Switching your retirement savings to Gold IRA account? Compare the top 3 Gold IRA companies to choose the best option; services, investment terms reviewed!

GLENDALE, CA / ACCESS Newswire / July 9, 2025 / Rising inflation, ongoing geopolitical tensions, and uncertainty in traditional markets have pushed more retirement savers in 2025 to look beyond stocks and bonds. One investment option getting serious consideration in this context is the Gold IRA, a self-directed retirement account that allows individuals to hold physical gold and other precious metals as part of a long-term diversification strategy.

This type of account has seen increased interest as investors aim to protect purchasing power and reduce exposure to market-driven volatility. In fact, U.S. demand for investment gold rose by over 10% in 2024, according to the World Gold Council, reflecting a broader shift toward tangible assets.

With more providers entering the space, it becomes all the more challenging to choose a Gold IRA company that caters to your every need, be it in terms of transparency, service, or pricing.

In this July 2025 review, we've independently ranked leading Gold IRA companies using clear criteria: reputation, storage security, account setup, client support, and fees, so you can assess your options with clarity.

Best Gold IRA Companies

Here's a side‑by‑side comparison of three leading Gold IRA companies, highlighting their BBB and Trustpilot ratings, minimum investment requirements, and the range of precious metals they offer to help you assess each provider's credentials at a glance.

Gold Dealer |

BBB Rating |

TrustPilot Rating |

Minimum Investment |

Precious Metals Offered |

Augusta Precious Metals (Overall Best) |

A+ |

4.8 (≈194 reviews) |

$50,000 each for cash and gold IRA |

Gold, Silver |

A+ |

4.4 (≈223+ reviews) |

$10,000 each for cash and gold IRA |

Gold, Silver, Platinum, Palladium |

|

American Hartford Gold |

A+ |

4.7 (≈1,478 reviews) |

$10,000 IRA / $5,000 cash |

Gold, Silver |

Top 3 Gold IRA Companies: Reviewed

Let's take a closer look at each of the top-ranked Gold IRA companies, examining their strengths, service quality, fee structures, and customer experiences to provide a clearer picture of what to expect before making a decision.

#1. Best Overall: Augusta Precious Metals

Founded in 2012 and headquartered in Casper, Wyoming, Augusta Precious Metals specializes exclusively in gold and silver IRAs. The company holds an A+ rating from the BBB and AAA from the Business Consumer Alliance, earning multiple "Best Overall Gold IRA Company" designations from Money Magazine between 2022 and 2025.

Augusta requires a $50,000 minimum investment, a threshold that sets it apart from many competitors but positions it at the premium end of the market. Custodian services are provided through Equity Trust, and storage is available at IRS‑approved depositories across several U.S. locations, with a strong preference toward Delaware's insured vault.

Why Set Up Your Gold IRA With Augusta Precious Metals?

Augusta distinguishes itself through its commitment to education and transparency. Investors receive a free one-on-one web conference conducted by a Harvard‑trained economic analyst, along with access to live price charts and market updates.

Moreover, the company charges zero management fees, has no hidden commissions, and includes a 7-day Price Protection Program on premiums. This fee structure is designed to prevent escalation over time. The company offers a price-match guarantee and no additional IRA fees for up to ten years.

Pros:

Strong education focus: dedicated webinars, analyst briefings, scam warning guides

Transparent pricing: no hidden fees, zero annual management fees, 7-day price guarantee

Reputation: consistently top-rated by BBB (A+), BCA (AAA), Money Magazine awards, and consumer platforms

Secure, IRS‑approved storage: in high-security depositories (e.g., Delaware Depository, Brink's) with full insurance coverage and 24/7 surveillance.

Highly personalized, lifetime customer support: with dedicated agents guiding clients through every step, from setup to buyback, without sales pressure

Cons:

High entry barrier: A $50,000 minimum may exclude investors with smaller IRAs

Premium-priced coins: Some selections carry higher markups than bullion counterparts

More About Augusta Precious Metals

Augusta maintains its reputation through a solid compliance infrastructure: a dedicated compliance department reviews all operations to ensure IRS regulation adherence. The company emphasizes client control.

If investors are unhappy, they can switch providers under a satisfaction guarantee and unmatched buy‑back commitment. Over 99% of assets are stored onshore in the Delaware vault, which is insured up to $1 billion, a reassuring detail for larger account holders.

Fee transparency is another cornerstone: a one-time $50 setup fee, annual custodian ($100) and storage fees ($100-150), and no hidden charges. Shipping and insurance are included, resulting in approximately $250 in costs during year one and about $200 annually thereafter.

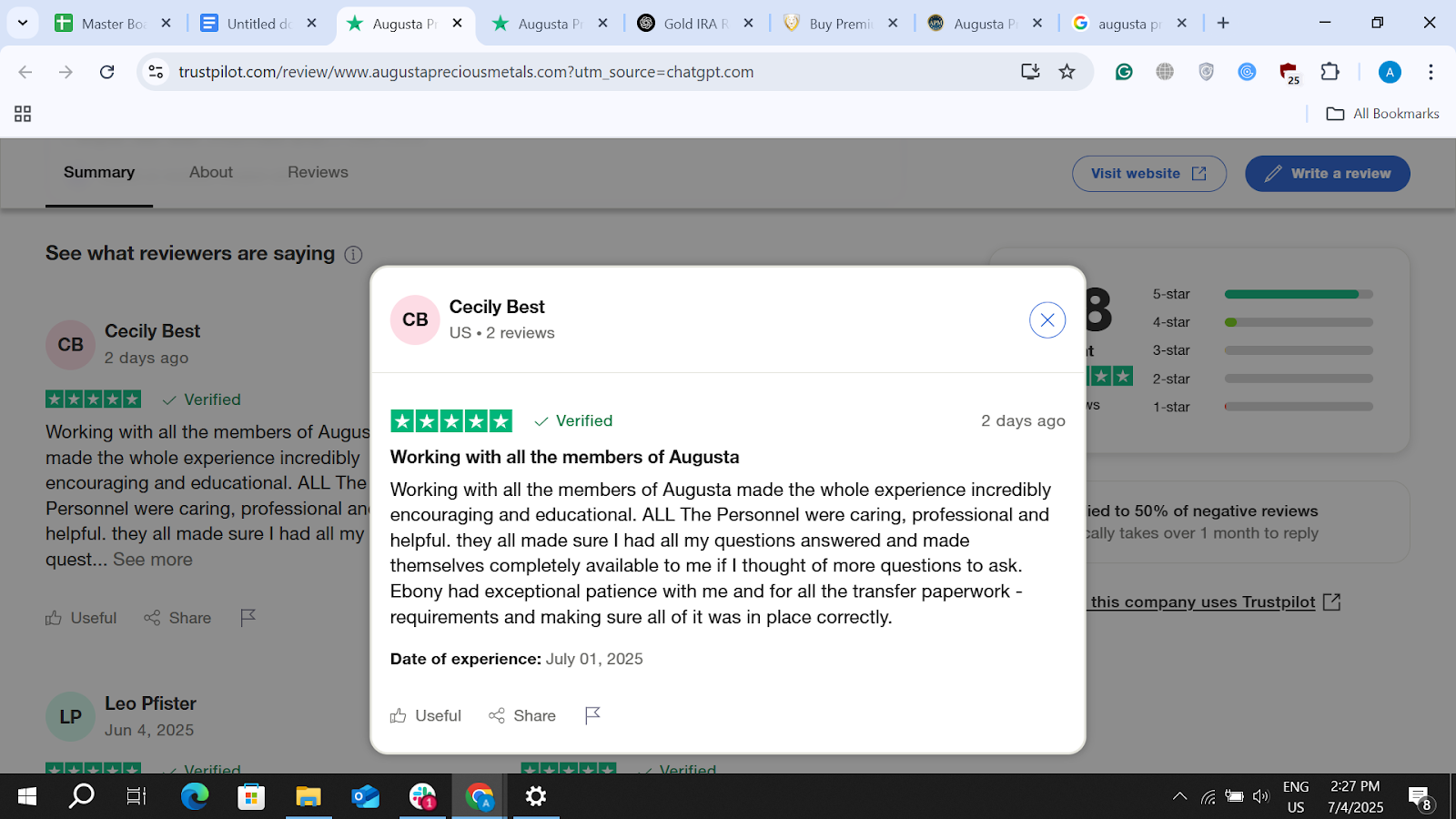

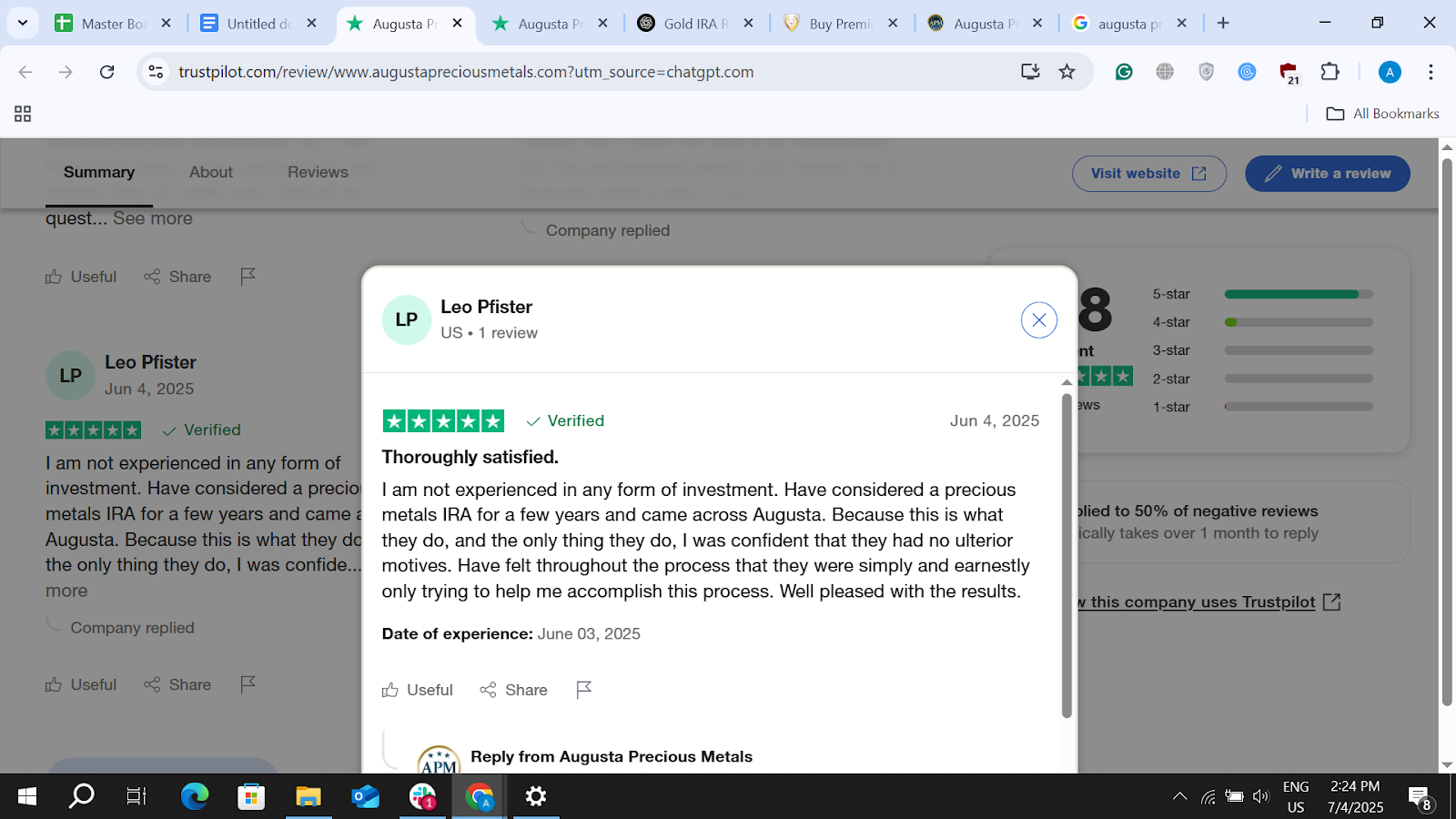

Trustpilot Reviews

Augusta holds a flawless 4.8-star average across nearly 200 reviews on Trustpilot. The most recent feedback highlights clear communication and knowledgeable service:

-

Cecily Best (July 1, 2025)

Leo Pfister (June 3, 2025)

A minor exception appears in older reviews, such as a 2023 complaint over price transparency, which Augusta addressed promptly by offering clearer responses on request. On balance, recent feedback remains overwhelmingly positive.

