Flavor and fragrance producer IFF (NYSE: IFF) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 7.9% year on year to $2.69 billion. On the other hand, the company’s full-year revenue guidance of $10.75 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $1.05 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy International Flavors & Fragrances? Find out by accessing our full research report, it’s free for active Edge members.

International Flavors & Fragrances (IFF) Q3 CY2025 Highlights:

- Revenue: $2.69 billion vs analyst estimates of $2.64 billion (7.9% year-on-year decline, 2.1% beat)

- Adjusted EPS: $1.05 vs analyst estimates of $1.02 (3.3% beat)

- Adjusted EBITDA: $519 million vs analyst estimates of $494.1 million (19.3% margin, 5% beat)

- EBITDA guidance for the full year is $2.08 billion at the midpoint, in line with analyst expectations

- Operating Margin: 8.4%, in line with the same quarter last year

- Free Cash Flow Margin: 1.2%, down from 9% in the same quarter last year

- Organic Revenue rose 8% year on year vs analyst estimates of 1.5% declines (945.2 basis point beat)

- Market Capitalization: $17.35 billion

Company Overview

Responsible for the scents in your favorite perfumes and the flavors in your daily snacks, International Flavors & Fragrances (NYSE: IFF) creates and manufactures ingredients for food, beverages, personal care products, and pharmaceuticals used in countless consumer goods.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $11.07 billion in revenue over the past 12 months, International Flavors & Fragrances is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. For International Flavors & Fragrances to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

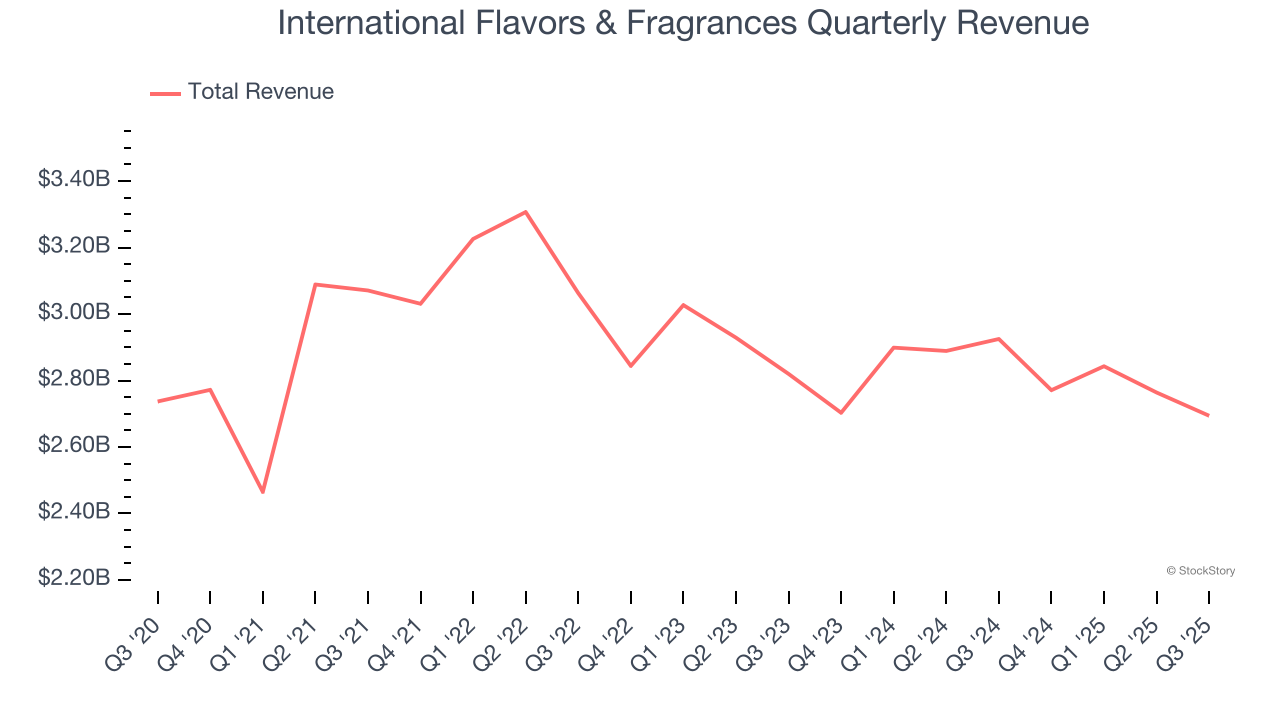

As you can see below, International Flavors & Fragrances’s revenue declined by 4.3% per year over the last three years, a poor baseline for our analysis.

