Over the past six months, Nicolet Bankshares has been a great trade, beating the S&P 500 by 20%. Its stock price has climbed to $130.08, representing a healthy 24.8% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is NIC a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On NIC?

Starting as Green Bay Financial Corporation in 2000 before rebranding in 2002, Nicolet Bankshares (NYSE: NIC) is a regional bank holding company that provides commercial, agricultural, and consumer banking services primarily in Wisconsin, Michigan, and Minnesota.

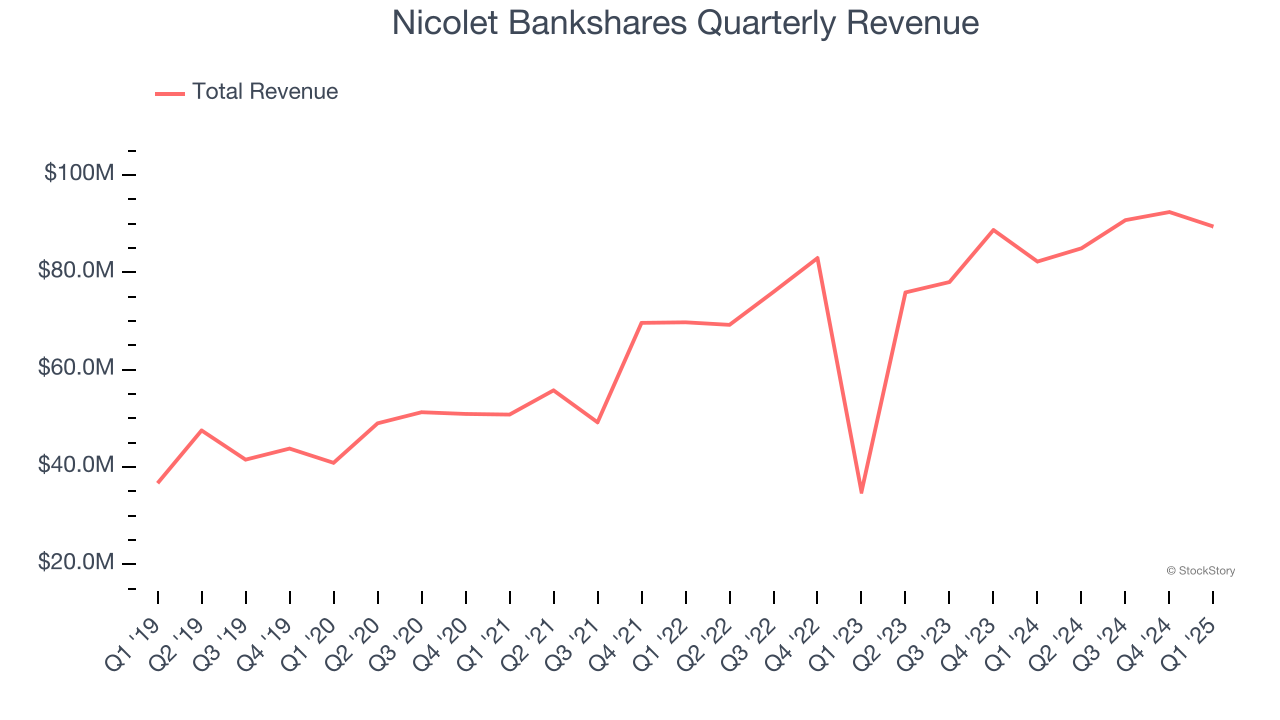

1. Skyrocketing Revenue Shows Strong Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Luckily, Nicolet Bankshares’s revenue grew at an incredible 15.5% compounded annual growth rate over the last five years. Its growth surpassed the average bank company and shows its offerings resonate with customers.

