Medical tech company Masimo (NASDAQ: MASI) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 9.4% year on year to $600.7 million. Its non-GAAP profit of $1.80 per share was 26.3% above analysts’ consensus estimates.

Is now the time to buy Masimo? Find out by accessing our full research report, it’s free.

Masimo (MASI) Q4 CY2024 Highlights:

- Revenue: $600.7 million vs analyst estimates of $591.9 million (9.4% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.80 vs analyst estimates of $1.43 (26.3% beat)

- Adjusted EBITDA: $40.1 million vs analyst estimates of $128 million (6.7% margin, 68.7% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $5.25 at the midpoint, beating analyst estimates by 11.9%

- Operating Margin: -0.4%, down from 8% in the same quarter last year

- Free Cash Flow Margin: 9.2%, down from 12.1% in the same quarter last year

- Constant Currency Revenue rose 9% year on year (-11.4% in the same quarter last year)

- Market Capitalization: $9.14 billion

Katie Szyman, Chief Executive Officer of Masimo, said “I am extremely excited about the opportunity to lead such an innovative organization as we refocus on our core healthcare business. There are numerous unmet clinical needs that we are well-positioned to address and we have strong momentum behind us. I look forward to interfacing with our customers and discussing our differentiated solutions for patient care. Our 2024 results clearly demonstrate the strong growth and earnings power of our healthcare business. We had a record year in terms of gaining share through customer contracts. As a result of our strategic realignment efforts in the fourth quarter, we expect to see increased earnings and cash flow in 2025 and beyond.”

Company Overview

Founded in 1989, Masimo Corporation (NASDAQ: MASI) develops and manufactures medical devices, with a focus on noninvasive monitoring technologies.

Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

Sales Growth

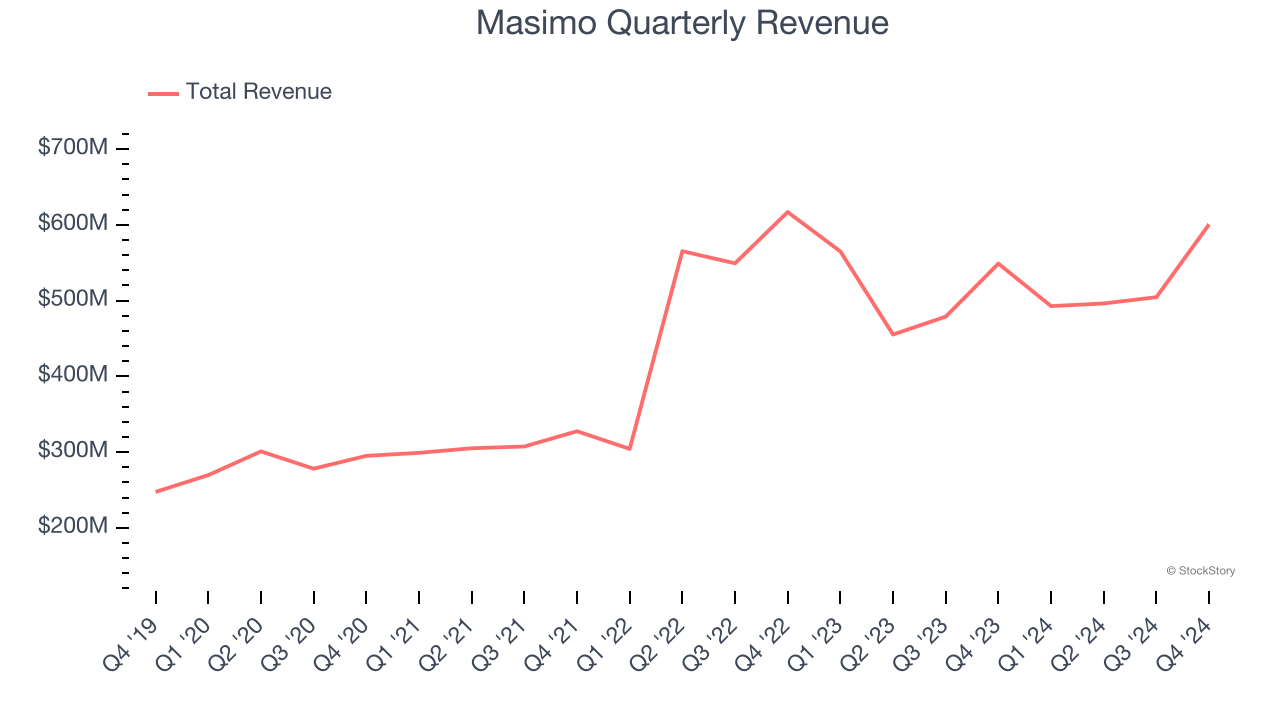

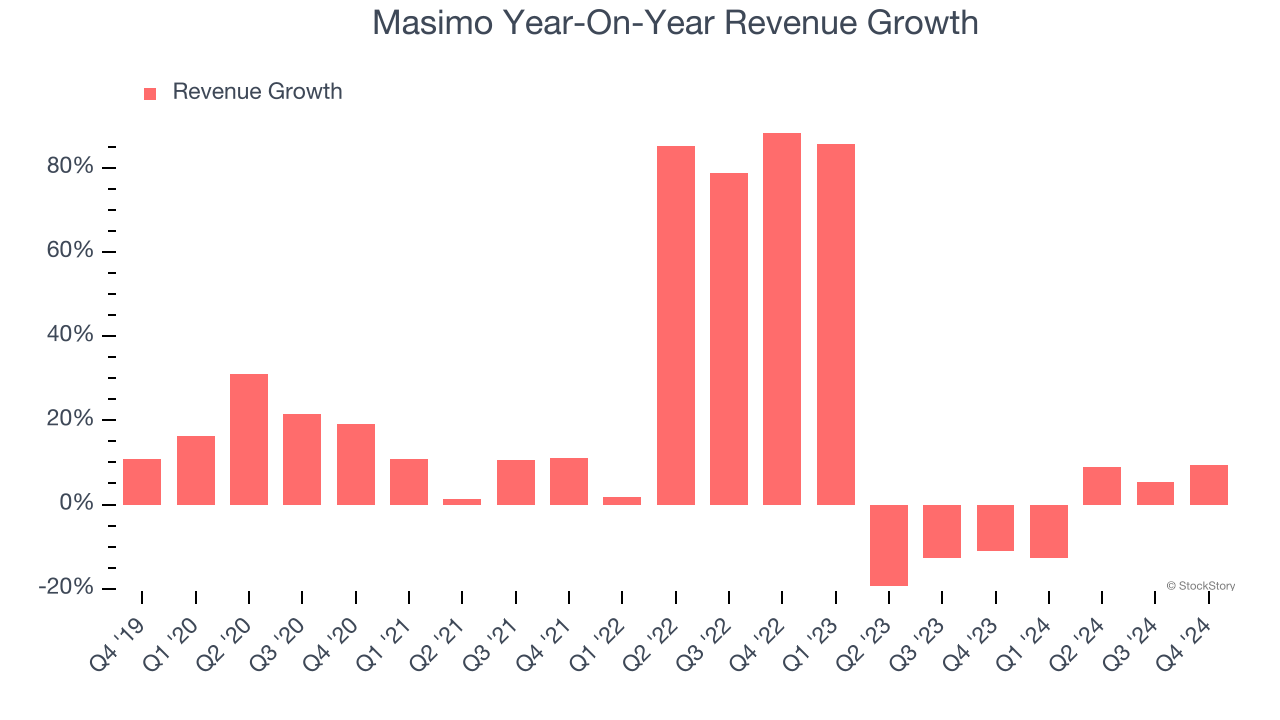

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Masimo grew its sales at an impressive 17.4% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Masimo’s recent history shows its demand slowed significantly as its annualized revenue growth of 1.4% over the last two years is well below its five-year trend.

