Dividend Kings are some of the most popular income-generating stocks researched today. Unlike Dividend Aristocrats, these companies have delivered shareholders 50+ years of consistent dividend increases. “Consistency” is practically a given when you invest in these stocks.

The thing is, most Dividend Kings offer yields that are uninspiring, which may turn off the more adventurous investors looking to supplement their high-risk portfolio with higher-yielding stocks. As a more conservative investor, I'm often drawn to yield- I think it's normal. The issue is, high yield often means high risk.

Thats why today, I’ll cover the highest-yielding Dividend King. And to add a measure of security, I’ll only consider it if it has a Wall Street “Buy” rating.

How I identified the top-yielding Dividend King

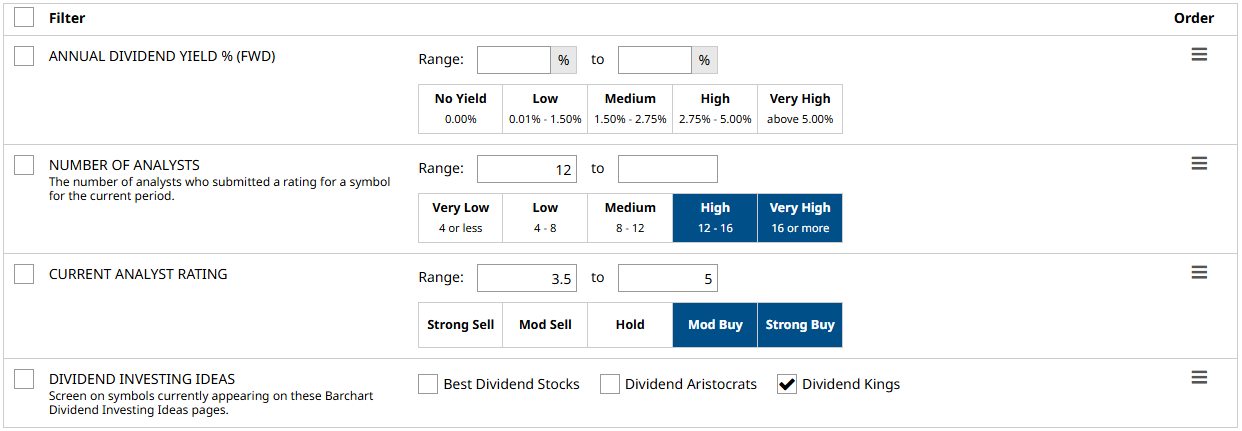

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield % (FWD): Left blank, which I can use to sort later from highest to lowest.

- Number of Analysts: 12 or higher.

- Current Analyst Rating: Moderate to Strong buy.

- Dividend Investing Ideas: Dividend Kings.

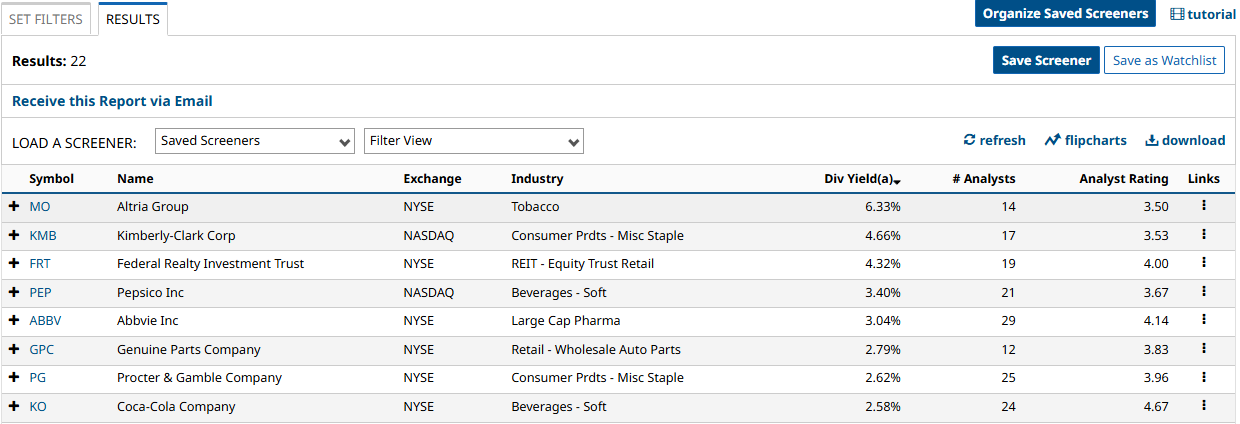

Here are the results, arranged from highest to lowest yield.

Altria Group (MO)

Altria Group is one of the largest tobacco companies in the world. It owns Philip Morris USA, which sells the very well-known Marlboro cigarette brand. Altria also produces other cigarette and smokeless tobacco products and has been expanding to nicotine pouches; however, recent FDA mutterings could shape how the segment evolves, which I’ll get into later.

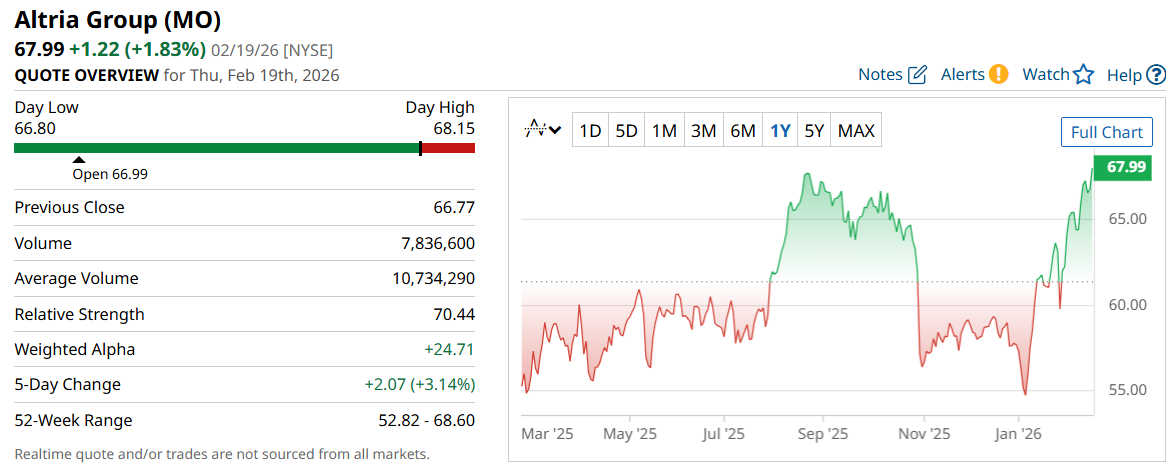

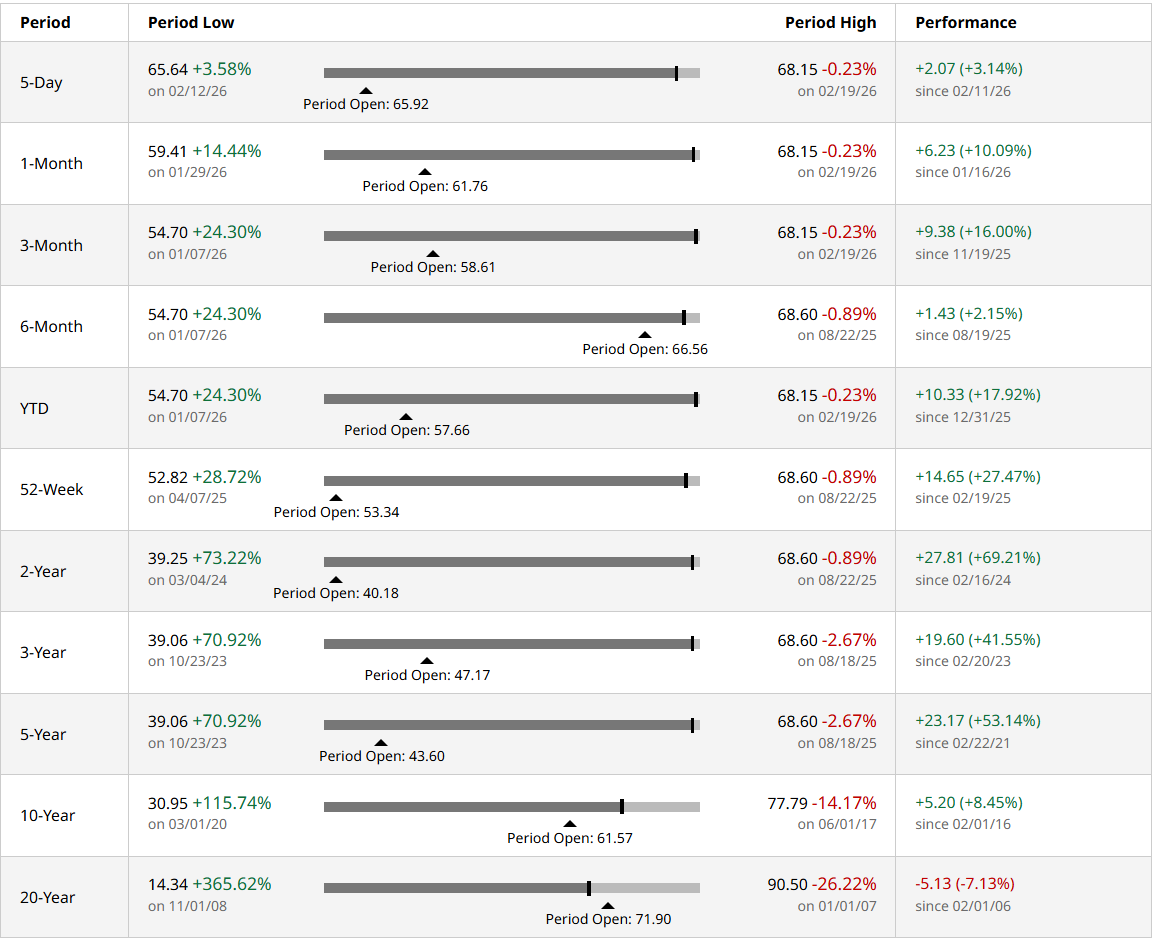

Altria stock's performance

Altria stock trades at approximately $68. It is up roughly 18% year-to-date and about 53% over the last 5 years. It may not be the highest-performing stock, but it has outperformed the S&P 500, which has been rather flat over the same period. That said, Altria's yield tells a very different story.

Altria stock's dividend profile

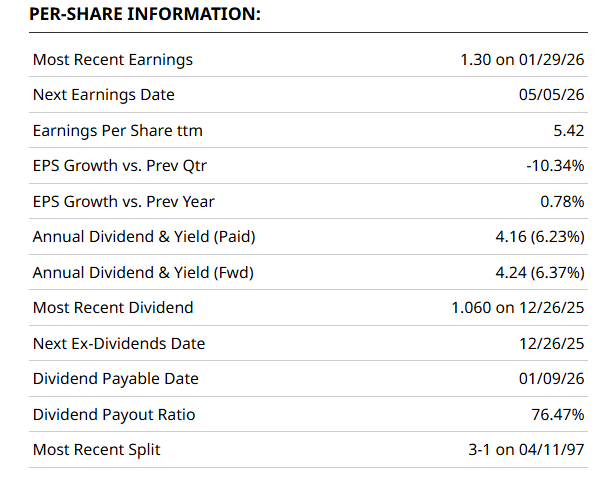

Altria has paid increasing dividends for 56 consecutive years, putting it in roughly the top 1% of dividend-growth companies here in the U.S. Currently, it pays a forward annual dividend of $4.24, translating to a yield of around 6.4%, making it both the highest-yielding Dividend King, and as a sweetener, it comes with a consensus buy rating.

In its recent quarterly financials, the company reported sales were down 4% to $5.8 billion, while net income rose around 4% to $2.4 billion, as lower cigarette volumes were partly offset by pricing and cost controls, which is fairly typical for tobacco companies and not necessarily a cause for concern.

All this resulted in an (non-GAAP) adjusted EPS of $1.30, which covers its $1.06 quarterly dividend payout. However, the company’s dividend payout ratio is at 76%. For reference, this is the part of the company’s income that it uses to pay dividends.

