Vertiv currently trades at $118.74 and has been a dream stock for shareholders. It’s returned 987% since December 2019, blowing past the S&P 500’s 86.2% gain. The company has also beaten the index over the past six months as its stock price is up 29.5% thanks to its solid quarterly results.

Is now still a good time to buy VRT? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On VRT?

Formerly part of Emerson Electric, Vertiv (NYSE: VRT) manufactures and services infrastructure technology products for data centers and communication networks.

1. Core Business Firing on All Cylinders

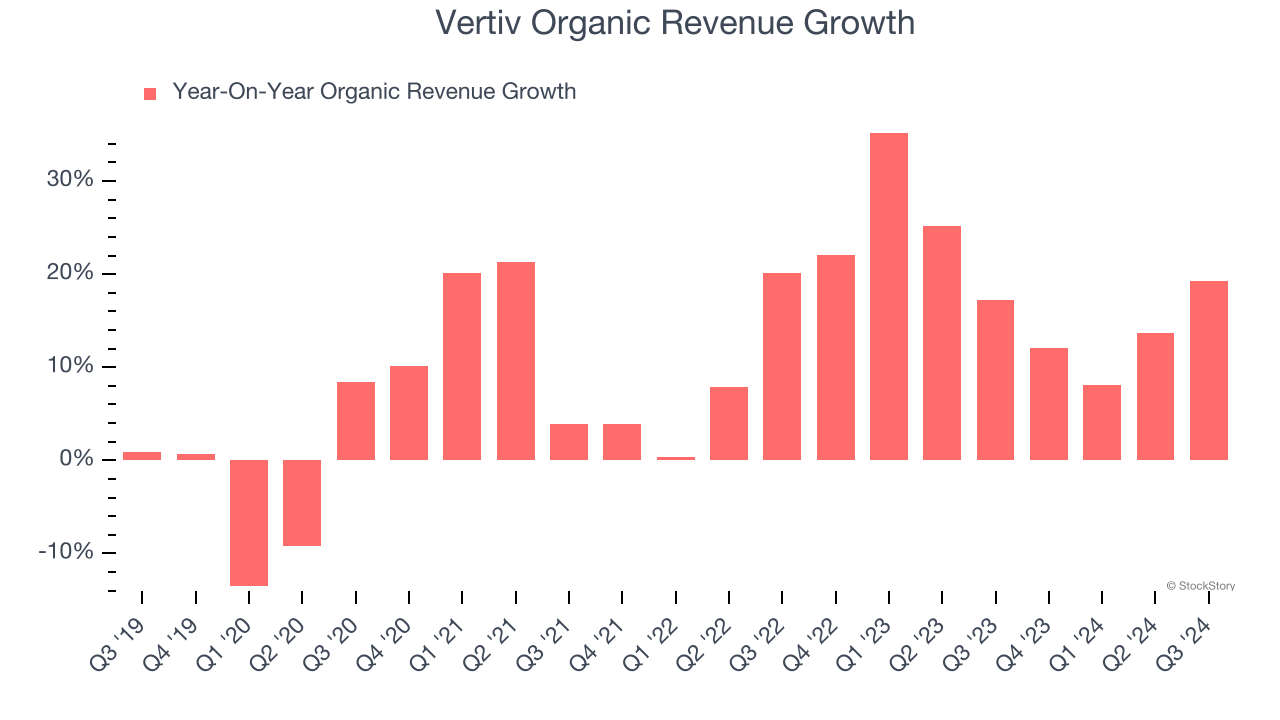

Investors interested in Electrical Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Vertiv’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Vertiv’s organic revenue averaged 19.1% year-on-year growth. This performance was fantastic and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

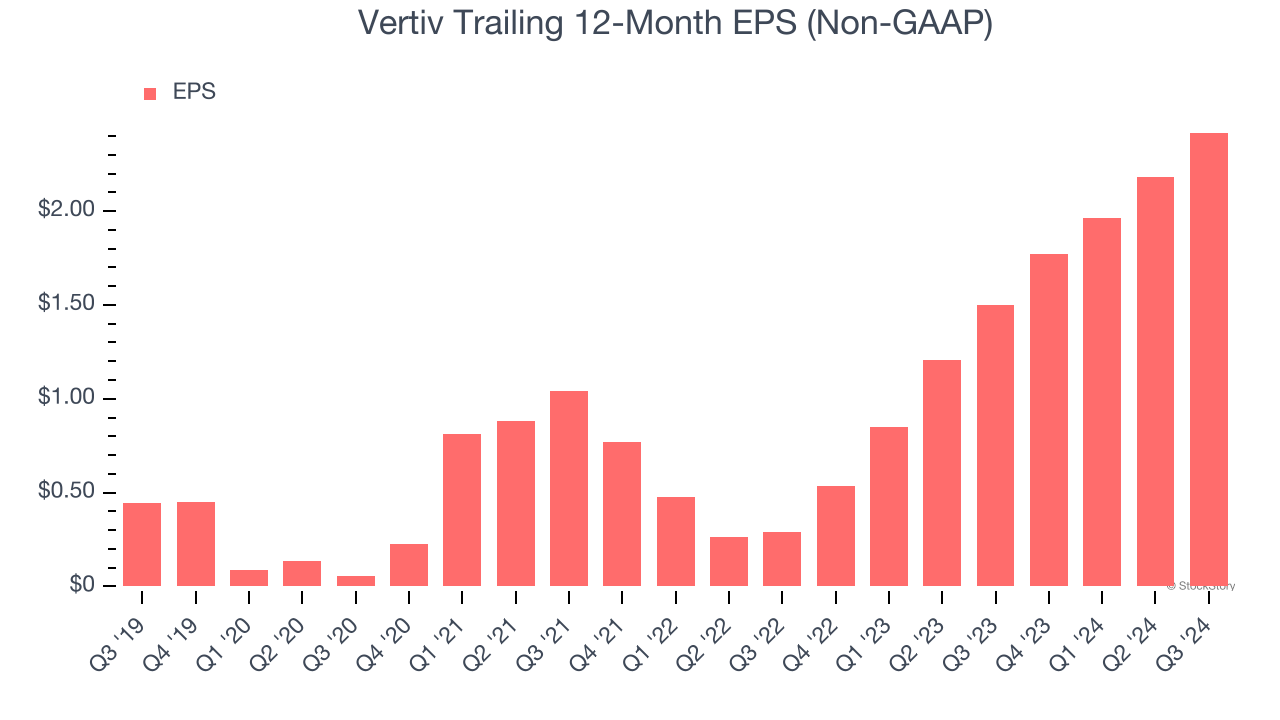

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vertiv’s EPS grew at an astounding 40.2% compounded annual growth rate over the last five years, higher than its 11.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Increasing Free Cash Flow Margin Juices Financials

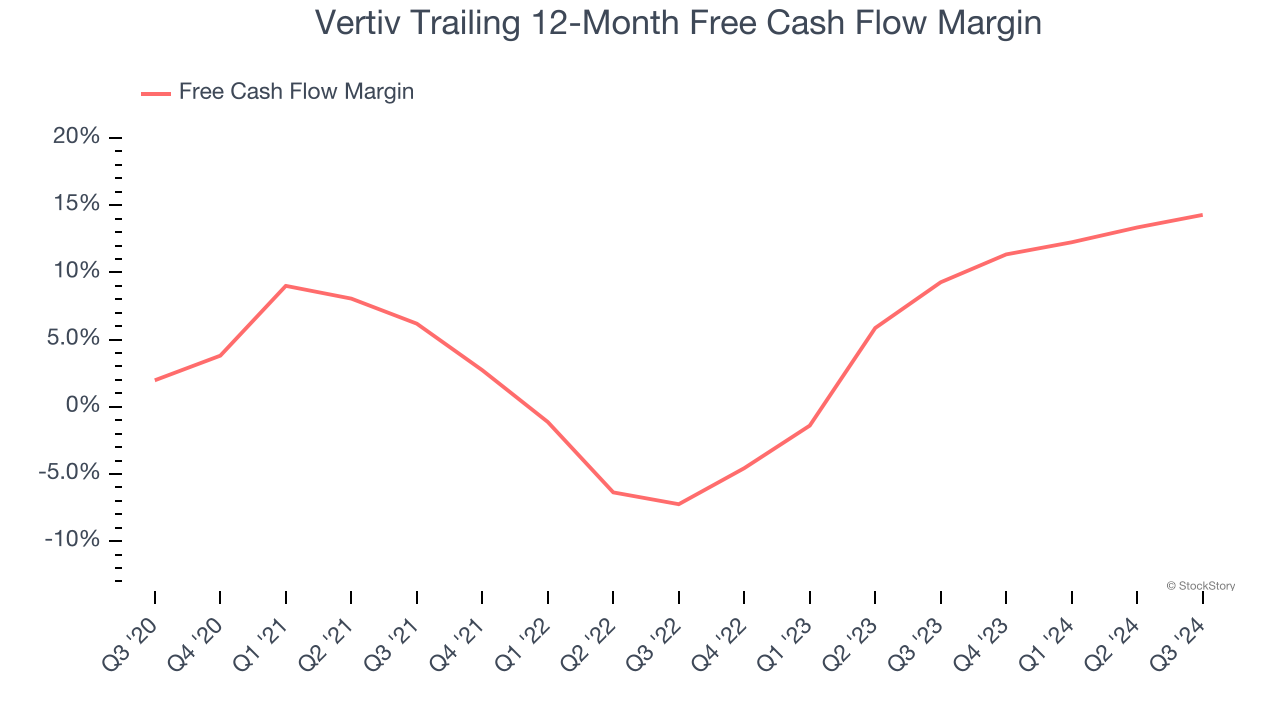

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Vertiv’s margin expanded by 12.3 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Vertiv’s free cash flow margin for the trailing 12 months was 14.3%.

Final Judgment

These are just a few reasons why Vertiv is a cream-of-the-crop industrials company, and with its shares outperforming the market lately, the stock trades at 38.1× forward price-to-earnings (or $118.74 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Vertiv

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.