Chewy, Inc. (NYSE: CHWY) and Williams-Sonoma (NYSE: WSM) received upgrades that investors can buy into. Not because a single upgrade is enough to move a market but because these upgrades align with recent trends. Those trends suggest the markets for these retail stocks are at a critical turning point and will provide market-leading returns for investors in 2024 and beyond.

Chewy, Inc: a good entry that is not without risks

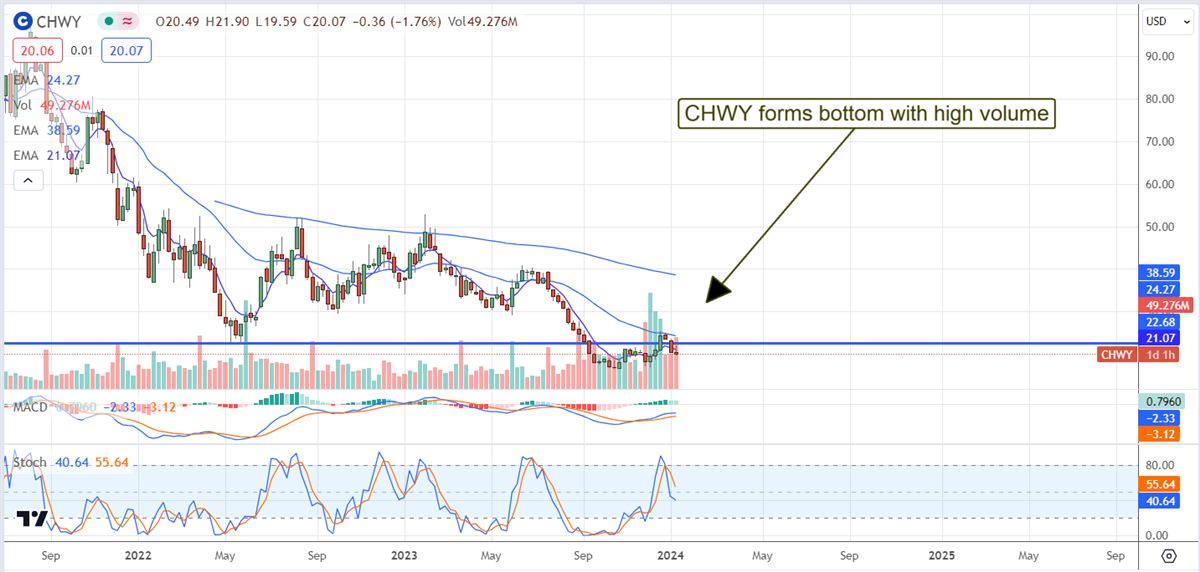

Chewy, Inc. got an upgrade from Barclays analyst Trevor Young. Mr. Young raised his rating to Overweight from Equal Weight, citing the company’s leadership position in eCommerce. In his view, the company’s revenue growth slowdown will trough in the year's first half and return to acceleration in the back half. This view aligns with the broad consensus but comes with something new. In his view, the consensus substantially undervalues the significant growth potential, setting Chewy to outperform in Q4 and next year.

Chewy, Inc. has multiple growth drivers, including expansion into Canada and insurance and vet clinics, which may spur analysts to upward revisions as they scale. The first Chewy Vet Care will open early this year, with multiple openings expected by year's end.

As it is, the group expects growth to slow to only 3% in Q4 despite an industry-wide forecast for mid-to-high single-digit growth. Regarding next year, growth is expected to accelerate, but the consensus forecasts a tepid 5% that should be easy for Chewy to beat. Chewy forecasts 5% to 7% addressable market growth over the next several years, not counting market share gains it may make.

Analyst sentiment is bullish. The critical takeaway from Barclay’s upgrade is that the low end of the sentiment and price target range is moving up to align with the consensus. Barclays’s Overweight is strong, but the $30 price target, a 60% increase from $19, is below consensus. That said, Barclay’s target forecasts a 50% increase in price.

Among the takeaways from the Q3 report is a wider margin. Margin gains were slim but provided a lever to earnings that resulted in a double-digit improvement in cash flow. Coincidentally, a director bought $300,000 worth of shares shortly after the release.

Williams-Sonoma crosses a critical hurdle

Williams-Sonoma analysts are less bullish on it than Chewy, but two significant trends in the data suggest a turning point has been reached. The first is that the consensus price target marched higher all year despite the consensus raging falling to Reduce; the second is that many upgrades and boosted price targets have emerged over the last four weeks, including the latest from Wedbush.

Wedbush double-upgraded Williams-Sonoma to Outperform with a price target of $230. That is the new high price target and implies a 15% upside for the stock. Wedbush analysts cite the company’s margin and an expectation for margin improvement as the year progresses. That, coupled with mid-to-high single-digit topline growth supported by a rebound in the housing market, set Williams-Sonoma up to outperform peers.

Williams-Sonoma provides value and yield compared to its peers. RH (NYSE: RH) trades at more than double the valuation while experiencing the same headwinds and sales declines. Unlike Williams-Sonoma, a moderately-yielding dividend growth stock, RH pays no dividend, another deterrent. Arhaus (NASDAQ: ARHS) trades at a comparable 13X earnings but also pays no dividends, and its earnings are forecasted to shrink in 2024.

Persistent outperformance, solid cash flow, and capital returns helped to lift WSM stock in the second half of 2023. The market hit critical resistance at the end of the year and was able to break out to new highs. The market retreated from the high but is now showing support at the prior resistance point and the potential to continue the rally in 2024. The next visible catalyst is the Q4 results due in March. Analysts expect revenue decline to lessen to the high-single-digits and for growth to return as soon as FQ1.