Wednesday was a scary day for Verizon Communications (VZ) and its customers. A widespread service outage affected cellular data and voice services for much of the day, prompting emergency alerts in Washington and New York, as well as a lot of negative social media commentary.

Such an outage is also nerve-racking for Verizon shareholders, as any widespread outage raises questions about a company’s cybersecurity, structural integrity, and ability to maintain consistent operations. Verizon has announced that the outage was caused by a software issue and is offering $20 credits to customers.

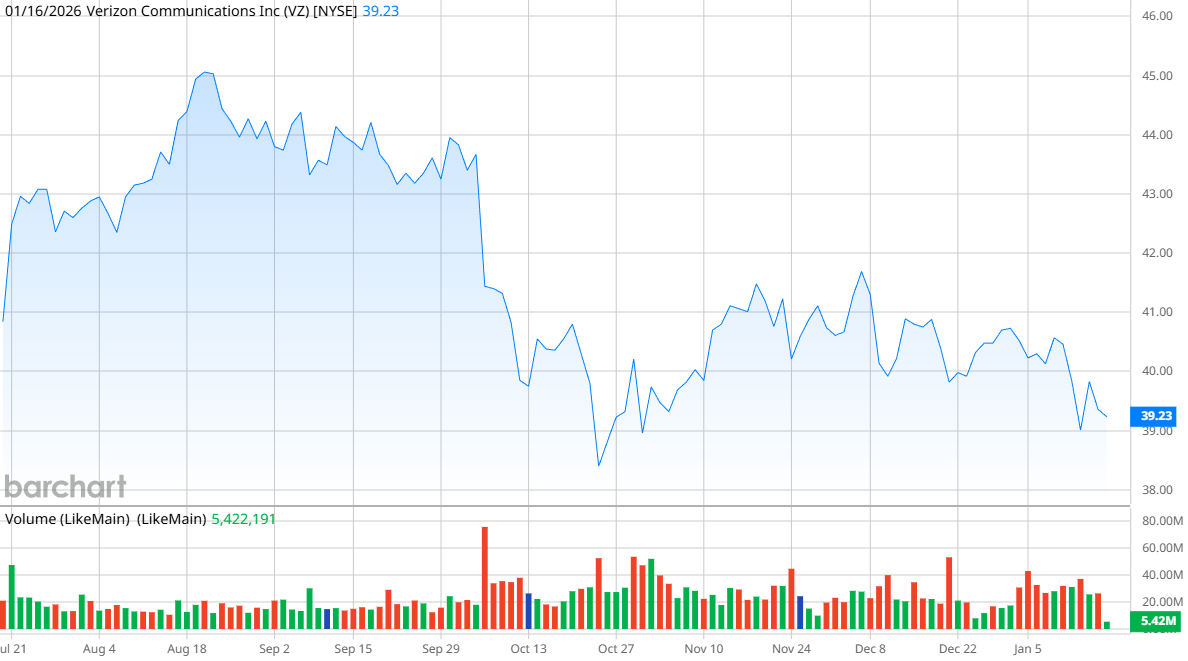

VZ stock dropped nearly 3% during the outage, so it wasn’t a traumatic event, although the stock has yet to regain its footing. Should incidents like Wednesday influence how you look at Verizon's stock?

About Verizon Communications Stock

Verizon is one of the biggest telecom companies in the U.S., offering mobile devices and plans, home services, broadband services, and telecom plans for small and medium-sized businesses. The company has 210 million wireless customers and 10.6 million broadband customers, as well as 31 million business accounts.

With a market capitalization of $166 billion, Verizon is the third-largest U.S. telecom by market cap, trailing T-Mobile US (TMUS) and AT&T (T). Shares are up nearly 2.5% in the last year, which by far underperforms the S&P 500 ($SPX), which is up 17%.

However, it should be noted that Verizon has a generous dividend yield of 7%, paying $0.69 per share. When you take the dividend into account, Verizon’s total return is 10.1% over the last 12 months.

Verizon is also under new leadership—Daniel Schulman took over as chief executive officer in October 2025 and pledged to introduce changes to the company to improve the stock price.

“When I look at our performance objectively, Verizon is clearly falling short of our potential,” he told analysts shortly after his appointment. “And as a result, we are not delivering the shareholder returns our investors expect. Despite investing significantly in network leadership, we have not been able to translate that into winning in the market. And consequently, we are not generating the financial profile necessary for share price appreciation. Our stock performance reflects this reality.”

Verizon Beats on Earnings

Verizon posted revenue in the third quarter of $33.8 billion, up from $33.3 billion a year ago. However, the company was able to cut its operating expenses from $27.4 billion to $25.7 billion, allowing net income to jump 48% to $5.05 billion for the quarter.

Earnings per share were $1.21, beating analysts’ expectations of $1.19.

The company said its consumer division revenue of $26.1 billion was up 2.9% from a year ago, while wireless revenue was up 2.4% to reach $17.4 billion. Business revenue, meanwhile, dropped 2.8% to $7.1 billion.

Schulman criticized the company’s recent strategy as being too reliant on price increases and suffering from higher churn. He said the company will shift to a customer-first culture to reduce churn.

