Tecnoglass has gotten torched over the last six months - since August 2025, its stock price has dropped 27.9% to $52.63 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Tecnoglass, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Tecnoglass Not Exciting?

Even though the stock has become cheaper, we're swiping left on Tecnoglass for now. Here are three reasons you should be careful with TGLS and a stock we'd rather own.

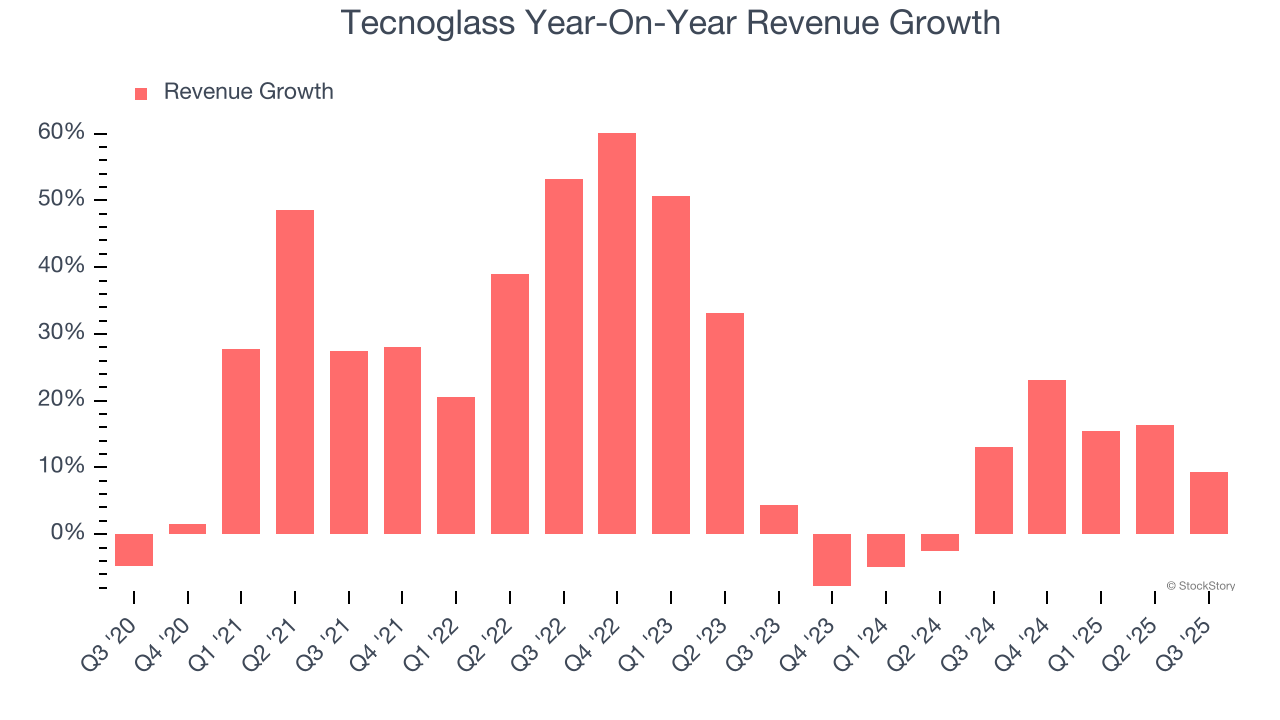

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Tecnoglass’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 7.3% over the last two years was well below its five-year trend.

