Over the past six months, iRhythm has been a great trade, beating the S&P 500 by 27.6%. Its stock price has climbed to $187.29, representing a healthy 39.1% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy IRTC? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does IRTC Stock Spark Debate?

Pioneering the shift from bulky, short-term heart monitors to sleek, wire-free patches, iRhythm Technologies (NASDAQ: IRTC) provides wearable cardiac monitoring devices and AI-powered analysis services that help physicians detect and diagnose heart rhythm disorders.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

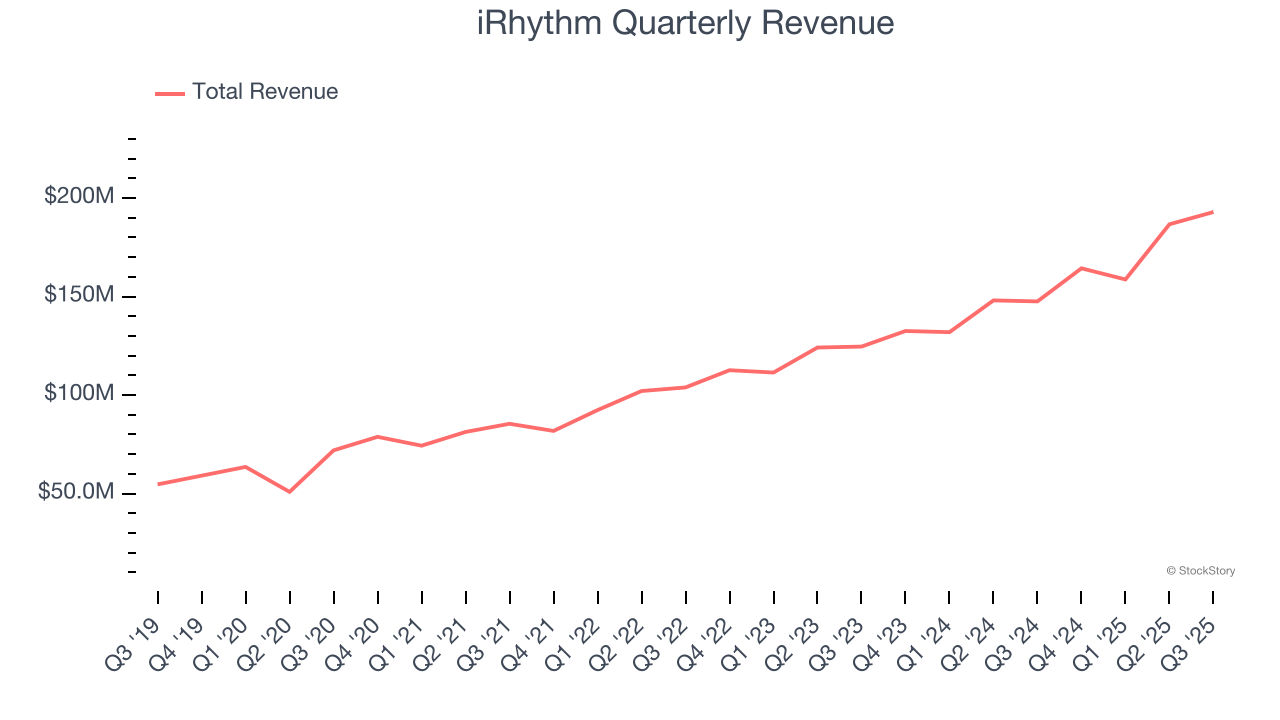

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, iRhythm’s 23.4% annualized revenue growth over the last five years was excellent. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

2. Increasing Free Cash Flow Margin Juices Financials

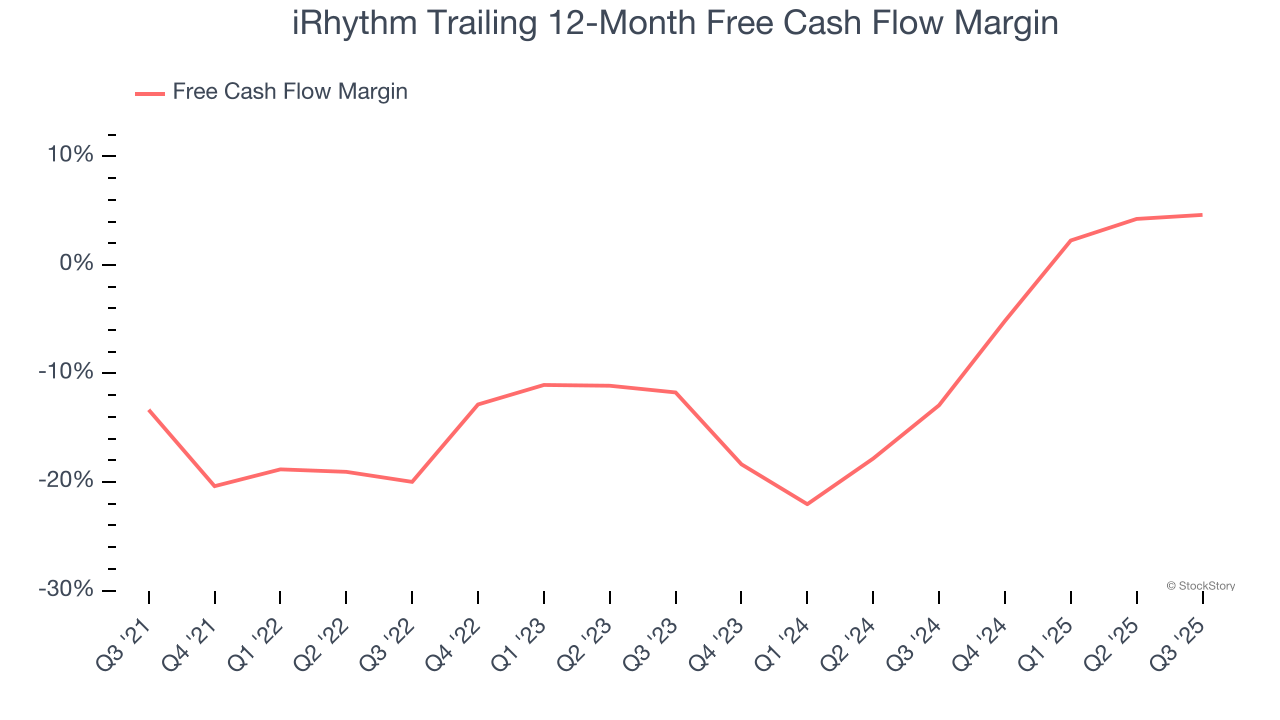

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, iRhythm’s margin expanded by 18 percentage points over the last five years. iRhythm’s free cash flow margin for the trailing 12 months was 4.6%.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $702.6 million in revenue over the past 12 months, iRhythm is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, iRhythm’s smaller revenue base allows it to grow faster if it can execute well.

Final Judgment

iRhythm has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 68.8× forward EV-to-EBITDA (or $187.29 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than iRhythm

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.