#2. Cost Effective: Birch Gold Group

Founded in 2003 and based in Burbank, California, Birch Gold Group specializes in self-directed IRAs backed by physical gold, silver, platinum, and palladium. With over 20 years in business, the company holds an A+ rating from the BBB (accredited since 2011), AAA from the Business Consumer Alliance, and decent customer reviews, 4.4 stars across Trustpilot.

The minimum to open a Gold IRA is $10,000, and they waive first-year custodial fees for rollovers exceeding $50,000, making them relatively accessible and cost-effective.

Why Set Up Your Gold IRA With Birch Gold Group?

Birch emphasizes investor education and transparency. New clients receive a complimentary information kit and personalized guidance through the form-filling and rollover procedures.

The company partners with Equity Trust and STRATA for custodial services and offers storage through IRS-approved depositories, including Delaware Depository, Brink's, Texas Precious Metals Depository, and IDS, with both segregated and non-segregated options.

Annual fees are straightforward and flat (setup $50, wire $30, storage/insurance $100, custodian $80-100), unaffected by account size, and waived in the first year for qualifying rollovers.

Pros:

Low barrier to entry: $10K minimum, much lower than the typical $25K-$50K in this industry.

Comprehensive education: kits, webinars, and individualized support reduce complexity.

Transparent, flat fees: a clear all-inclusive fee of about $180-$200 annually, waived in the first year for larger accounts.

Wide metal selection: includes gold, silver, platinum, and palladium.

Secure, insured storage: partnerships with top-tier depositories offering up to $1 billion coverage.

Cons:

No online ordering: purchases require coordination with a representative, which may slow the process.

Potential product markups: some clients report higher premiums on select coins, so vigilance is advised.

Account setup time: paperwork and rollovers may take days or weeks, standard for IRAs.

More About Birch Gold Group

Birch's flat fee structure makes the cost predictable, unlike percentage-based fees used by many rivals. Their promotional waiver of fees for rollovers above $50,000 rewards larger investors.

Storage partners include both domestic and international depositories, offering segregated options and robust insurance, with transparency provided through quarterly audits and real-time inventory access. Buyback services enable investors to liquidate their holdings without incurring hidden exit fees.

