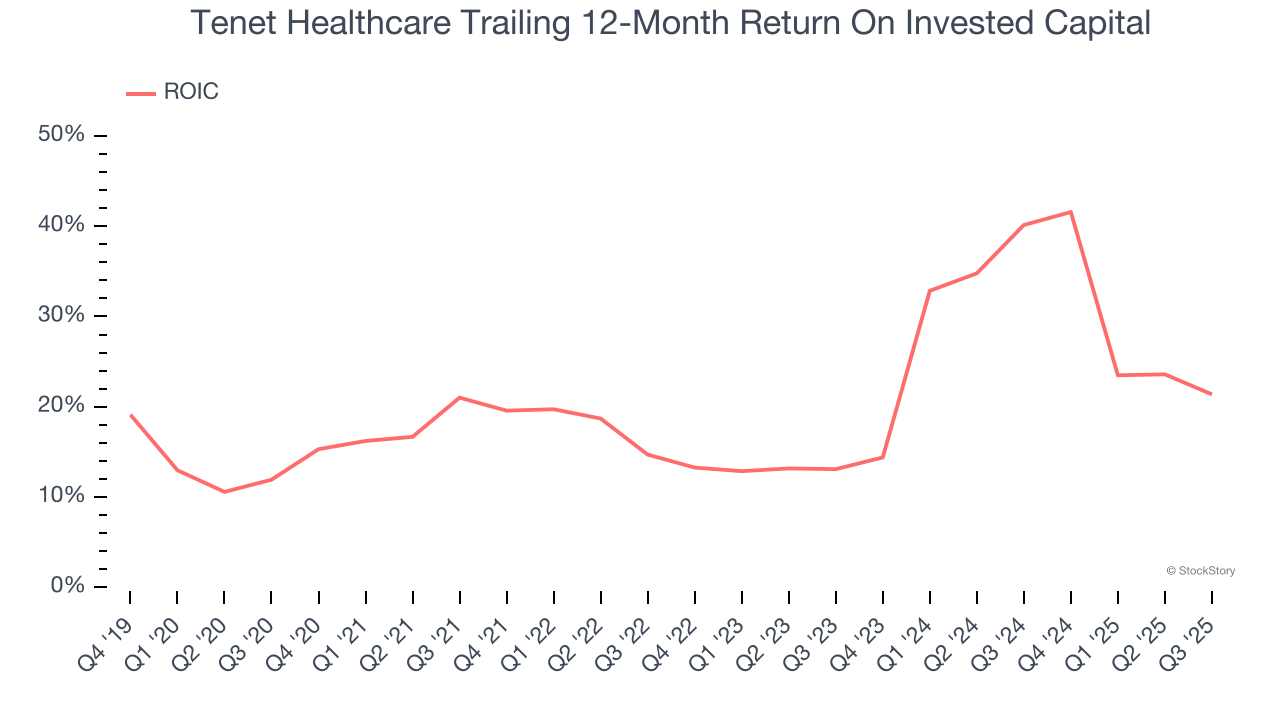

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Tenet Healthcare’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

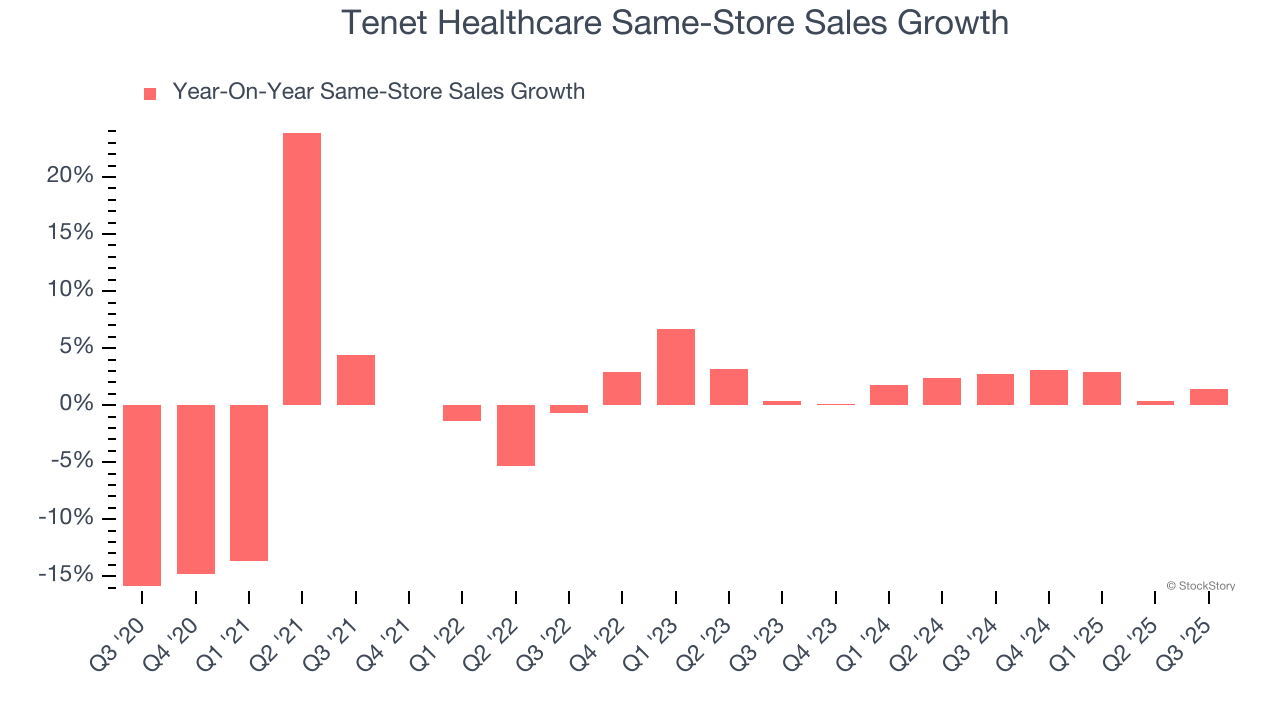

Same-Store Sales Falling Behind Peers

Investors interested in Hospital Chains companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Tenet Healthcare’s underlying demand characteristics.

Over the last two years, Tenet Healthcare’s same-store sales averaged 1.9% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

Final Judgment

Tenet Healthcare has huge potential even though it has some open questions, and with its shares beating the market recently, the stock trades at $201.39 per share (or a forward price-to-sales ratio of 0.8×). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Tenet Healthcare

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.