Quest trades at $179.96 and has moved in lockstep with the market. Its shares have returned 6.9% over the last six months while the S&P 500 has gained 11.3%.

Is now the time to buy Quest, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Quest Not Exciting?

We don't have much confidence in Quest. Here are three reasons there are better opportunities than DGX and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

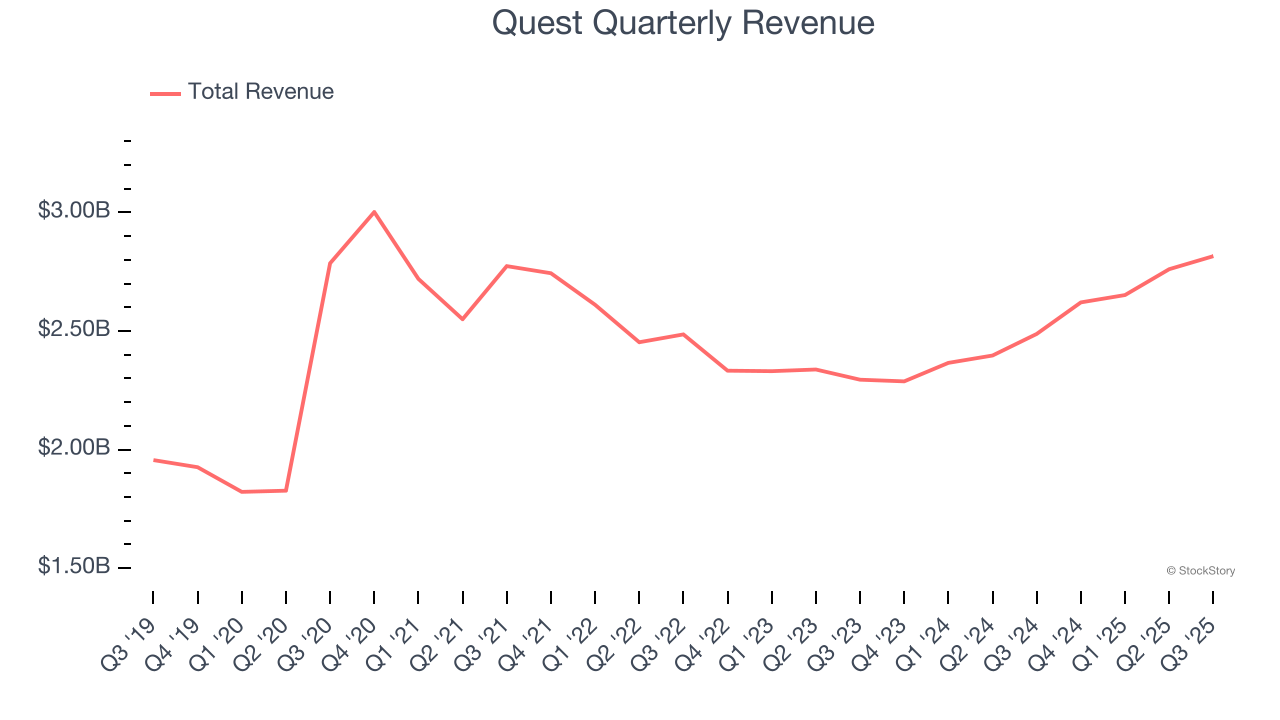

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Quest’s sales grew at a mediocre 5.3% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector.