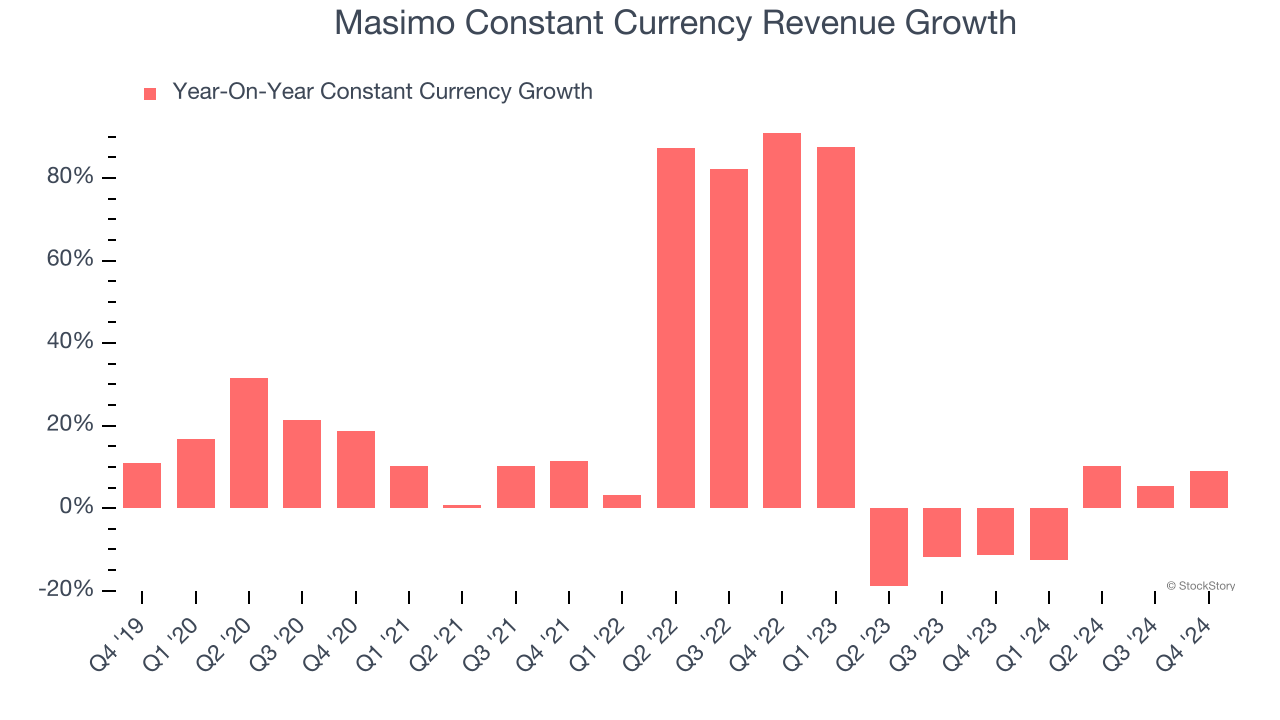

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 7.2% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Masimo.

This quarter, Masimo reported year-on-year revenue growth of 9.4%, and its $600.7 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