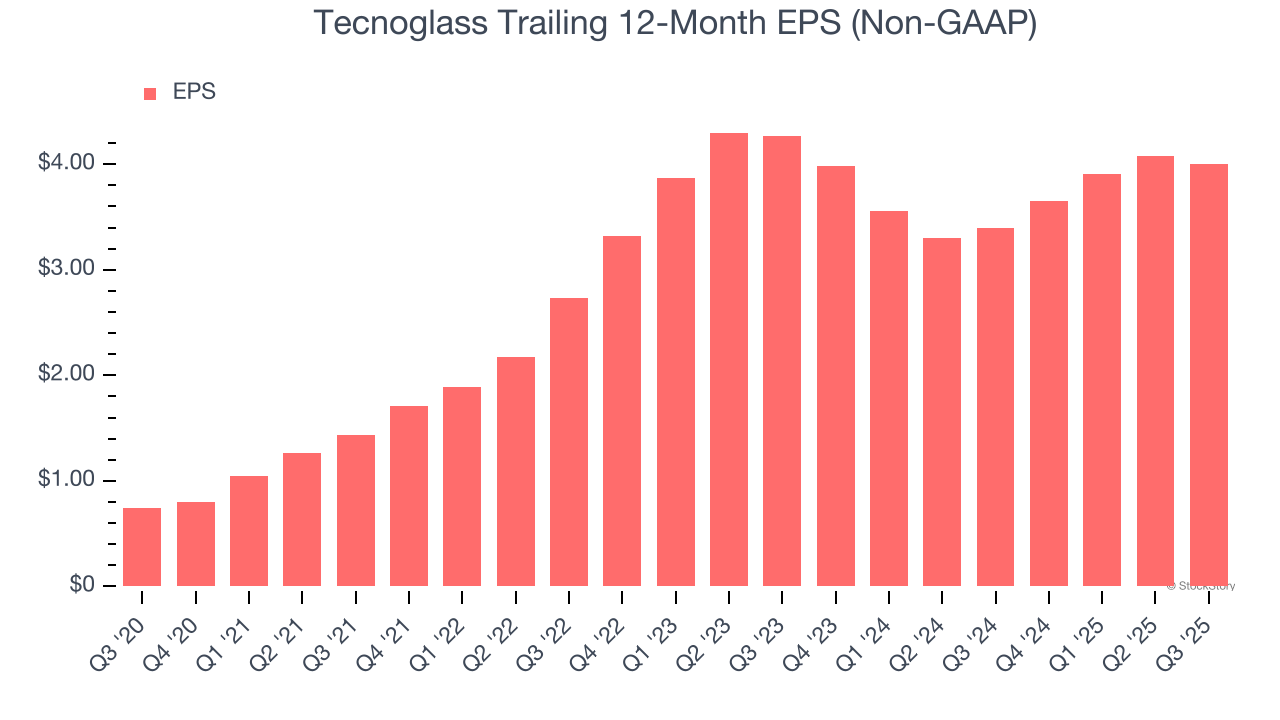

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Tecnoglass, its EPS declined by 3.2% annually over the last two years while its revenue grew by 7.3%. This tells us the company became less profitable on a per-share basis as it expanded.

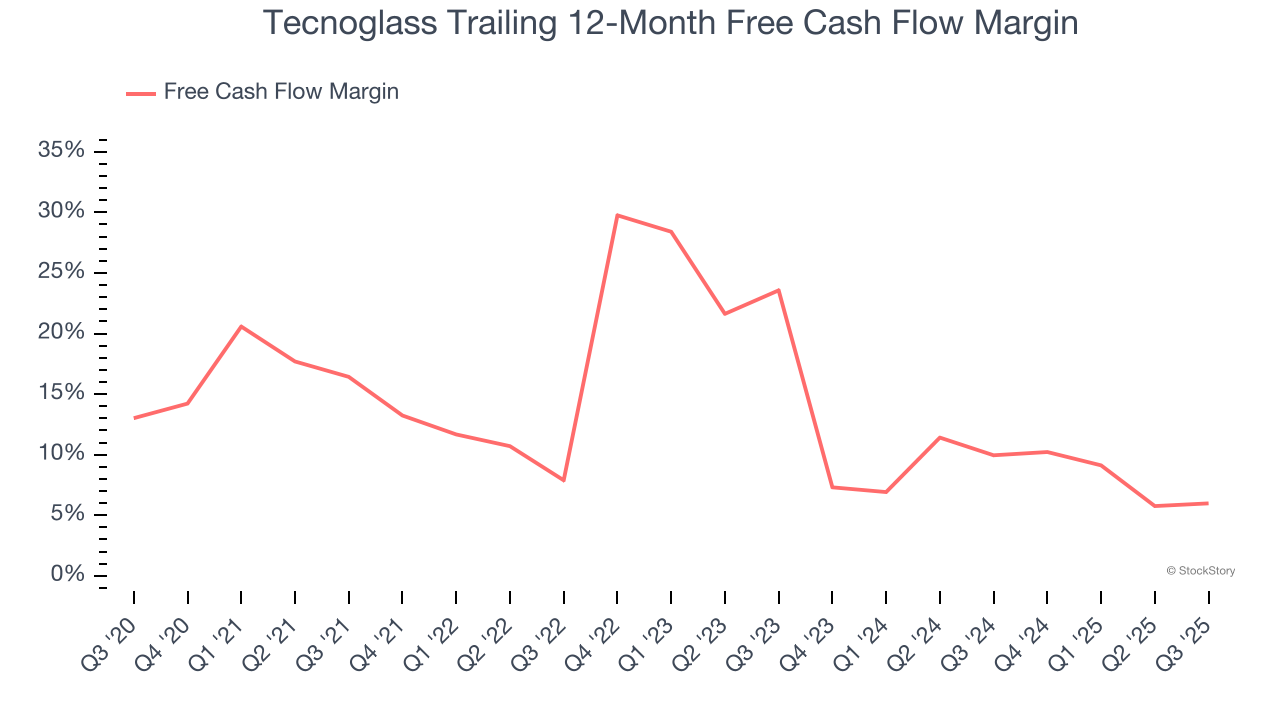

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Tecnoglass’s margin dropped by 10.4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Tecnoglass’s free cash flow margin for the trailing 12 months was 6%.

Final Judgment

Tecnoglass isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 14× forward P/E (or $52.63 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.