2. Shrinking Adjusted Operating Margin

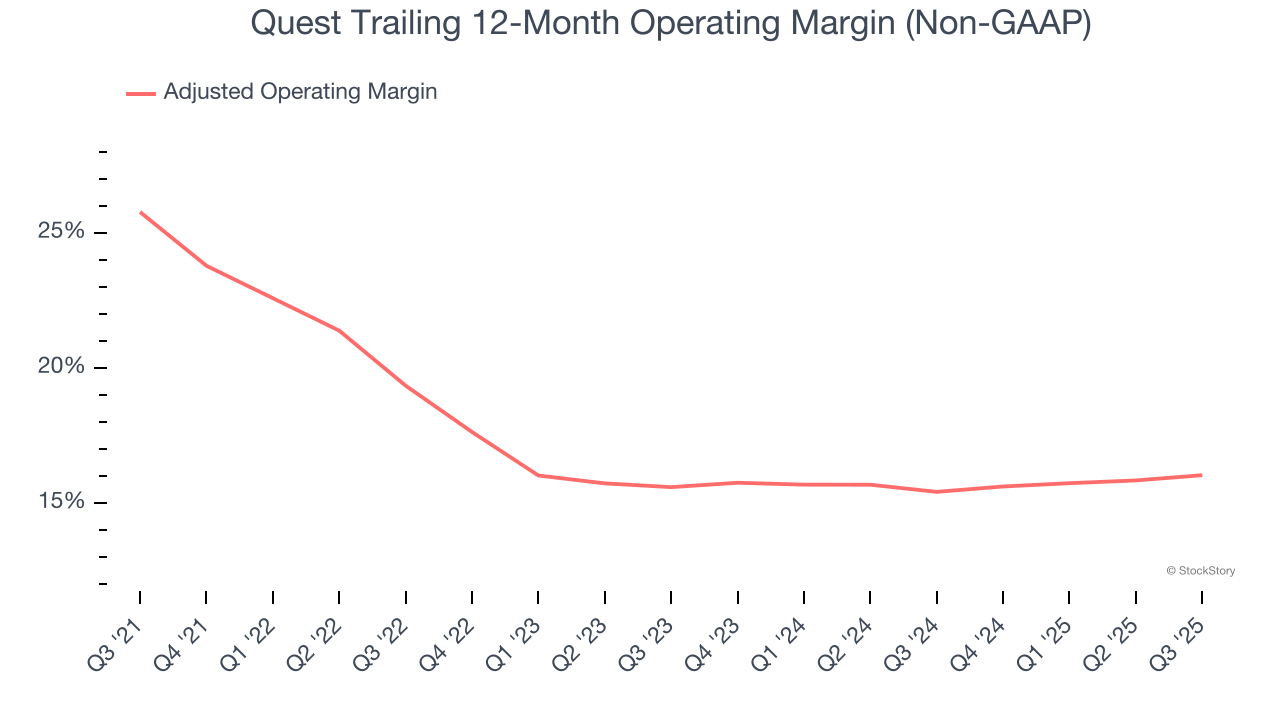

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Analyzing the trend in its profitability, Quest’s adjusted operating margin decreased by 9.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 16%.

3. New Investments Fail to Bear Fruit as ROIC Declines

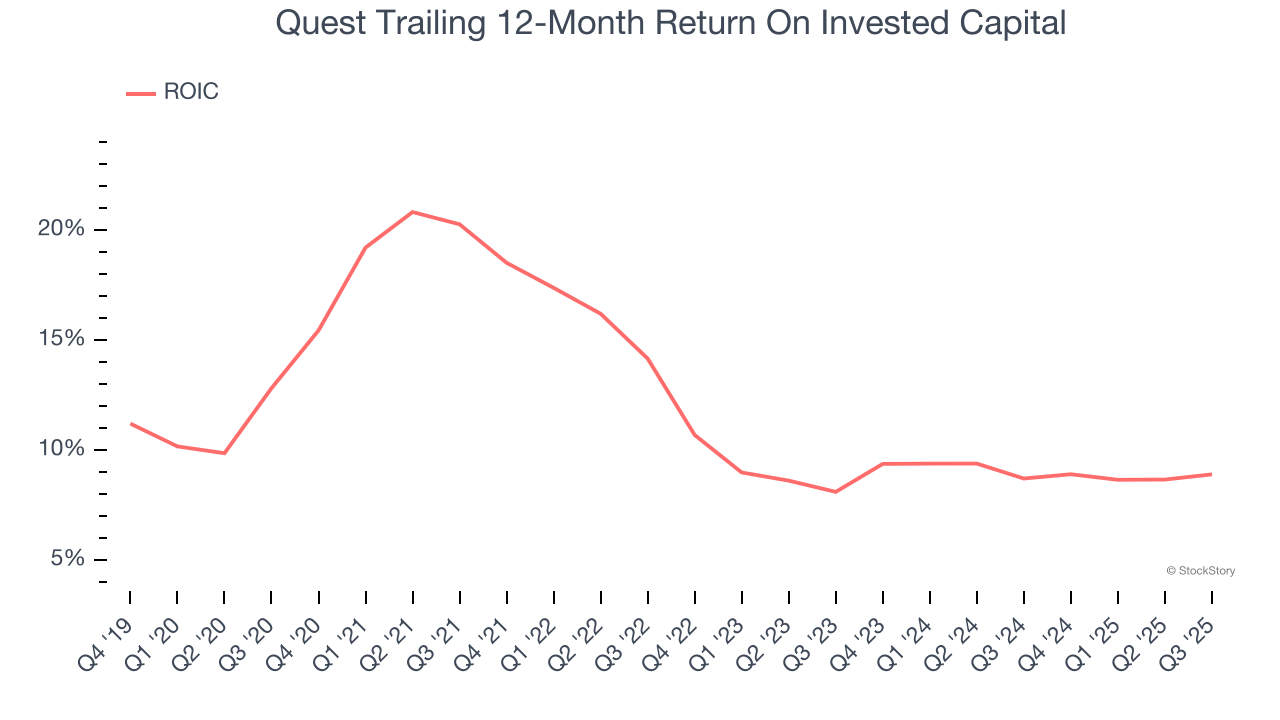

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Quest’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Quest’s business quality ultimately falls short of our standards. That said, the stock currently trades at 17.3× forward P/E (or $179.96 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.