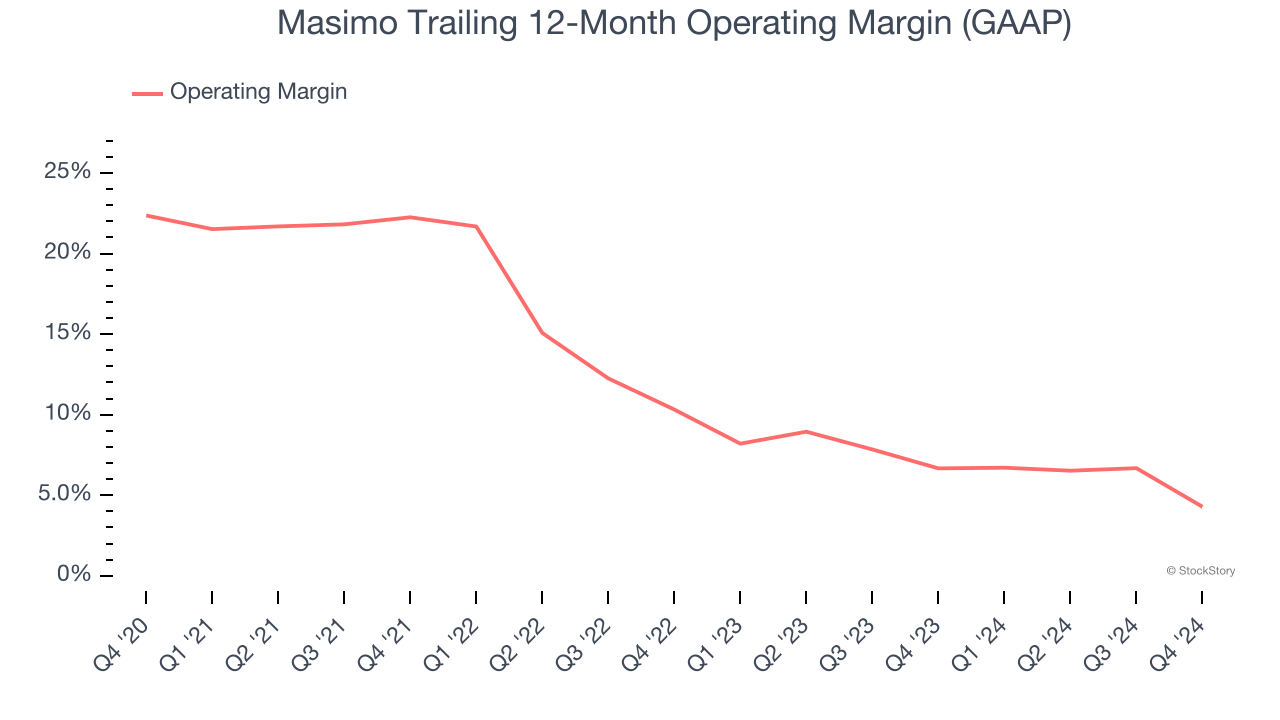

Masimo has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.3%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Masimo’s operating margin decreased by 18.1 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 6 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Masimo’s breakeven margin was down 8.5 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

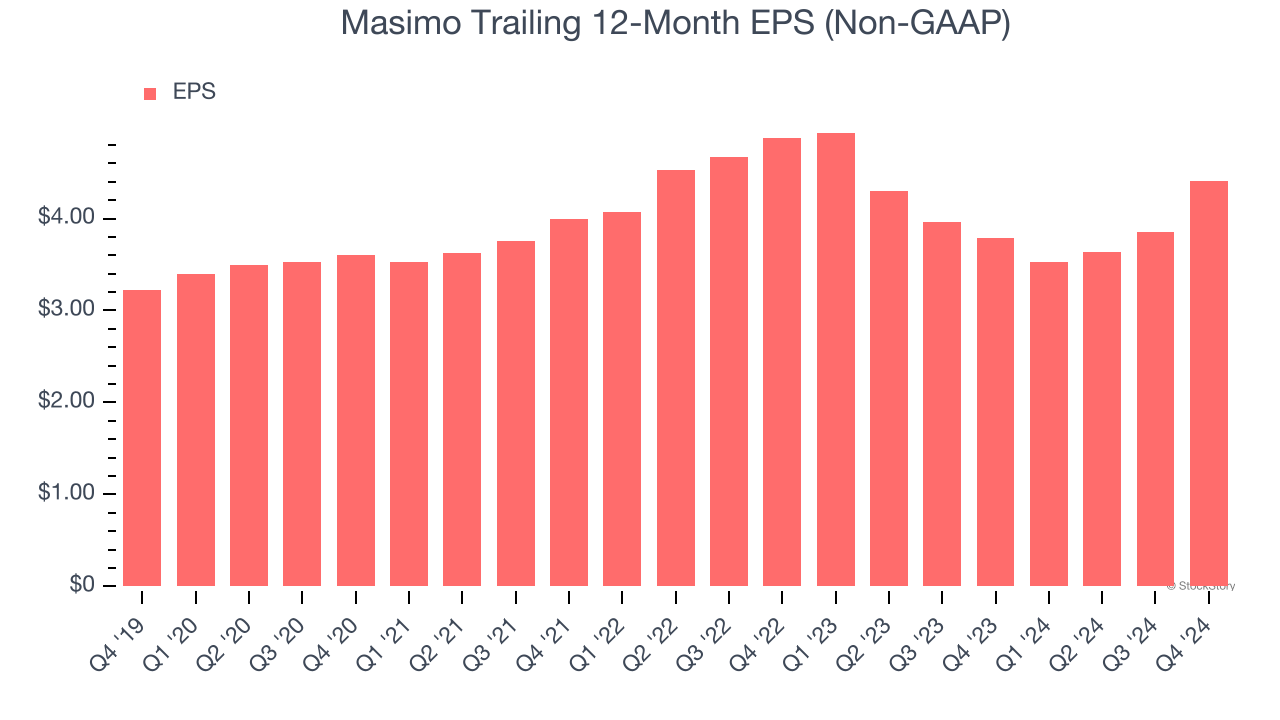

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Masimo’s EPS grew at a decent 6.5% compounded annual growth rate over the last five years. However, this performance was lower than its 17.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Masimo’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Masimo’s operating margin declined by 18.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Masimo reported EPS at $1.80, up from $1.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Masimo’s full-year EPS of $4.41 to grow 5.5%.

Key Takeaways from Masimo’s Q4 Results

It was great to see Masimo beat past analysts’ revenue and EPS expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock traded up 4.2% to $176.26 immediately following the results.

Masimo put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.