Let’s dig into the relative performance of Astec (NASDAQ: ASTE) and its peers as we unravel the now-completed Q3 heavy machinery earnings season.

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new demand for heavy machinery and equipment companies. The gradual transition to clean energy also allows companies to innovate around emissions, potentially spurring replacement cycles that can accelerate revenue growth. On the other hand, heavy machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 21 heavy machinery stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 4.3% on average since the latest earnings results.

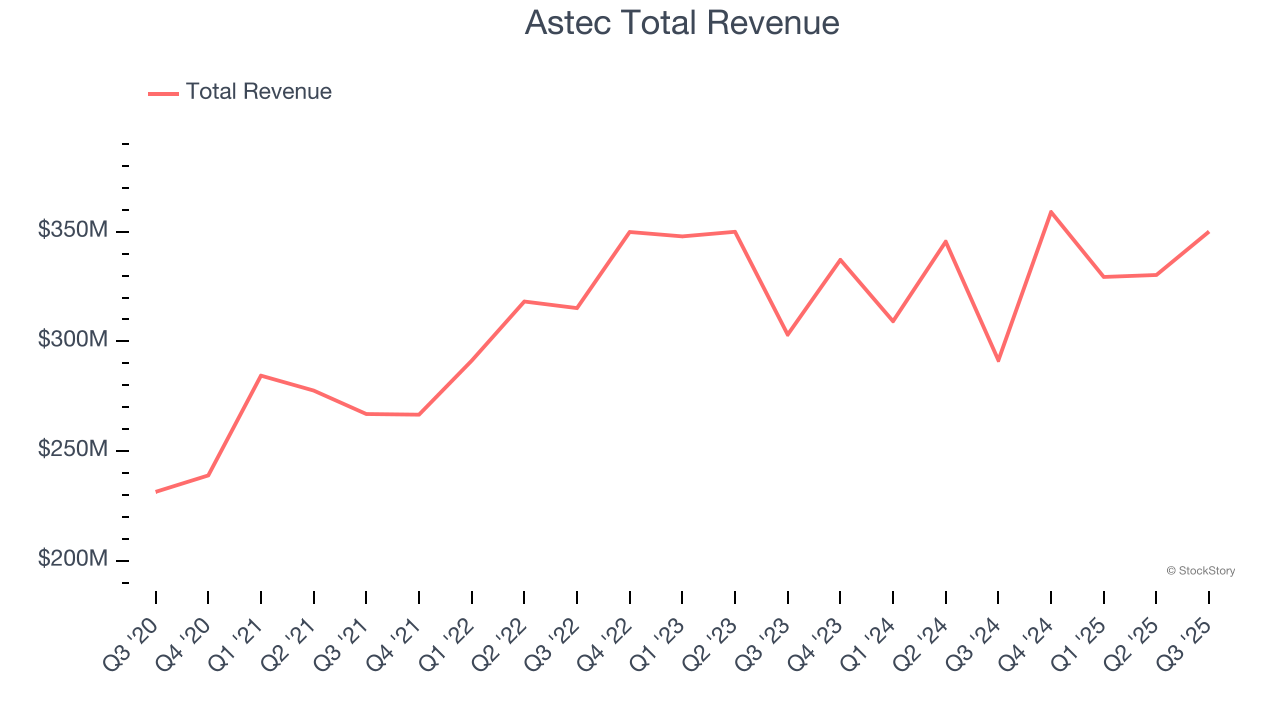

Astec (NASDAQ: ASTE)

Inventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ: ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete.

Astec reported revenues of $350.1 million, up 20.1% year on year. This print exceeded analysts’ expectations by 5.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

"We were pleased to post another strong quarter evidencing our focus on delivering consistent profitability and growth," said Jaco van der Merwe, Chief Executive Officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $46.44.

Is now the time to buy Astec? Access our full analysis of the earnings results here, it’s free for active Edge members.

