Understanding the Quick Ratio

The Quick Ratio, also known as the Acid-Test Ratio, is a key financial metric used to evaluate a company’s short-term liquidity and ability to meet its current liabilities with its most liquid assets. Unlike the current ratio, which includes all current assets, the quick ratio focuses only on assets that can be quickly converted into cash — typically within 90 days or less.

This metric provides investors, creditors, and analysts with insight into whether a company can pay off its short-term debts without relying on the sale of inventory or securing additional financing.

The Formula for Quick Ratio

The quick ratio is calculated using the following formula:

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities

Each component plays a specific role:

- Cash: The most liquid asset, readily available for debt payments.

- Marketable Securities: Short-term investments easily converted into cash without significant loss of value.

- Accounts Receivable: Money owed by customers expected to be collected soon.

- Current Liabilities: Obligations due within one year, such as accounts payable, short-term loans, and accrued expenses.

For example, if a company has $50,000 in cash, $20,000 in marketable securities, $30,000 in receivables, and $70,000 in current liabilities, its quick ratio would be:

(50,000 + 20,000 + 30,000) ÷ 70,000 = 1.43

A quick ratio of 1.43 means the company has $1.43 in liquid assets for every $1 of short-term liability.

Why the Quick Ratio Matters

The quick ratio is one of the most effective indicators of a company’s financial health. It shows how well a firm can withstand sudden financial stress without needing to liquidate long-term assets or raise external funds.

Key reasons why it matters:

- Liquidity Assessment: It helps determine if a business has sufficient liquid resources to meet obligations immediately.

- Risk Evaluation: Creditors use it to assess the risk of lending money or extending credit.

- Financial Stability: Investors analyze it to gauge a company’s operational resilience in uncertain conditions.

- Management Insight: Internal managers can use it to identify liquidity issues early and adjust cash flow management strategies.

Interpreting the Quick Ratio

The interpretation of the quick ratio depends on the industry and the company’s operational structure. Generally:

- Quick Ratio > 1: Indicates strong liquidity; the company can cover short-term obligations comfortably.

- Quick Ratio = 1: Suggests adequate liquidity; current liquid assets equal current liabilities.

- Quick Ratio < 1: Implies potential liquidity issues; the firm may struggle to meet short-term debts.

However, a very high quick ratio may also signal inefficiency. For instance, if a company is holding excessive cash instead of reinvesting or expanding, it may indicate underutilized resources.

Quick Ratio vs. Current Ratio

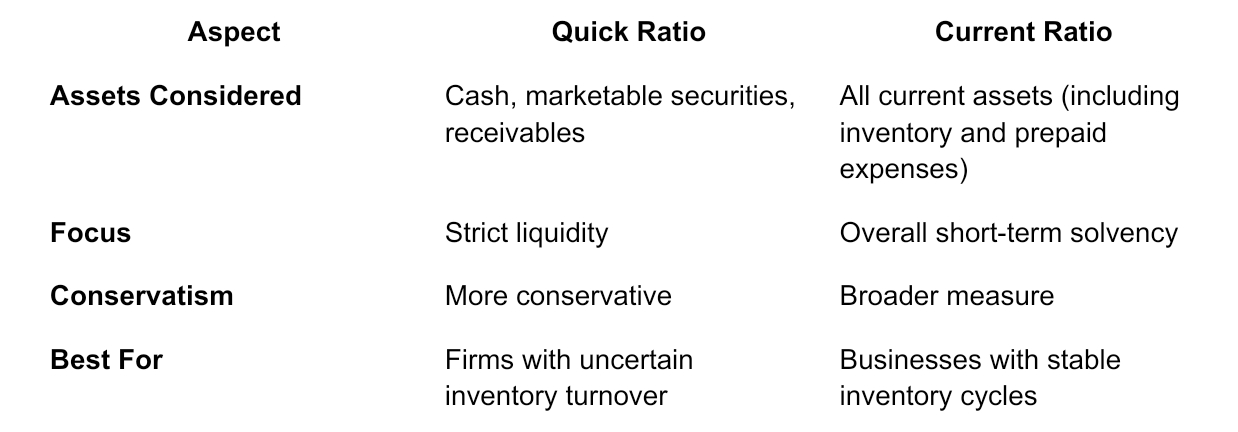

While both ratios assess liquidity, they differ in scope:

Firms with uncertain inventory turnover

Businesses with stable inventory cycles

The quick ratio provides a stricter test of liquidity by excluding inventory, which might not be easily sold in emergencies. In contrast, the current ratio gives a broader perspective but may overestimate liquidity in certain sectors, such as retail or manufacturing.

Industry Benchmarks

There is no universal “ideal” quick ratio. Acceptable values vary widely by industry:

- Technology & Software: Typically above 1.5, since these firms hold more cash and receivables.

- Manufacturing & Retail: Often between 0.5 and 1, as inventory makes up a large portion of assets.

- Financial Services: Usually above 1.2, reflecting their liquidity-heavy operations.

Therefore, comparing a company’s quick ratio only makes sense within its industry context and over time, rather than against companies in unrelated sectors.

Limitations of the Quick Ratio

Although useful, the quick ratio has its limitations:

- Ignores Cash Flow Timing: It doesn’t consider when cash inflows and outflows occur.

- Excludes Inventory and Prepaids: Some industries rely heavily on inventory that sells quickly, making the ratio appear worse than it is.

- Snapshot in Time: It provides a static view that may not reflect ongoing liquidity management.

- Potential for Misinterpretation: High receivables might not always be collectible, overstating liquidity strength.

To get a more accurate picture, analysts should use the quick ratio alongside other metrics like cash flow analysis, debt ratios, and current ratio.

How to Improve the Quick Ratio

Companies can take several measures to strengthen their quick ratio:

- Speed Up Collections: Encourage faster payments from customers.

- Reduce Short-Term Debt: Refinance or extend debt maturities.

- Manage Cash More Efficiently: Keep an optimal cash reserve without excessive idle funds.

- Sell Non-Core Assets: Convert unused assets into liquid capital.

- Enhance Inventory Management: Minimize reliance on slow-moving goods.

Effective liquidity management ensures financial flexibility and better creditworthiness.

Final Thoughts

The Quick Ratio is an essential indicator of a company’s ability to meet short-term obligations using its most liquid assets. While a ratio above 1 generally signals financial stability, the ideal benchmark depends on the company’s size, industry, and operational model.

Investors and managers should not view the quick ratio in isolation but as part of a broader liquidity and profitability assessment framework. When interpreted correctly, it provides valuable insights into a business’s efficiency, stability, and financial resilience — key components for long-term success.