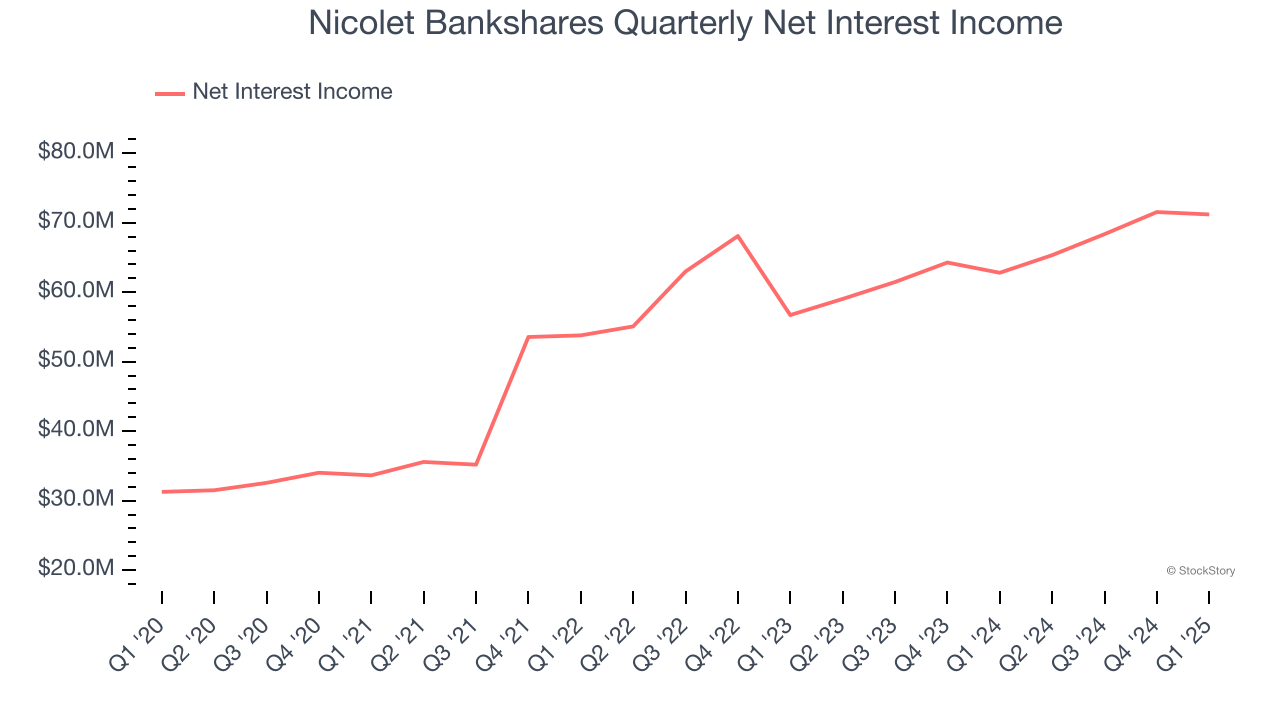

2. Net Interest Income Skyrockets, Fueling Growth Opportunities

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Nicolet Bankshares’s net interest income has grown at a 20.4% annualized rate over the last four years, much better than the broader bank industry.

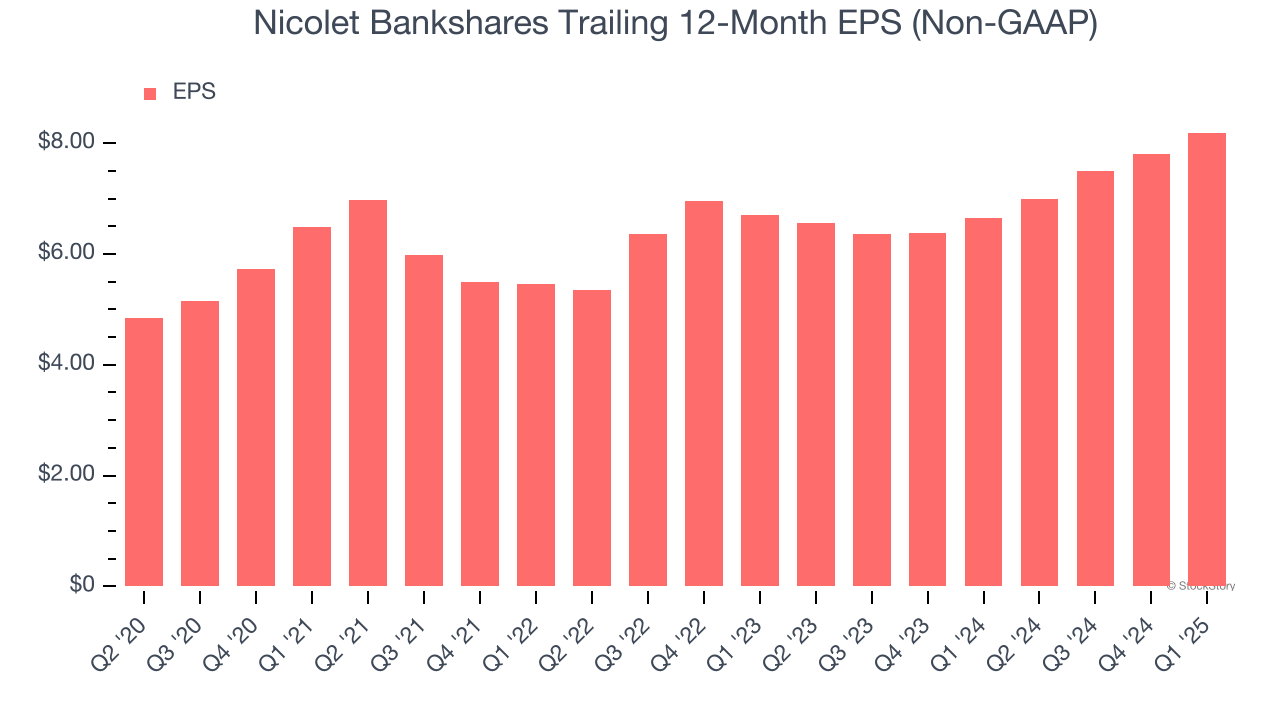

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Nicolet Bankshares’s EPS grew at an astounding 12.1% compounded annual growth rate over the last five years. This performance was better than most bank businesses.

Final Judgment

These are just a few reasons Nicolet Bankshares is a high-quality business worth owning, and with its shares topping the market in recent months, the stock trades at 1.6× forward P/B (or $130.08 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.