FMC Corporation (FMC) plunged last week after the company missed Q3 2025 revenue estimates by a mile. It also slashed its dividend by 86% to 8 cents, which is still a healthy dividend yield of over 2.2% at current prices. Let's explore whether FMC is a buy after the crash or if you should give the stock a pass.

To begin with, the Q3 report was not a one-off negative event for FMC stock this year, which is now trading at the lowest levels since 2008. The stock lost a third of its market capitalization after missing Q4 2024 earnings estimates earlier this year and was also removed from the prestigious S&P 500 Index ($SPX). The post-earnings price action was relatively muted following the next two earnings reports, but the company lost nearly half of its market capitalization following the Q3 2025 report and experienced its worst single-day performance.

What’s Wrong With FMC?

Some of FMC’s problems are related to macros and are rooted in the agricultural chemicals industry, which is battling a demand-supply mismatch. While the demand has been tepid, capacity has expanded, particularly on the generic side. The problem is particularly severe in Asia and Latin America, where generic capacity in products that are not protected by patents is expanding at a fast pace. On a similar note, FMC has decided to exit India while marking down the fair value of that business to $450 million.

The tariffs on China are not helping matters, as while FMC needs to pay these upfront, it takes a long time for these to flow back to its coffers, given the long supply chain and high inventory issues in the industry.

On the company-specific level, FMC's core portfolio, which consists of products that are either post-patent or are nearing one, is battling intense competition. The company listed the example of Rynaxypyr and said that its manufacturing costs are not competitive for a part of its portfolio. Incidentally, Rynaxypyr’s patent is also expiring, and FMC said that its customers have been putting off purchases ahead of generics hitting the market in early 2026.

Secondly, while FMC’s growth portfolio, which includes newly launched patent-protected products, has helped offset the slowdown, the growth is still not that high. The company expects its growth portfolio to become a significant driver only by 2028 and sees 2026 as a “difficult” year during which it would need to do “very heavy lifting.”

Why Did FMC Cut Its Dividend?

Meanwhile, FMC’s dividend cut is hardly a surprise, and in my article earlier this year, I had noted such a possibility if the company’s turnaround does not yield the expected results. FMC’s earnings have plunged, and it at best expects to be breakeven on free cash flows this year, while the lower end of its guidance calls for negative free cash flows of $200 million. Dividends are further draining FMC’s cash flows, and after accounting for the $291 million that it has doled out so far in 2025, the company expects its net debt to rise by $400 million by the end of this year.

FMC expects to conserve cash worth $250 million next year after the dividend cut and is optimistic of generating “significantly more” free cash flows in 2026, even as it said it is “just too early” to guide for the next year. The company intends to use the cash to deleverage its balance sheet, which is saddled with net debt of $4.5 billion. For context, the net debt is over 2.5x its current market cap.

FMC acknowledged that its financial metrics are not in line with its investment-grade credit rating but said that it is in discussions with credit rating agencies. The company's adjusted net debt to earnings before interest, tax, depreciation, and amortization (EBITDA) has risen to 4.94x, which is dangerously close to the leverage covenant limit of 5.25. It expects its 2025 interest outgo to be between $240 million and $250 million, which, while being similar to 2024, is higher than its previous guidance. Maintaining the investment-grade credit rating won’t be an easy task for FMC unless its free cash flows improve next year.

Should You Buy FMC Stock?

