Gorman-Rupp (NYSE: GRC) manufactures and sells pumps globally. met Wall Streets revenue expectations in Q4 CY2025, with sales up 2.4% year on year to $166.6 million. Its non-GAAP profit of $0.55 per share was 27.9% above analysts’ consensus estimates.

Is now the time to buy Gorman-Rupp? Find out by accessing our full research report, it’s free.

Gorman-Rupp (GRC) Q4 CY2025 Highlights:

- Revenue: $166.6 million vs analyst estimates of $167.1 million (2.4% year-on-year growth, in line)

- Adjusted EPS: $0.55 vs analyst estimates of $0.43 (27.9% beat)

- Adjusted EBITDA: $31.51 million vs analyst estimates of $27.29 million (18.9% margin, 15.5% beat)

- Operating Margin: 14.9%, up from 13.4% in the same quarter last year

- Free Cash Flow Margin: 6.1%, up from 3.2% in the same quarter last year

- Market Capitalization: $1.57 billion

Scott A. King, President and CEO, commented, “We are proud to have attained record sales, adjusted earnings per share and incoming orders during the year. Full year sales increased across the majority of our markets and all markets saw an increase in incoming orders. We maintained the record gross margin rates we achieved in 2024 and effectively managed our SG&A costs throughout the year. Cash flow continued to be strong, enabling a $60 million reduction in debt, resulting in a significant decrease in interest expense. Improvements in operating income, combined with reduced interest expense, led to a 22% increase in adjusted earnings per share. As we begin 2026 our outlook remains positive. The 10% increase in incoming orders during 2025 increased our backlog to a healthy $244 million. We expect our municipal market to continue to benefit from infrastructure spending, including strong demand for flood control and storm water management, and expect a number of our markets to continue to benefit from increased demand related to data center construction. Our strong cash flow positions us well to further reduce our debt and interest expense going forward.

Company Overview

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE: GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

Revenue Growth

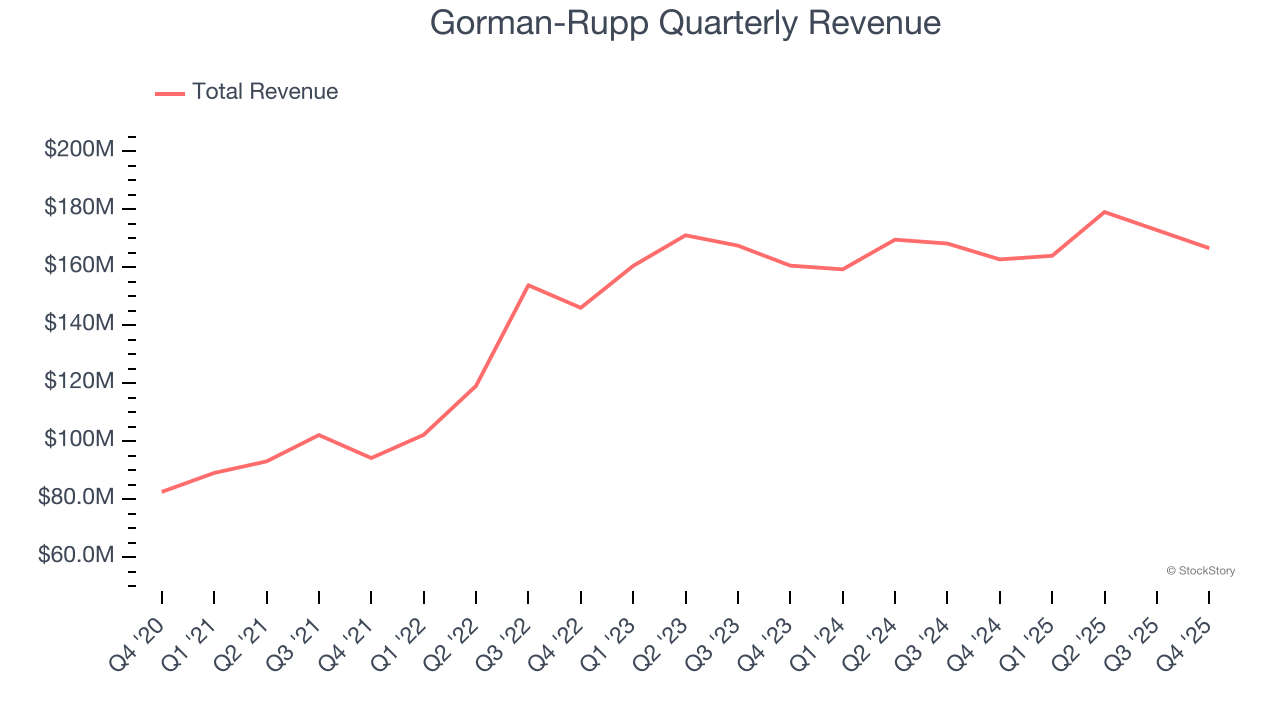

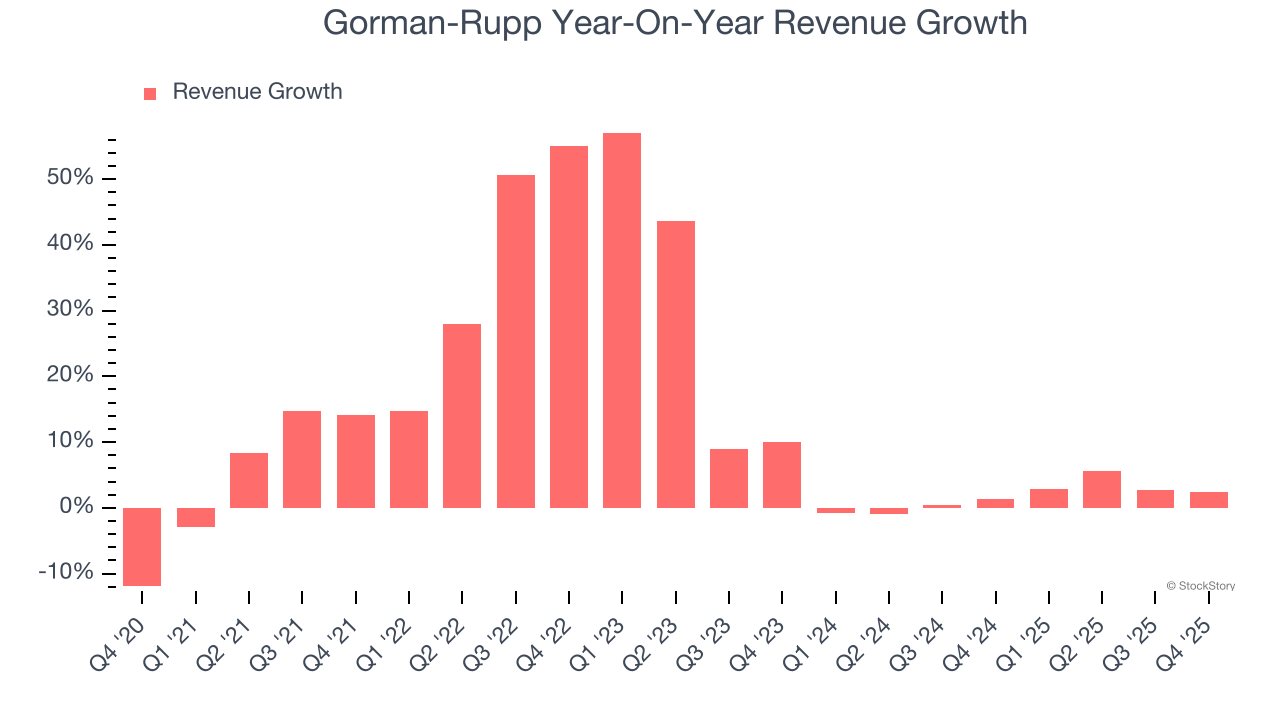

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Gorman-Rupp’s 14.4% annualized revenue growth over the last five years was exceptional. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Gorman-Rupp’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.7% over the last two years was well below its five-year trend.

This quarter, Gorman-Rupp grew its revenue by 2.4% year on year, and its $166.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

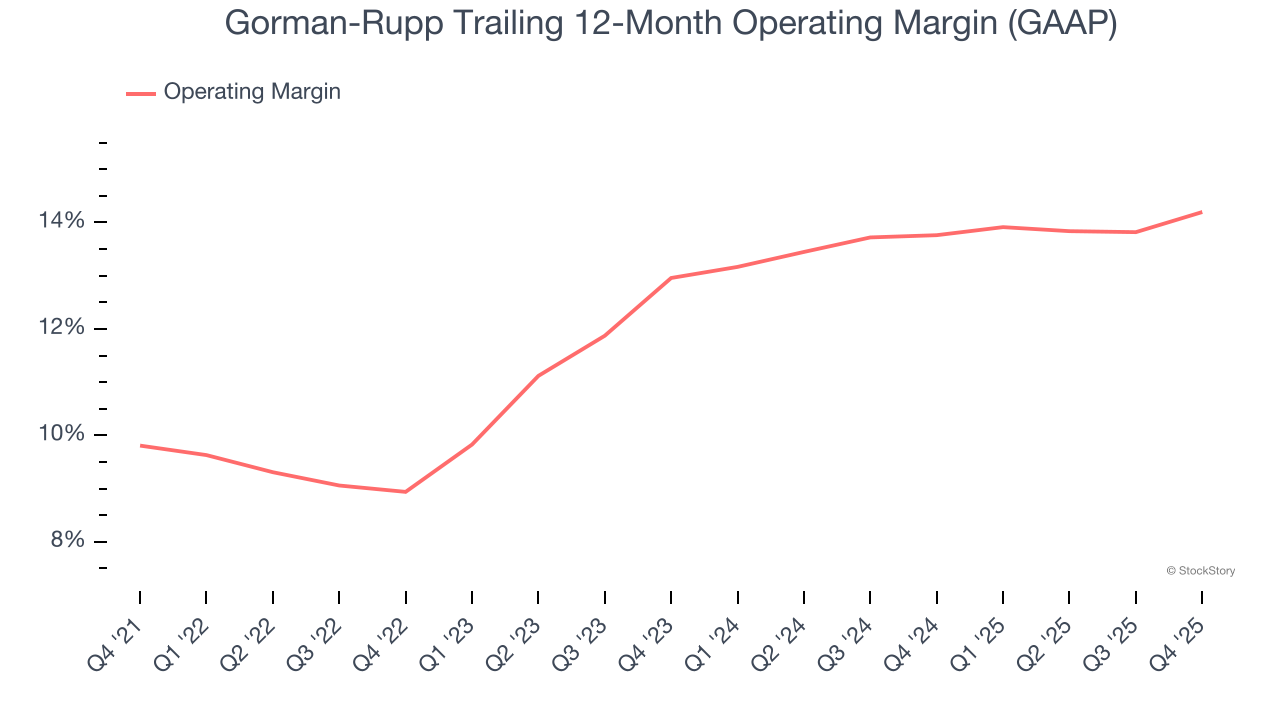

Gorman-Rupp has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Gorman-Rupp’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Gorman-Rupp generated an operating margin profit margin of 14.9%, up 1.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

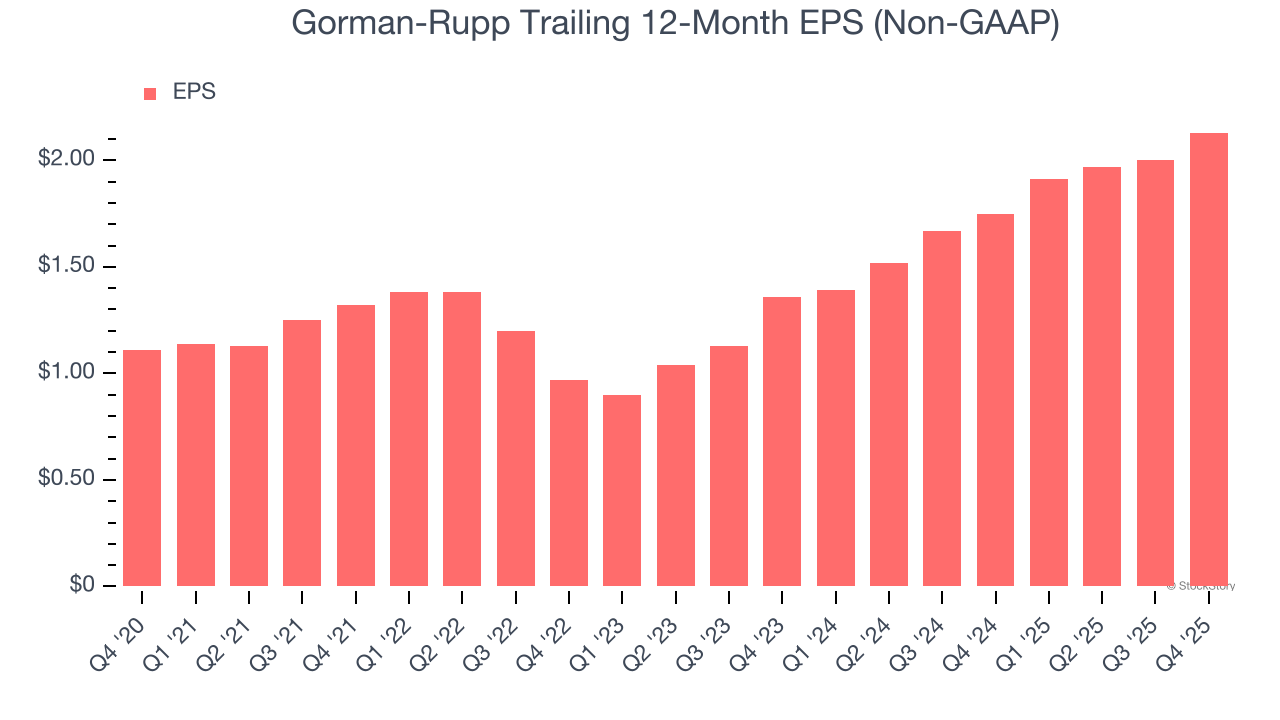

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Gorman-Rupp’s remarkable 13.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Gorman-Rupp’s two-year annual EPS growth of 25.1% was fantastic and topped its 1.7% two-year revenue growth.

Diving into the nuances of Gorman-Rupp’s earnings can give us a better understanding of its performance. Gorman-Rupp’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Gorman-Rupp reported adjusted EPS of $0.55, up from $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gorman-Rupp’s full-year EPS of $2.13 to grow 5.6%.

Key Takeaways from Gorman-Rupp’s Q4 Results

It was good to see Gorman-Rupp beat analysts’ EBITDA and EPS expectations this quarter despite in line revenue. Zooming out, we think this quarter featured some important positives. The stock remained flat at $59.55 immediately following the results.

Big picture, is Gorman-Rupp a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).