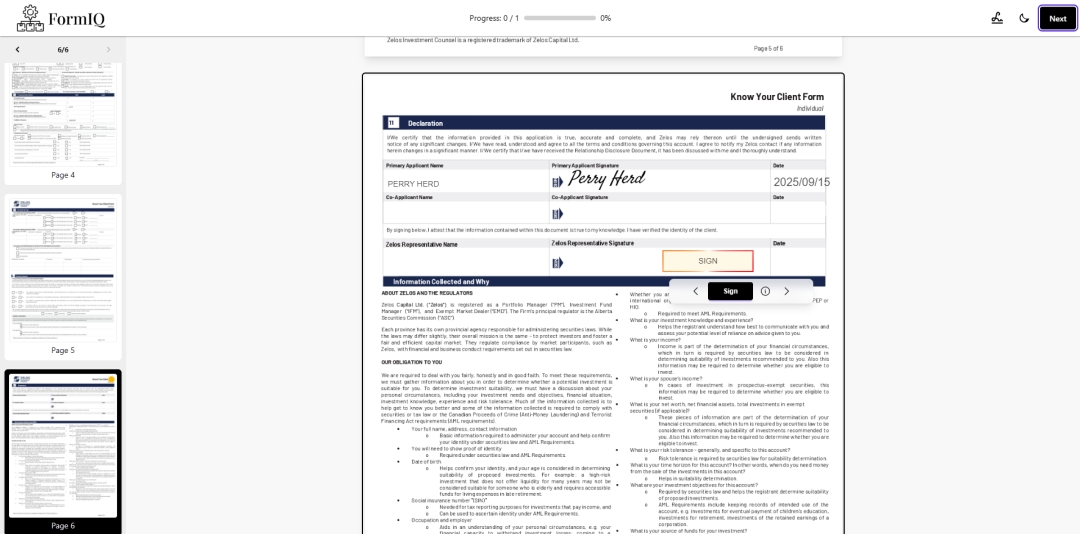

FormIQ announced today the public launch of its AI-agent platform, designed to eliminate the customer drop-off and operational burden caused by complex onboarding in compliance-intensive industries. Instead of wrestling with PDFs, portals, and endless back-and-forth email chains, organizations can deploy FormIQ Agents that guide applicants step-by-step, auto-collect required data and documents, perform third-party checks, explain terms in plain language, and assemble clean, regulator-ready packages.

FormIQ pairs specialized onboarding agents with a policy-driven orchestration engine, so every step—identity verification, KYC/AML attestations, suitability questionnaires, medical or financial disclosures, and digital signatures—happens in the right order with auditable evidence.

Our customers report materially improved experiences, ~99% required-field accuracy on representative packages, up to 85% faster time-to-approval enabling same-day decisions when checks return clean, and 50% lower abandonment—driven by policy-aware agents that orchestrate ID/KYC/AML checks, validate documents, and auto-assemble regulator-ready packages.

“Onboarding should be a positive experience for customers —not a cumbersome maze of forms. We trained AI Agents that understand the substance of an onboarding journey, not just the fields on a page. They know what to collect, what to check, and how to keep the workflow compliant without exhausting customers or ops teams.”

Why it matters

- Regulatory-Grade Compliance, Zero-Friction Consumer Experience Agents simplify dense requirements into dynamic dialogues, completing only the information needed for a specific product, account, jurisdiction, or risk profile.

- Agentic Orchestration: Seamless Integration Across Systems Out-of-the-box actions: ID verification, credit and suitability checks, document extraction and validation, e-signature, and data sync to CRMs, policy admin, transfer agents, or core banking.

- Explainability and Auditability by Design Every agent decision is logged with citations to the underlying rule, policy, or document; reviewers can replay any step for audit and compliant record keeping.

- Enterprise-Ready Security Posture Least-privilege access, encryption in transit and at rest, granular data residency controls, and a program aligned to SOC 2/ISO 27001 practices.

“AI in high-stakes workflows must be safe, supervised, and measurable. Our agents are tightly scoped, policy-aware, and instrumented for oversight, ensuring leaders can ship automation without sacrificing control.”

FormIQ’s proprietary technology has been independently reviewed by a leading machine learning institute in a focused study to benchmark reliability and safety boundaries across representative onboarding scenarios.

Built for regulated onboarding—from day one

- Capital Markets: Expedite Investor Onboarding, Simplify KYC/AML, and Automate Transfer Agent Handoffs.

- Insurance: Shorten Applicant Onboarding, capture complete applications and disclosures, and improve straight-through underwriting

- Financing: Automate KYB/KYC and income/asset verification, auto-assemble collateral packages, and standardize adverse-action workflows

- Healthcare: Streamline Patient Intake, Verification, and Consent Management for faster care access.

To see FormIQ Agents in action and discuss a Compliant Onboarding Assessment for your firm, visit www.formiq.ai or contact sales@formiq.ai

About FormIQ

FormIQ delivers AI-powered, form-first workflow automation for regulated industries. We replace PDF-based processes with customizable digital forms, integrated e-signatures and payments, and policy-aware AI Agents that collect data, validate documents, run checks, and assemble audit-ready packages—so teams approve faster with less risk across capital markets, insurance, financing, and healthcare.

Media Contact

Company Name: FormIQ

Contact Person: Brad Denton

Email: Send Email

Country: United States

Website: www.formiq.ai