Valued at a market cap of $71 billion, Norfolk Southern Corporation (NSC) is a major U.S. Class I freight railroad that transports raw materials, intermediate goods, and finished products across the eastern United States. Headquartered in Atlanta, Georgia, the company operates an extensive rail network connecting key industrial regions, ports, and population centers from the Midwest and Southeast to the East Coast.

Shares of this railroad company have outpaced the broader market over the past 52 weeks. NSC has gained 22.6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 12.3%. Moreover, on a YTD basis, the stock is up 9.7%, outpacing SPX’s marginal return.

Zooming in further, NSC has also outperformed the SPDR S&P Transportation ETF (XTN), which has returned 15.6% over the past 52 weeks.

On Jan. 29, Norfolk shares jumped 2% after the company released its Q4 2025 earnings. Its revenue fell 2% year over year to $3 billion as freight volumes fell 4%. Despite the softer top line, adjusted EPS of $3.22 rose 6% year over year and exceeded expectations, driven by productivity gains and disciplined cost control that maintained profitability, including income from railway operations of $937 million.

For the current fiscal year, ending in December, analysts expect NSC’s EPS to grow marginally year over year to $12.58. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

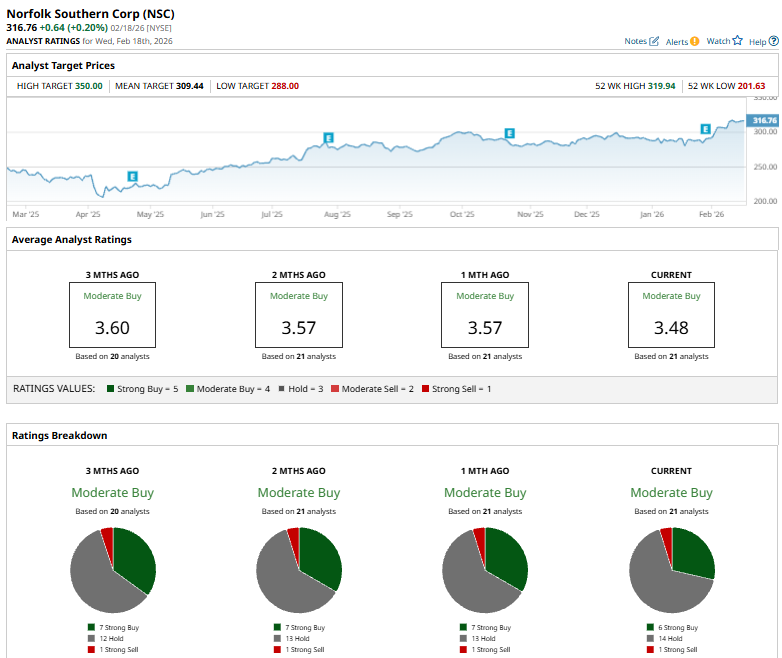

Among the 21 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on six “Strong Buy,” 14 "Hold,” and one “Strong Sell” rating.

The configuration is bearish than a month ago, when the stock had seven “Strong Buy” suggestions for the stock.

On Feb. 2, Baird analyst Daniel Moore maintained a “Neutral” rating on Norfolk Southern while lowering the price target to $288 from $293.

While the stock currently trades above the mean price target of $309.44, the Street-high price target of $350 suggests an ambitious 10.5% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart