Bark (BARK) is a dog-centric company dedicated to making all dogs happy through innovative products, services, and content tailored to individual play styles. Its flagship offerings include BarkBox and Super Chewer subscription boxes filled with themed toys, treats, and accessories. Bark's custom retail products are also sold via partners like Target (TGT), Chewy (CHWY), and Amazon (AMZN). Operating an omnichannel model, Bark leverages data-driven insights to serve millions of dogs monthly, blending direct-to-consumer subscriptions with commerce expansion amid a mission to enhance canine health and joy worldwide.

Founded in 2011 and headquartered in New York, Bark primarily operates in North America, with a growing global footprint spanning continents like Europe and Asia.

Bark Stock Surges After Low

BARK stock is on a surge following recent news, with shares gaining over 50% in the past five days on elevated volume. In one month's time, the stock is up 44% but up just 4% over the past six months and down more than 50% over the past 52 weeks. That reflects pet sector volatility and profitability challenges.

Bark significantly outperforms the Russell 2000 (IWM) benchmark in the short term, with the index gaining just 2% over a five-day period and almost 7% in one month. However, the dog-centric stock lags the Russell 200 in the longer term. The index is up 21% in the past six months and 19% in the past 52 weeks. Trading below its 50-day moving average (MA) amid a 50%-plus drop from 52-week highs, BARK stock remains speculative with high beta volatility.

Bark Delivers Mixed Results

Bark reported its second-quarter financial results on Nov. 10 with revenue of $107 million, down 15% year-over-year (YOY) but exceeding company guidance of $102 million to $105 million and the analyst consensus estimate of around $103 million. Loss per share came in at $0.03, missing estimates of a $0.02 loss and prior-year levels, amid direct-to-consumer (DTC) pressures offset by commerce strength. Total revenue reflected 26.5% from commerce and Bark Air, with DTC at $82.1 million.

Gross margin stood at 57.9%, down 250 basis points YOY due to mix shift toward lower-margin commerce/Air and tariffs. Adjusted EBITDA was -$1.4 million, worse than last year's $3.5 million, while marketing fell 18% to $15.4 million. During the quarter, Bark became debt-free by clearing $45 million of convertible notes in cash. Commerce revenue rose 6% to $24.8 million, Bark Air soared 138% YOY to $3.6 million, while the subscriber base shrank YOY from moderated acquisition. Additionally, retention improved for six months, with many opting for premium Super Chewer/Combo plans.

For Q3, Bark guided for revenue of $101 million to $104 million and adjusted EBITDA of -$5 million to -$1 million, prioritizing diversification, cost discipline, and profitability amid macro/tariff headwinds.

Takeover Rumors

BARK stock rallied sharply on Jan. 14 after GNK Holdings and Marcus Lemonis submitted a preliminary, non-binding offer to acquire the company for $1.10 per share in cash. The bid values Bark at an enterprise value of about $188.7 million, a 22% premium over Great Dane Ventures' prior proposal, sparking a bidding war for the pet subscription firm.

GNK President Nachum Klugman highlighted Bark’s strong brand, loyal customers, and growth potential, citing opportunities in execution, merchandising, and engagement. Lemonis, current Bed Bath & Beyond (BBBY) CEO and recent Camping World (CWH) ex-CEO, joins the group pursuing the deal. The proposal aims to unlock shareholder value through strategic enhancements to Bark’s platform.

Should You Buy BARK Stock?

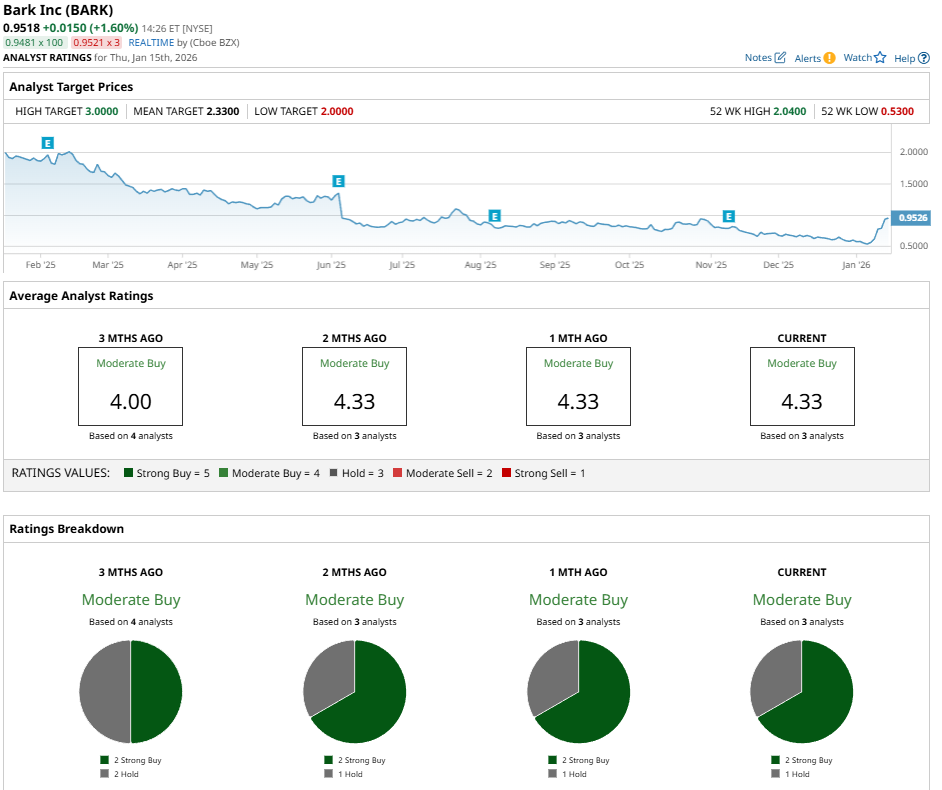

As acquisition talks heat up, BARK stock continues to rise, presenting investors with an interesting opportunity. Analysts have assigned the stock a “Moderate Buy” consensus rating with a mean price target of $2.33. That represents potential upside of 150% from the current market rate.

BARK stock has been rated by three analysts with coverage, receiving two “Strong Buy” ratings and one “Hold” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mark Cuban Warns Healthcare Giants Are ‘Too Big to Care’: Is Divestiture the Only Cure for the 3,200% Admin Bubble?

- Morningstar’s New Generative AI Index Could Unlock Opportunities in OpenAI and Anthropic for Everyday ETF Investors

- SoFi CEO Anthony Noto Says His Company Is Poised to Win if Trump Caps Credit Card Rates: Why Personal Loans Could Come Out on Top

- Hedge Funds Are Shorting This Classic Warren Buffett Stock. Should You Sell Shares Now?