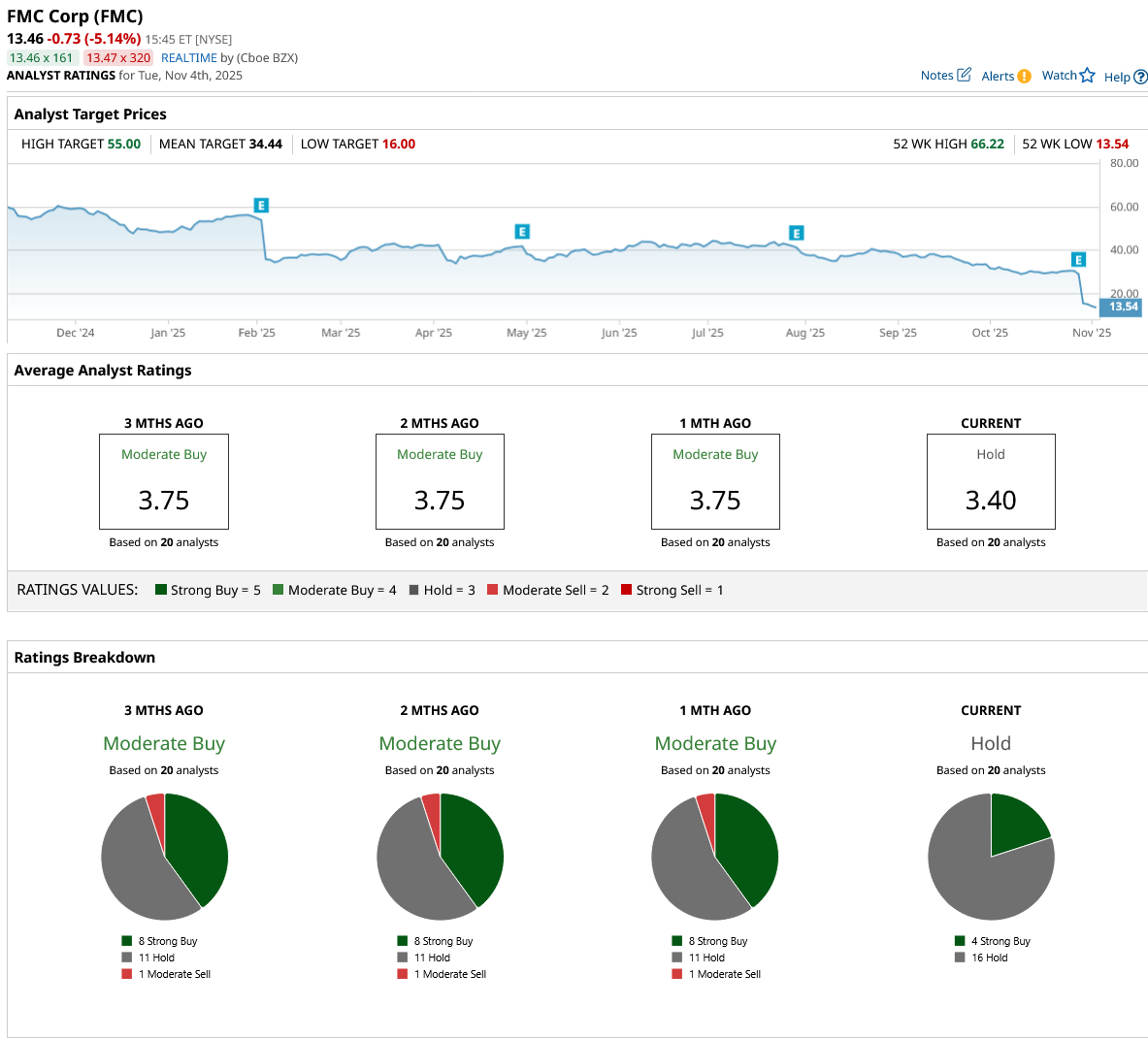

As expected, several Wall Street analysts drastically lowered FMC’s target price following the Q3 earnings last week. For instance, Citigroup slashed its target price by half to $17, while Goldman Sachs lowered its from $43 to $19. UBS and Wells Fargo also lowered their target prices by over 50% to $17 and $16, respectively.

FMC is currently going through turmoil, which is reflected in its price action this year, where it has declined by over 70%. The company’s turnaround under CEO Pierre Brondeau, who returned to the position last year, is turning out to be a lot more difficult than previously expected, with the macro situation only compounding the problem.

From a valuation perspective, FMC will appear quite cheap at a forward price-to-earnings (P/E) multiple of 5.13x. However, these are based on estimates of future earnings, which should get reset once the company provides its new multi-year outlook in February 2026.

Overall, the next couple of years look quite tough for FMC as it navigates the challenging market conditions. I would prefer to sit out on this name for now, even as I believe the worst of the selloff is now behind us.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart