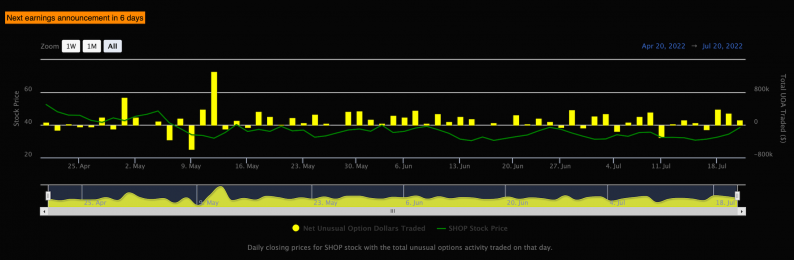

SAN FRANCISCO - July 20, 2022 - PRLog -- Shopify is expected to report earnings on Wednesday, July 27.

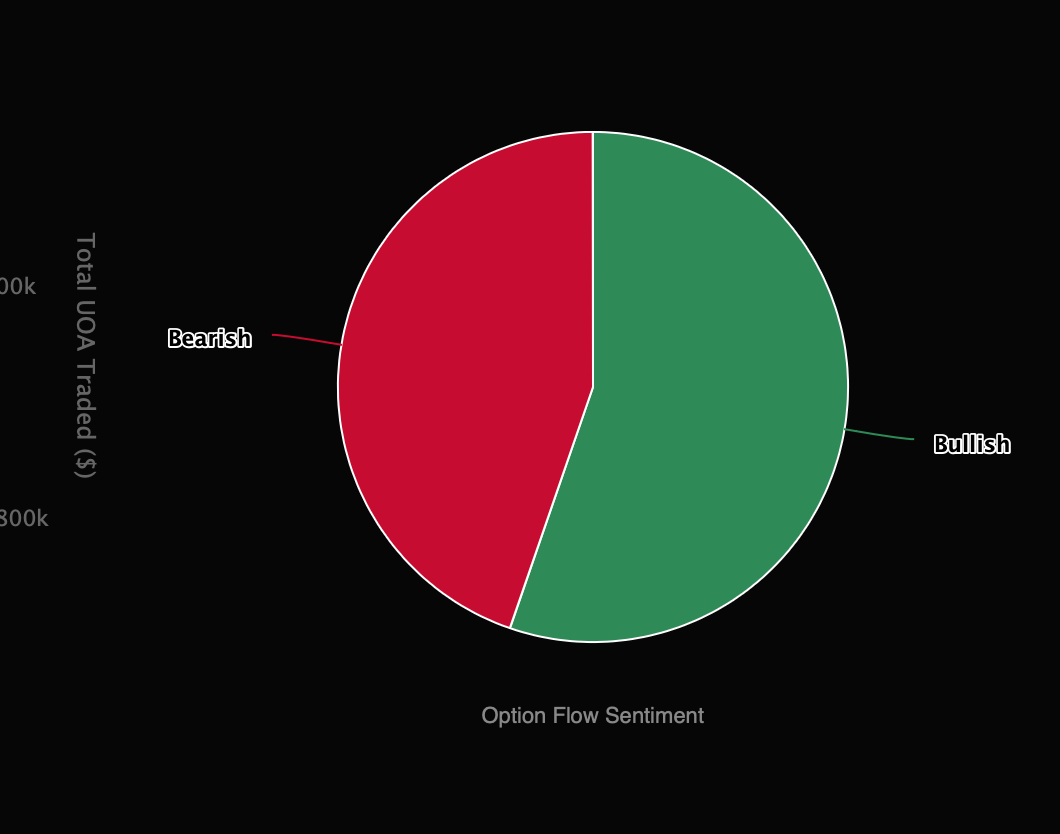

The options market is not looking at this event favorably, with the stock down over 60% since their last earnings release. In fact, traders have been buying put options and put option spreads betting that the stock will further decline in price.

The options market is usually a good indicator of how investors feel about a company's prospects. As you know, when an investor buys a call option he or she pays a premium for the right to buy stocks at a certain price by a certain date. If the stock price moves higher than what was expected by the investor then it would be more expensive for them to exercise their call option and buy shares of the stock at that price. On the other hand, if the investor feels the shares will fall below his purchase price then he should sell those shares short rather than buy them long because then he can make money when prices go down instead of up!

Why pay attention to options activity?

Investors often trade options to hedge their bets. However, options are a good indicator of market sentiment, especially when large blocks are traded. It's important to note unusual trades, often at the asking price, because they're a good gauge of expectations among institutional investors with extensive capital. With Optionsonar's state-of-the-art machine learning and artificial intelligence, this process is incredibly easy for retail investors to discover unusual options.

Photos: (Click photo to enlarge)

Read Full Story - Option traders expect further decline in Shopify stock | More news from this source

Press release distribution by PRLog

More News

View More

Shipping Shock: ZIM Shareholders Secure Massive Cash Exit ↗

February 18, 2026

Can Analog Devices Really Hit $400 This Year? ↗

February 18, 2026

Berkshire & AI Hyperscalers: Buffett Holds GOOGL, Dumps AMZN ↗

February 18, 2026

3 Names to Watch as Homebuilders Near Breakout ↗

February 18, 2026

Corning’s Surprise AI Boom: Is It Already Too Late to Buy? ↗

February 18, 2026

Recent Quotes

View More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.