With a market cap of $72.8 billion, Colgate-Palmolive Company (CL) is a leading global consumer goods company specializing in oral care, personal care, home care, and pet nutrition products. Headquartered in New York City, it operates in more than 200 countries and territories, making it one of the most internationally diversified firms in the consumer staples sector.

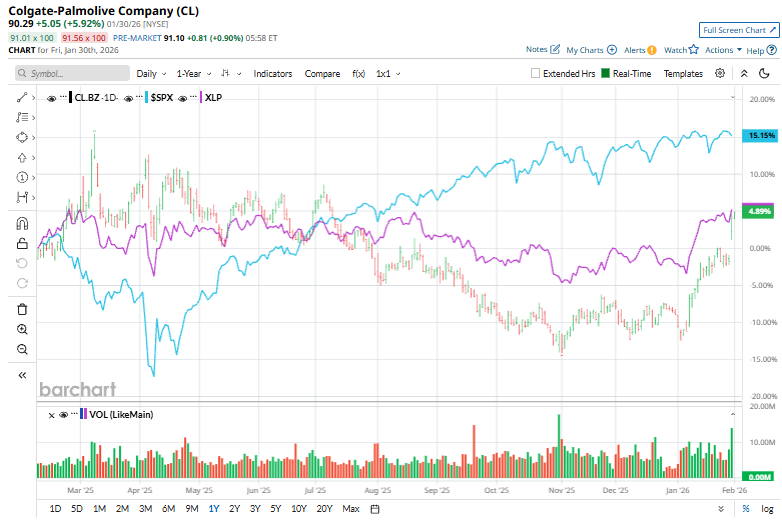

The consumer staples titan’s shares have lagged behind the broader market, declining marginally over the past year and 14.3% in a YTD basis. In contrast, the S&P 500 Index ($SPX) has surged 14.3% over the past year and 1.4% year-to-date.

Narrowing the focus, the stock has underperformed the State Street Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% rise over the past 52 weeks and 7.5% return in 2026.

On Jan. 30, Colgate shares popped 5.9% after the company released its fiscal 2025 Q4 earnings. It reported net sales of $5.23 billion, a 5.8% year over year increase, with organic sales up 2.2% despite a negative impact from the exit of private-label pet food. The company’s net sales and base business EPS stood at $5.23 billion and $0.95, exceeding market expectations thanks to resilient demand in key international markets and pricing strength. For the full year, net sales rose 1.4% to a record $20.38 billion, with strong cash flow and significant shareholder returns through dividends and buybacks

For FY2026 ending in December, analysts expect Colgate-Palmolive Company to report a 4.6% year-over-year increase in EPS to $3.86. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

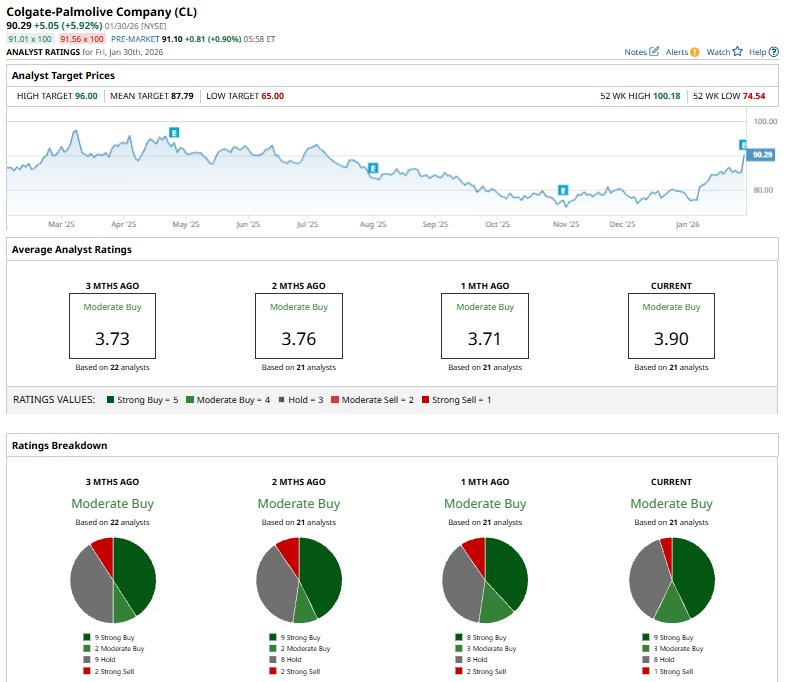

The stock holds a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the CL stock, opinions include nine “Strong Buys,” three “Moderate Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is bullish than a month ago when the stock had eight “Strong Buy” recommendations.

On Jan. 16, JPMorgan Chase analyst Andrea Teixeira raised the price target on Colgate-Palmolive to $93 from $88 while maintaining an “Overweight” rating, reflecting a 5.7% increase and continued confidence in the company’s market position and growth prospects.

While the stock currently trades above the mean price target of $87.79, the Street-high price target of $96 implies a potential upside of 6.3% from the current price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart