Over the last six months, Encompass Health’s shares have sunk to $109.09, producing a disappointing 10.7% loss - a stark contrast to the S&P 500’s 6.7% gain. This may have investors wondering how to approach the situation.

Is now the time to buy Encompass Health, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Encompass Health Not Exciting?

Even though the stock has become cheaper, we're swiping left on Encompass Health for now. Here are two reasons we avoid EHC and a stock we'd rather own.

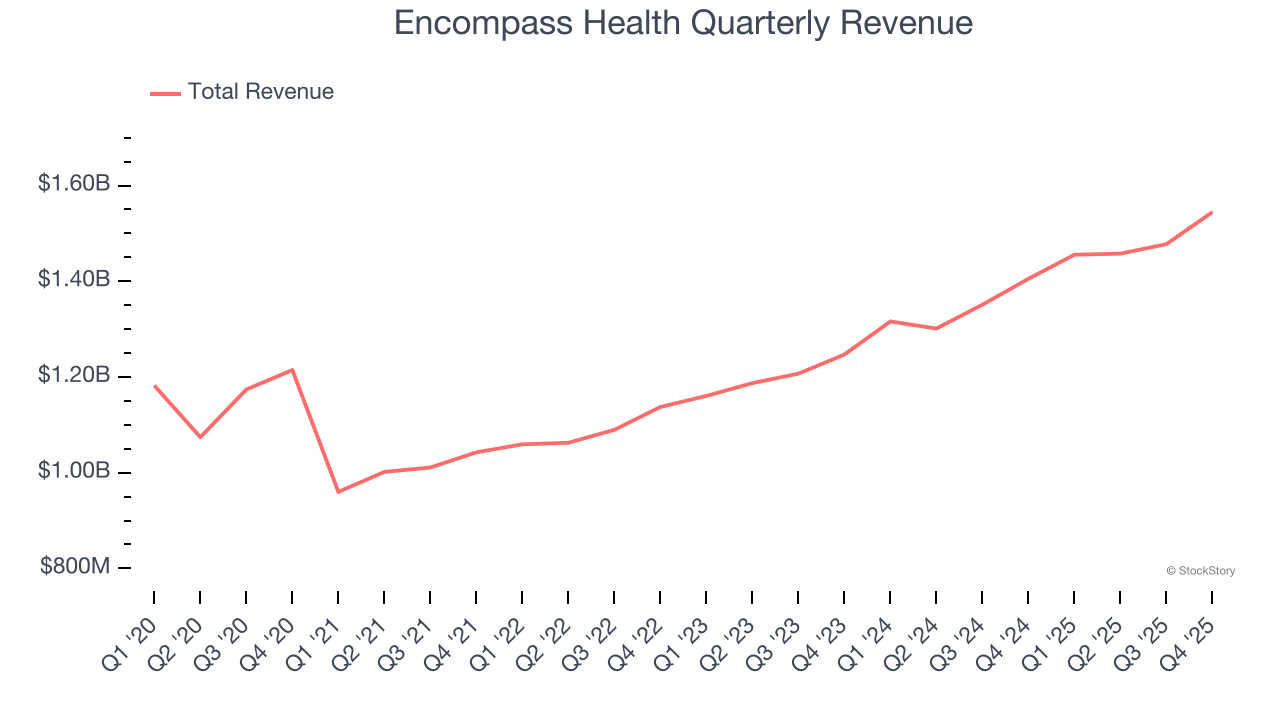

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Encompass Health’s sales grew at a mediocre 5% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector.

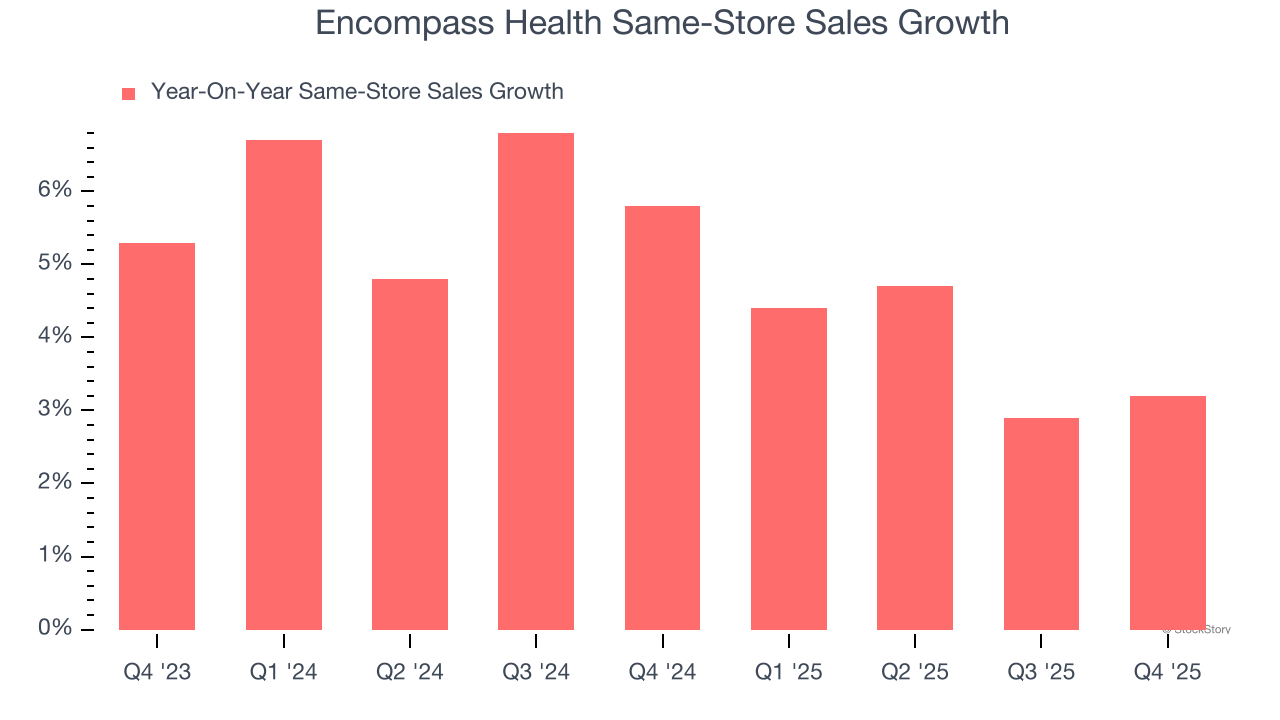

2. Same-Store Sales Falling Behind Peers

In addition to reported revenue, same-store sales are a useful data point for analyzing Outpatient & Specialty Care companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Encompass Health’s underlying demand characteristics.

Over the last two years, Encompass Health’s same-store sales averaged 4.9% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

Final Judgment

Encompass Health’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 18.5× forward P/E (or $109.09 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Encompass Health

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.