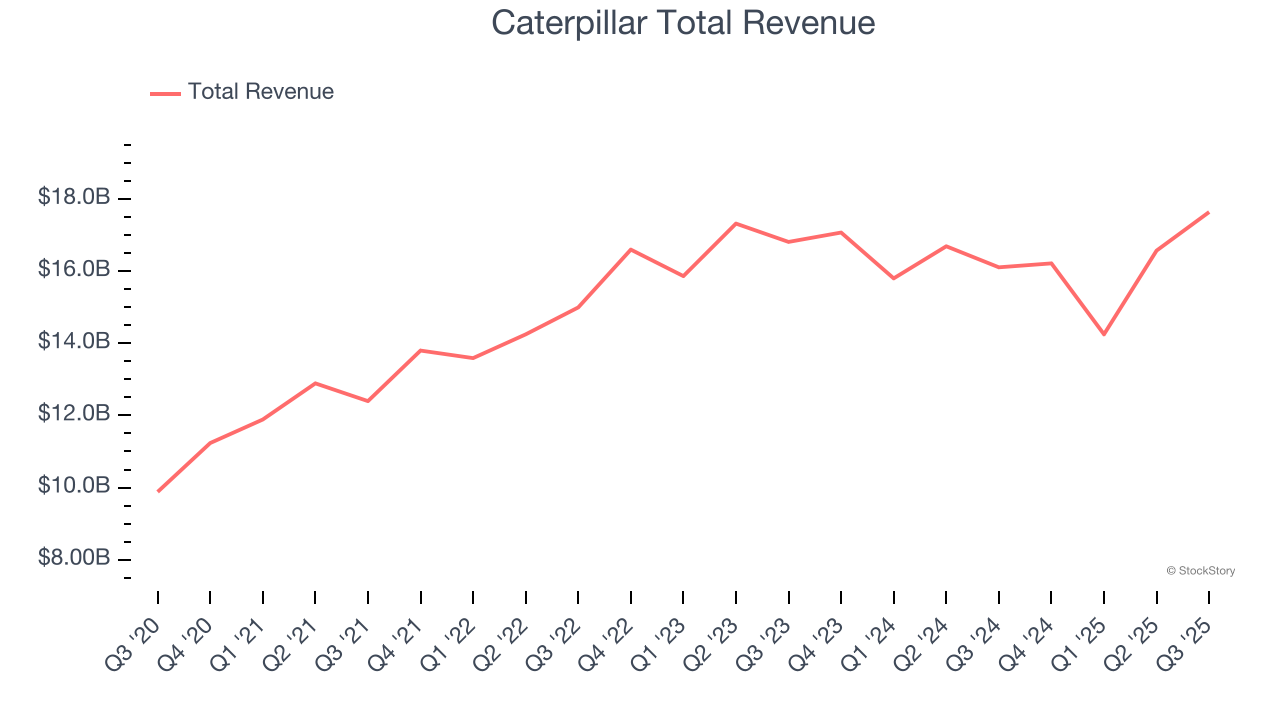

Best Q3: Caterpillar (NYSE: CAT)

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE: CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Caterpillar reported revenues of $17.64 billion, up 9.5% year on year, outperforming analysts’ expectations by 6.1%. The business had a stunning quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 12.2% since reporting. It currently trades at $588.36.

Is now the time to buy Caterpillar? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Wabash (NYSE: WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE: WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $381.6 million, down 17.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

Wabash delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 17.7% since the results and currently trades at $9.79.

Read our full analysis of Wabash’s results here.

Titan International (NYSE: TWI)

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

Titan International reported revenues of $466.5 million, up 4.1% year on year. This print surpassed analysts’ expectations by 1.7%. Overall, it was a strong quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 3.8% since reporting and currently trades at $8.26.

Read our full, actionable report on Titan International here, it’s free for active Edge members.

Wabtec (NYSE: WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE: WAB) provides equipment, systems, and related software for the railway industry.

Wabtec reported revenues of $2.89 billion, up 8.4% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ organic revenue estimates.

The stock is up 7.8% since reporting and currently trades at $213.39.

Read our full, actionable report on Wabtec here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.