Specialty insurance company Bowhead Specialty Holdings (NYSE: BOW) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 23.3% year on year to $143.9 million. Its GAAP profit of $0.45 per share was 14.2% above analysts’ consensus estimates.

Is now the time to buy Bowhead Specialty? Find out by accessing our full research report, it’s free for active Edge members.

Bowhead Specialty (BOW) Q3 CY2025 Highlights:

Bowhead Chief Executive Officer, Stephen Sills, commented, “Bowhead delivered another excellent quarter highlighted by consistent strong top and bottom line growth. Gross written premiums in the third quarter grew 17.5% year-over-year and adjusted net income grew 25.5%. We achieved adjusted return on equity of 15.1% and diluted adjusted earnings per share of $0.47. These results are a testament to our disciplined approach to underwriting, the continued expansion of our “craft” and “flow” underwriting operations, and our commitment to operational excellence.

Company Overview

Named after the Arctic bowhead whale known for navigating challenging waters, Bowhead Specialty Holdings (NYSE: BOW) is a specialty insurance company that provides customized coverage for complex and high-risk commercial sectors.

Revenue Growth

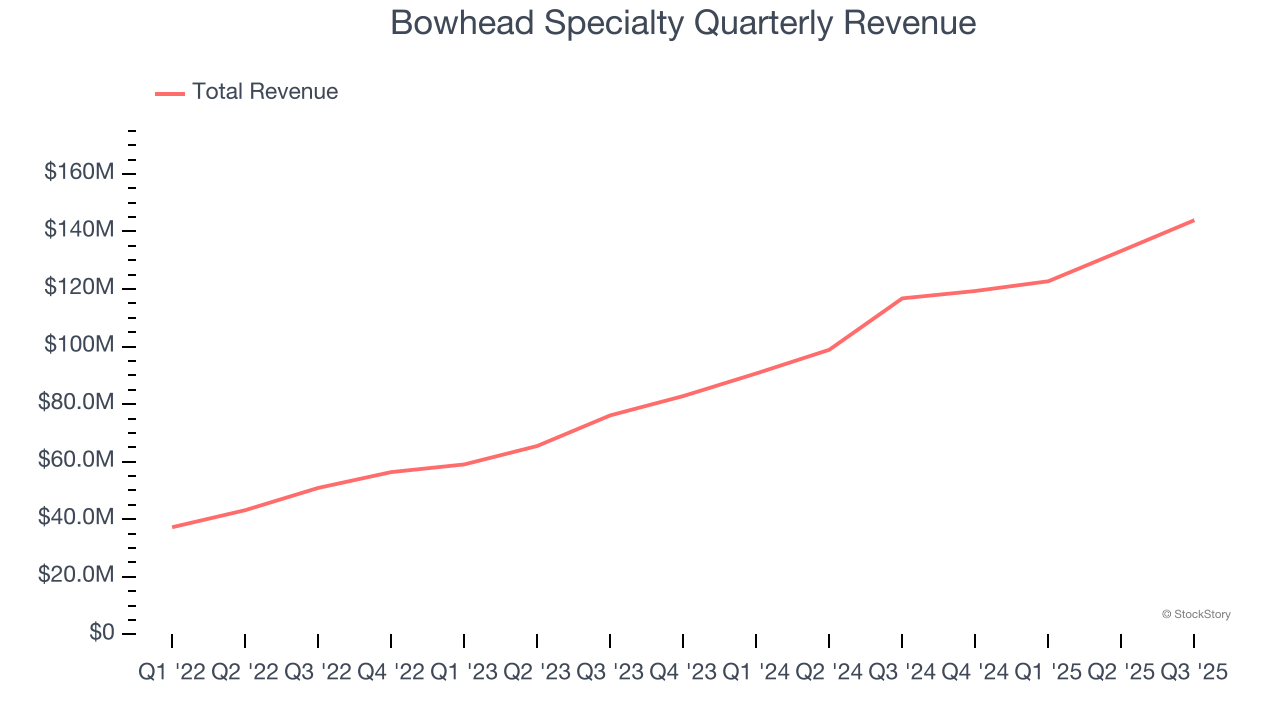

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Bowhead Specialty’s annualized revenue growth rate of 42.1% over the last two years was incredible for an insurance business.

This quarter, Bowhead Specialty reported robust year-on-year revenue growth of 23.3%, and its $143.9 million of revenue topped Wall Street estimates by 1.2%.

