As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at shelf-stable food stocks, starting with TreeHouse Foods (NYSE: THS).

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.9%.

In light of this news, share prices of the companies have held steady as they are up 1.1% on average since the latest earnings results.

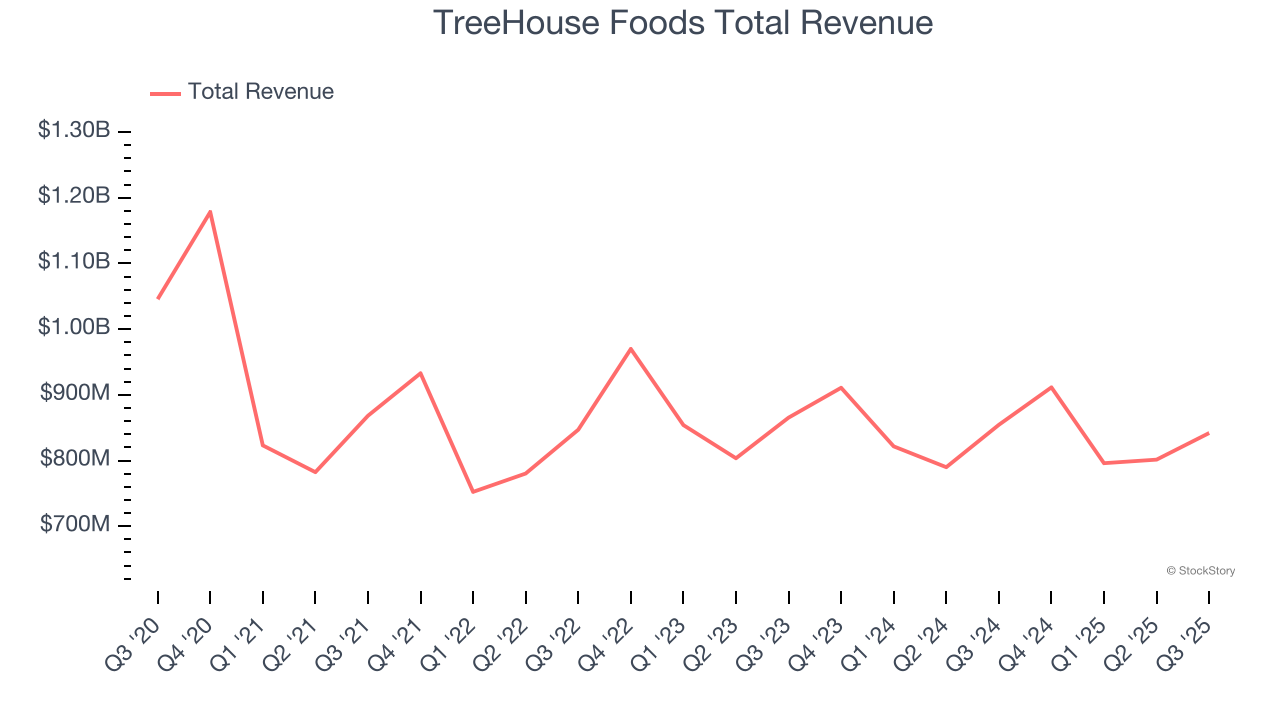

Slowest Q3: TreeHouse Foods (NYSE: THS)

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE: THS) produces a wide range of private-label foods for grocery and food service customers.

TreeHouse Foods reported revenues of $841.9 million, down 1.5% year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ gross margin estimates.

Interestingly, the stock is up 25.4% since reporting and currently trades at $23.89.

Read our full report on TreeHouse Foods here, it’s free for active Edge members.

