In today’s uncertain markets, investors aren’t just chasing growth. They’re chasing income they can count on.

In his video “7 Ways to Make Money from Your Investments (Beyond Dividends),” Rick Orford breaks down how to build a diversified, income-generating portfolio using a mix of bonds, dividend stocks, and options strategies — plus, how to balance risk vs. reward for long-term success.

1. Bonds: The Foundation of Predictable Income

Bonds remain the backbone of most retirement portfolios, and for good reason.

When you buy a U.S. Treasury bond, you’re lending money to the government and collecting interest (called coupon payments) along the way. The longer the term, the higher the yield — and today’s 10-year Treasurys (USTY10.RT) are paying around 4.1%–4.5% annually, backed by the full faith and credit of the U.S. government.

The benefits are stability and predictability, while the drawbacks are limited upside and inflation risk.

That’s why many investors use a bond laddering strategy — buying bonds that mature at different times, and rolling them to maintain steady time exposure — to keep cash flowing while staying flexible if rates change.

Track U.S. Treasury rates and bond yields on Barchart’s Interest Rates Page →

2. Dividend Stocks: The Reliable Paycheck

Dividends are like the “baseline paycheck” for investors. You’re paid just for holding shares of companies that distribute a portion of their earnings to shareholders.

Long-term investors often focus on:

- Dividend Aristocrats — S&P 500 companies that have increased their dividends for 25+ years

- Dividend Kings — Companies with 50+ years of dividend growth

These names — think Coca-Cola (KO), Johnson & Johnson (JNJ), and Procter & Gamble (PG) — have survived wars, recessions, and various interest rate cycles while rewarding shareholders every quarter.

“Dividends are the baseline paycheck,” Rick explains. “They reward patience, discipline, and consistency.”

You can find dividend opportunities across Barchart’s Best Dividend Stocks & ETF Page →

3. Options Income: The Side Hustle

If dividends are your paycheck, covered calls are your side hustle.

This popular options strategy lets investors generate additional income from the stocks they already own by selling call options. You collect a premium upfront — and as long as the stock doesn’t rally past your strike price, you keep both your shares and the premium.

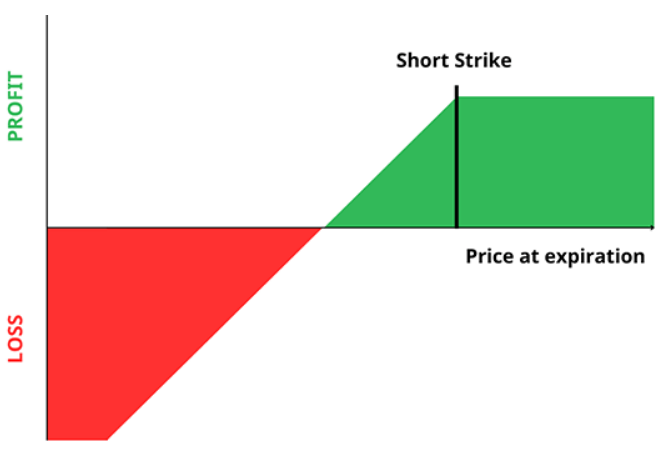

In addition to covered calls, traders can use credit spreads (bull puts and bear calls) or iron condors to generate income with less capital.

- Covered Calls: Ideal for investors who already hold stock positions.

- Bull Put / Bear Call Spreads: Defined-risk plays that work with smaller accounts.

- Iron Condors: Combine both spreads to create a “profit zone” in rangebound markets.

“Covered calls are income from what you already own,” Rick says. “Spreads and condors are the advanced plays — perfect for maximizing every opportunity.”

Explore Barchart’s tools for income traders:

Building a Balanced Income Portfolio

The key is diversification across income types, not just chasing yield. A simple, durable income portfolio might include:

- Treasurys or government bonds for safety and stability

- Dividend-paying stocks for consistent growth

- Options strategies for boosted returns and flexibility

You don’t have to pick just one. As Rick explains, the most successful income investors rotate these strategies throughout the year, adjusting based on interest rates, volatility, and market cycles.

“Understand the risks, weigh them against the rewards, and you can build a portfolio that pays you for years to come,” Rick says.

Watch the Clip: Rick’s ‘Side Hustle’ Options Strategy

- Watch the Full Video: 7 Ways to Make Money from Your Investments →

- Explore Barchart’s Tools for Dividend & Options Income →

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Produces Strong FCF As Expected - Shorting OTM Puts is an Attractive Play

- Use This Options Strategy as a ‘Side Hustle’ to Generate Steady Income in Retirement

- Bull Put Spread Provides Opportunities for Long-Term Microsoft Bulls

- In a Golden Era of Covered Call ETFs, Don’t Miss This 1 Overlooked Fund