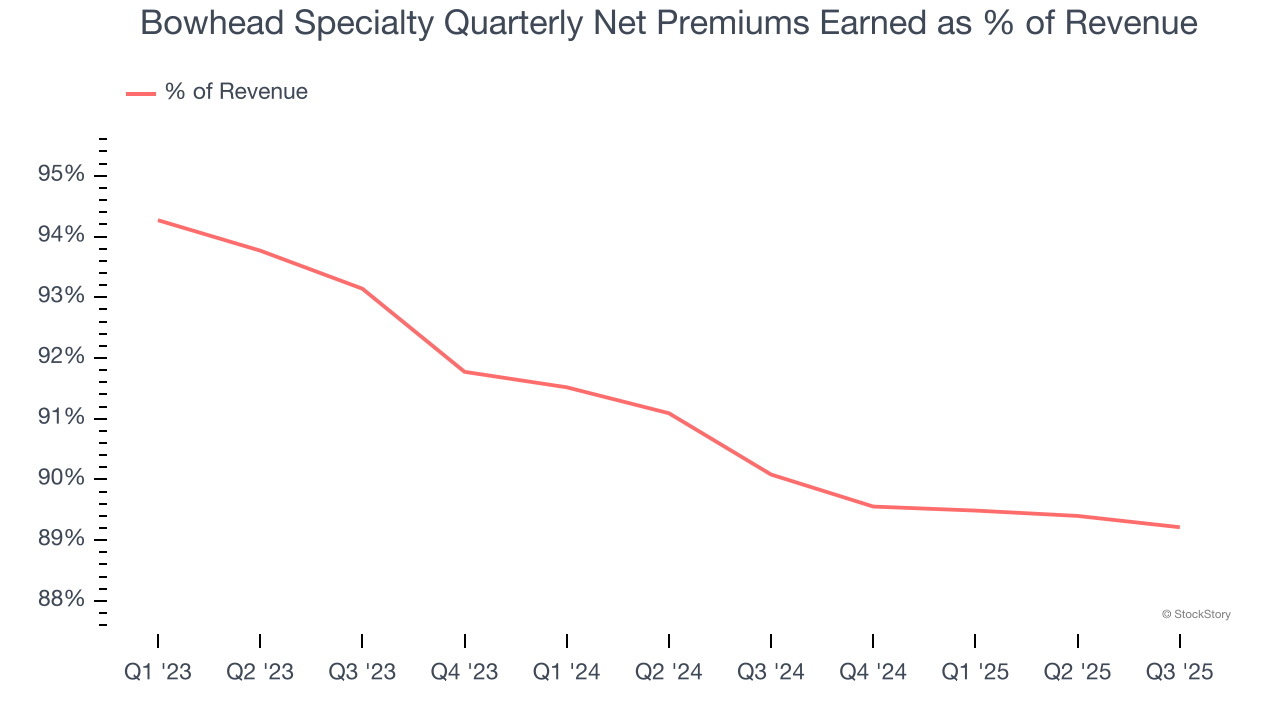

Net premiums earned made up 90.7% of the company’s total revenue during the last three years, meaning Bowhead Specialty lives and dies by its underwriting activities because non-insurance operations barely move the needle.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

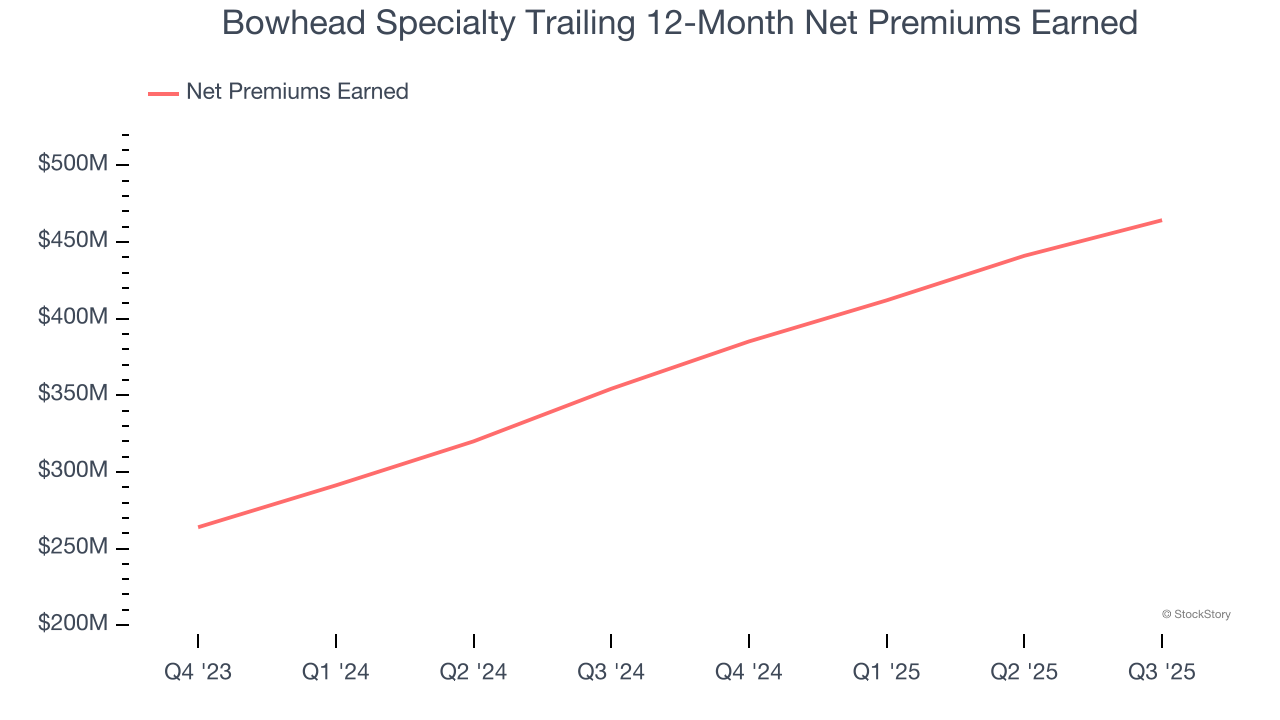

Bowhead Specialty’s net premiums earned has grown at a 37.9% annualized rate over the last two years, much better than the broader insurance industry but slower than its total revenue.

In Q3, Bowhead Specialty produced $128.4 million of net premiums earned, up a hearty 22.1% year on year and in line with Wall Street Consensus estimates.

Key Takeaways from Bowhead Specialty’s Q3 Results

It was good to see Bowhead Specialty beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its net premiums earned slightly missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $24.35 immediately after reporting.

Bowhead Specialty put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.