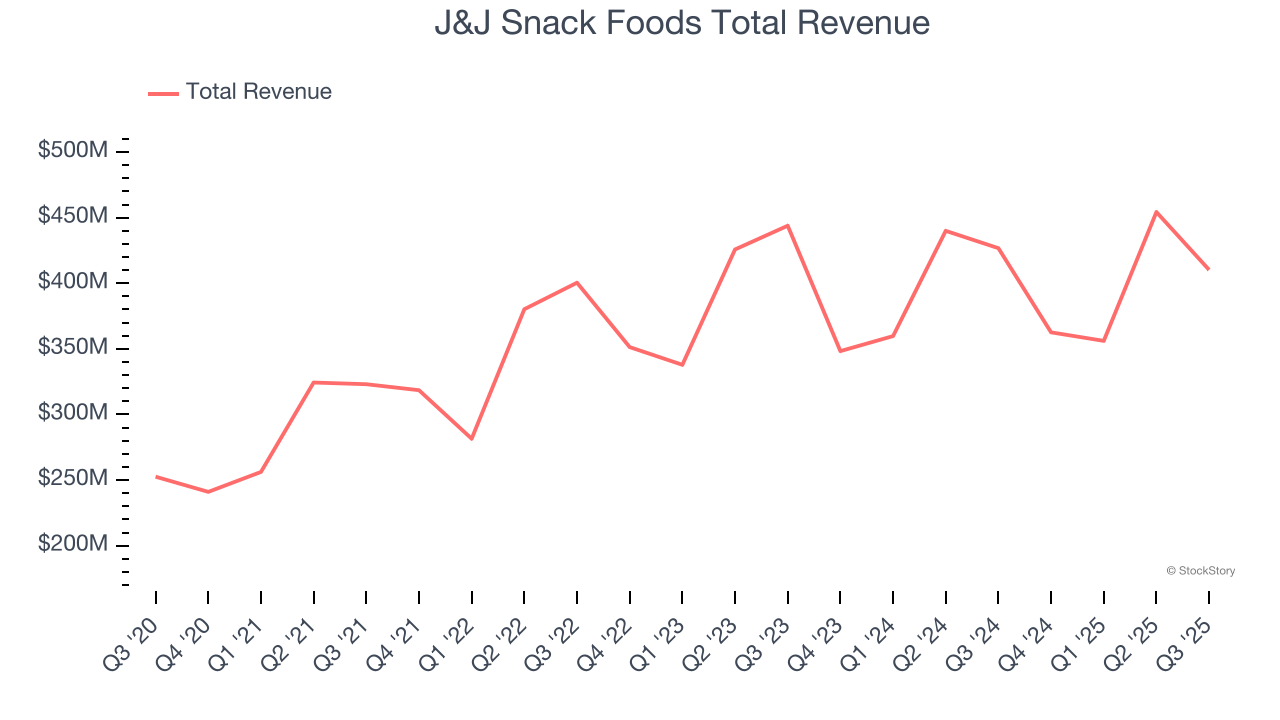

Best Q3: J&J Snack Foods (NASDAQ: JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $410.2 million, down 3.9% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 14.3% since reporting. It currently trades at $94.95.

Is now the time to buy J&J Snack Foods? Access our full analysis of the earnings results here, it’s free for active Edge members.

BellRing Brands (NYSE: BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE: BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $648.2 million, up 16.6% year on year, exceeding analysts’ expectations by 2.3%. Still, it was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ gross margin estimates.

Interestingly, the stock is up 28% since the results and currently trades at $32.79.

Read our full analysis of BellRing Brands’s results here.

Conagra (NYSE: CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE: CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.63 billion, down 5.8% year on year. This print surpassed analysts’ expectations by 0.7%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

The stock is down 1.9% since reporting and currently trades at $17.96.

Read our full, actionable report on Conagra here, it’s free for active Edge members.

Post (NYSE: POST)

Founded in 1895, Post (NYSE: POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Post reported revenues of $2.25 billion, up 11.8% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a significant miss of analysts’ gross margin estimates.

The stock is down 6.3% since reporting and currently trades at $100.38.

Read our full, actionable report on Post here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.