A 76% payout ratio is not, in itself, a cause for concern, but investors should monitor it alongside earnings stability, debt levels, and cash flow to make sure the company has enough to cover, and increase its dividends.

The next step in the tobacco industry

But, the real story isn’t just the yield or its latest quarterly results. It’s how Altria is navigating the next phase of the tobacco industry: FDA authorization of six on! PLUS nicotine pouch products.

Recently, the Food and Drug Administration (FDA) approved the products under a pilot program designed to streamline scientific review, completing the process in record time. Nicotine pouches contain lower levels of harmful constituents than many traditional smokeless products and are positioned as alternatives for adult smokers. Developments like this suggest the regulatory backdrop for next-generation products may be evolving.

Now, of course, the regulatory environment can shift quickly, and while recent FDA authorizations are encouraging, future rulings, taxation changes, or restrictions on marketing could alter the outlook. As always in tobacco, policy risk is part of the equation. And Altria does have a long history of resilience and maintaining margins, the simple fact is the industry is evolving beyond traditional cigarettes. Yes, the recent “OK” from the FDA for on! PLUS nicotine pouch products is encouraging, consumer adoption is never guaranteed. If execution falters or policy direction changes, the impact would become evident in volumes and investor sentiment.

How does Wall Street rate Altria?

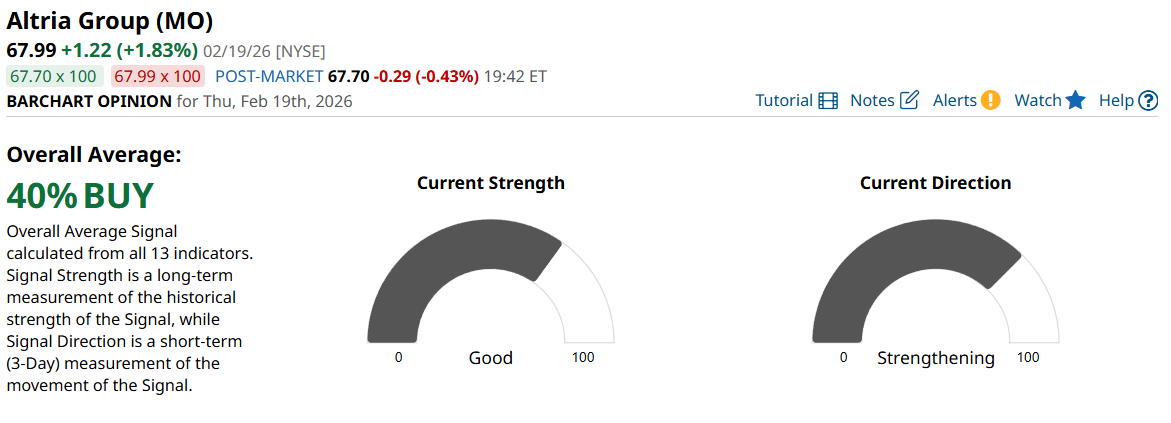

Speaking of sentiment, a consensus among 14 analysts rates the stock a “Moderate Buy”. The high target price of $72 suggests around a 6% potential upside.

Aside from that, another technical dashboard, Barchart Opinion, shows an overall average of 40% buy with a strengthening trend, suggesting potential bullish momentum.

Is Altria a buy today?

Altria may not have topped the recent headlines, but if there’s one consistent thing it brings, it is a dependable dividend-paying stock. Even rarer, they've been increasing it for more than 50 years, weathering all sorts of market meltdowns, recessions, and other headwinds. Still, buyers today should watch the high payout ratio- not a major concern at the moment, but it is getting up there.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock Lets You Collect a Dividend While on Vacation

- This High-Yield Dividend King Has 56 Years of Raises and Wall Street Is Screaming ‘Buy’

- Kraft Heinz Pauses Its Breakup Plans. Should You Buy the High-Yield Dividend Stock Here?

- A Utility Stock with Steady Earnings and a Dividend Higher Than a 30 Year T-Bill