“My top strategic imperative for Verizon is to grow our customer base profitably across our Mobility and Broadband subscription businesses,” he said. “I strongly believe that growing volumes are essential to drive sustainable long-term revenue and adjusted EPS growth.”

He described Verizon’s future as “a simpler, leaner and scrappier business” with the primary objective of building customer loyalty. “Verizon will no longer be the hunting ground for competitors looking to gain share. We are reinventing how we operate to make Verizon more agile and efficient,” he said.

Verizon reiterated its full-year guidance for wireless revenue growth in a range of 2% and 2.8% and adjusted EPS growth of 1% to 3%. Its guidance does not reflect assumptions related to Verizon’s previously announced $20 billion purchase of Frontier Communications (FYBR), which is expected to close Jan. 20.

What Do Analysts Expect for VZ Stock?

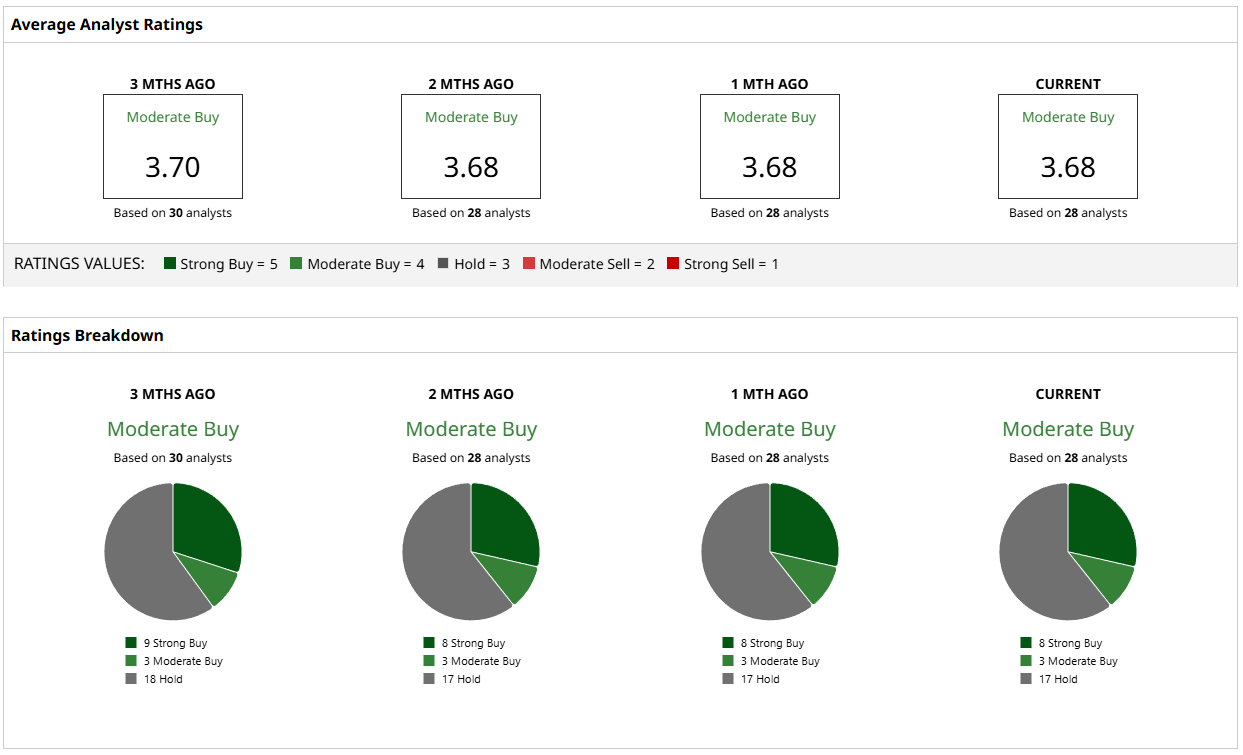

Despite working in a sector that’s been underperforming the market, analysts are largely positive toward Verizon. Eleven of 28 analysts followed by Barchart have “Buy” ratings on the stock, with the others recommending that investors hold. There are no “Sell” ratings.

Analysts have a mean price target of $47 on the stock, which suggests potential gains of 20%. The most bullish target of $58 indicates a whopping 98% jump is possible for VZ stock, while the most bullish target of $41 hints at a slight increase from today’s price.

Wednesday's outage doesn't move the needle at all on Verizon. Instead, the outlook for Verizon’s stock will lie largely in its success in integrating the Frontier business. While it has the potential to fortify Verizon’s national fiber optic strategy and better compete with AT&T and T-Mobile, Verizon will have to make good on Schulman’s pledge to reduce customer churn to make VZ stock more appealing.

For now, Verizon is a solid dividend play, but it doesn’t have enough of a competitive advantage over T-Mobile and AT&T to stand out in the pack.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Barclays Calls This 1 AI Server Stock ‘Best in Class’ Amid Upgrade to ‘Overweight’ Rating

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings

- Why Rosenblatt Thinks Rigetti Computing Stock Can Soar 60% from Here

- Micron Stock’s Stunning Run Isn’t Over Yet — Could $500 Be Next?