This quarter, International Flavors & Fragrances’s revenue fell by 7.9% year on year to $2.69 billion but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to decline by 4.8% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and implies its newer products will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

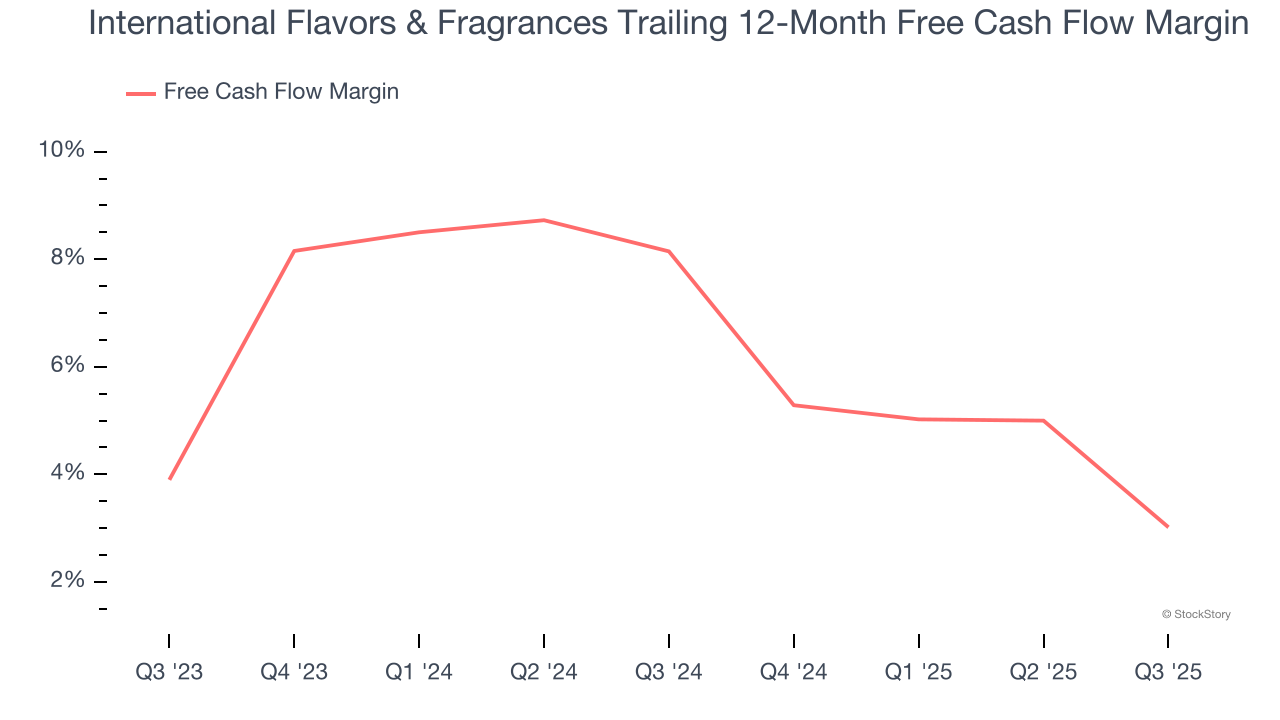

International Flavors & Fragrances has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.6% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that International Flavors & Fragrances’s margin dropped by 5.1 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

International Flavors & Fragrances’s free cash flow clocked in at $32 million in Q3, equivalent to a 1.2% margin. The company’s cash profitability regressed as it was 7.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from International Flavors & Fragrances’s Q3 Results

We were impressed by how significantly International Flavors & Fragrances blew past analysts’ organic revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its adjusted operating income missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $67.96 immediately following the results.

International Flavors & Fragrances had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.