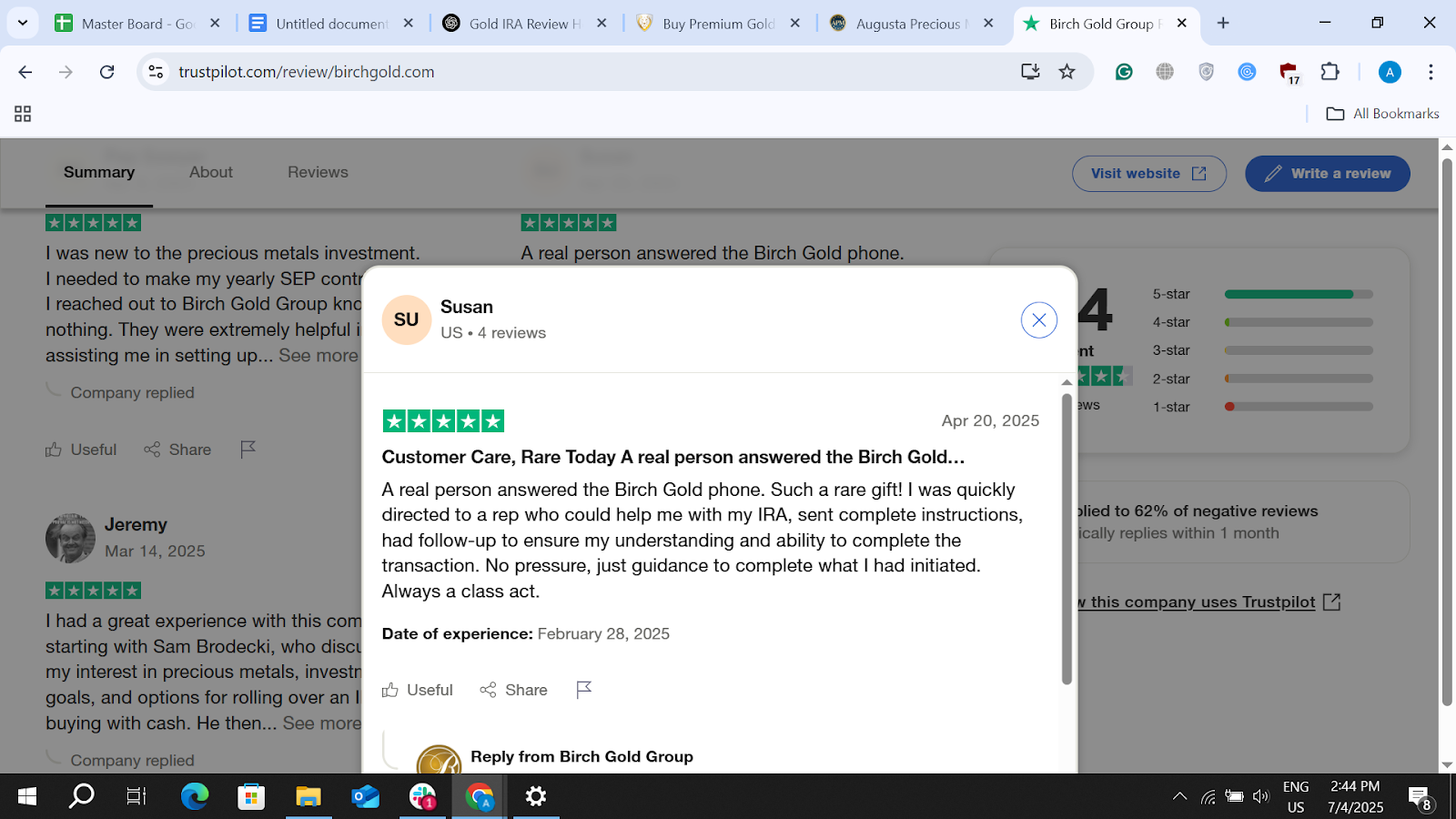

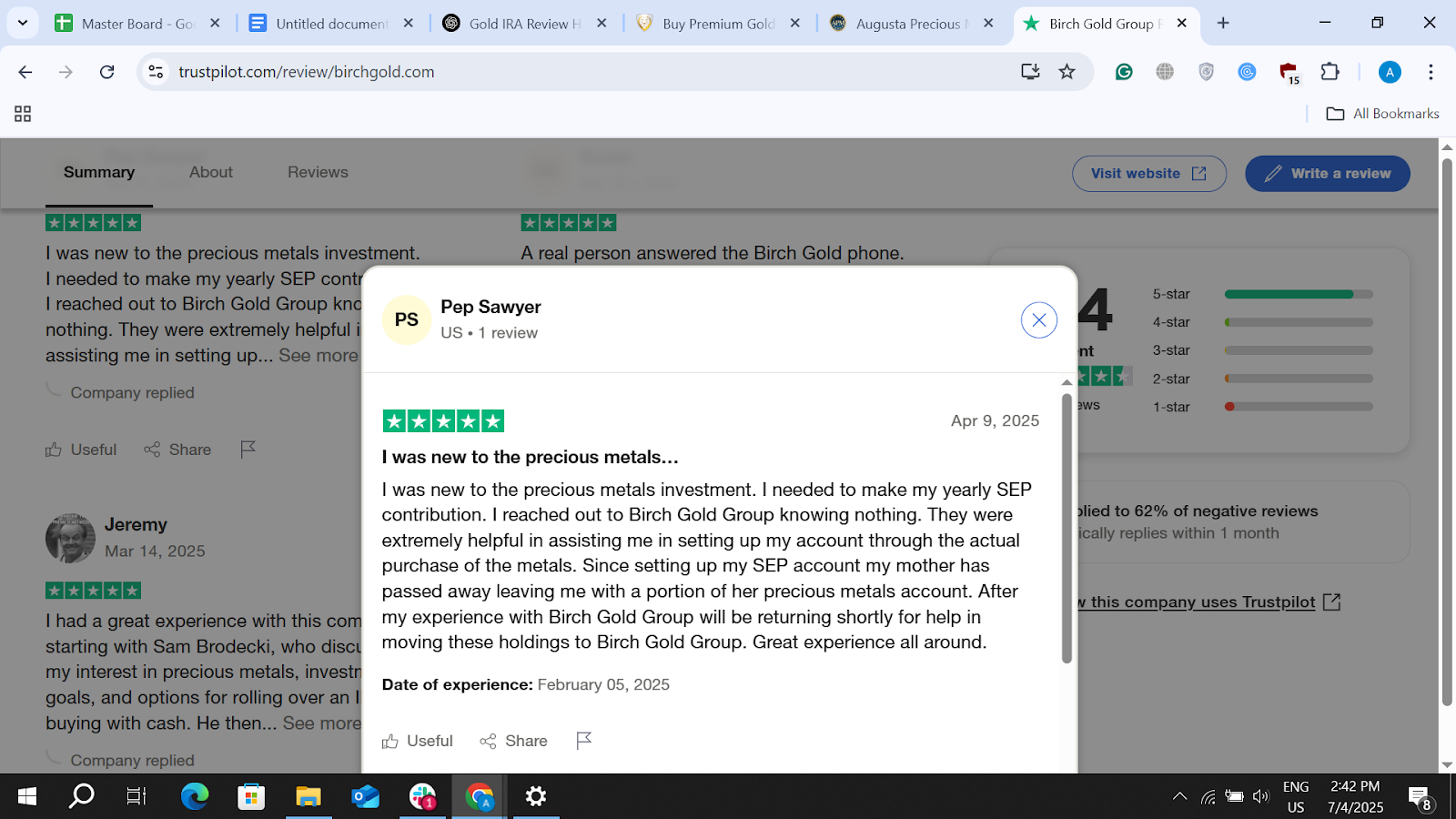

Trustpilot Reviews

Birch Gold holds a 4.4-star rating on Trustpilot based on approximately 230 reviews. Many praise the patient, knowledgeable representatives:

Susan (February 28, 2025)

Others praise their guidance and service:

Pep Sawyer (April 9, 2025)

Overall, positive sentiment around professionalism and education is strong, but potential clients should be cautious of premium markups and occasional procedural delays.

#3. Fastest Growing: American Hartford Gold

Founded in 2015 and headquartered in Los Angeles, American Hartford Gold (AHG) is a family-owned precious metals dealer specializing in physical gold and silver IRAs, direct purchases of coins and bars, and platinum offerings.

The firm maintains an A+ rating from the BBB, a 4.7 rating average on Trustpilot across 1470+ reviews, and recognition on the Inc. 5000 list as one of America's fastest-growing private financial services companies.

With a $10,000 minimum for IRA accounts (and $5,000 for cash purchases), AHG positions itself as a middle-market option, more accessible than many premium providers, yet designed for those with moderate capital.

Why Set Up Your Gold IRA With American Hartford Gold?

AHG emphasizes education, transparency, and customer care, offering a free Investor's Kit, personalized onboarding, and expert assistance through the rollover process. The firm partners with Equity Trust as custodian and uses IRS-approved depositories like Brinks and Delaware Depository for storage, offering both segregated and non-segregated options.

It also provides a no-liquidation-fee buyback commitment and promotional offers like fee waivers on larger investment amounts.

Pros:

Moderate entry threshold: $10,000 IRA minimum and $5,000 cash account minimum.

Educational support plus personalized service: Investor Kit, phone assistance, and thorough consultation praised by users.

Fee waivers for larger accounts: Free storage/maintenance for qualifying accounts (e.g., over $50-100K). No liquidation fees and a streamlined buyback process.

Strong reputation and endorsements: A+ BBB rating, Inc. 5000 rankings, and endorsements from Bill O'Reilly and Rick Harrison.

Cons:

High minimum: $10K minimum may still be out of reach for new investors.

Fee details are opaque pre-contact: Exact costs are not listed online, requiring users to engage via call or form.

Limited metal variety: compared to some competitors, primarily gold and silver.

More About American Hartford Gold

AHG's client experience is built around convenience and transparency. IRA rollovers typically complete in three to five business days, and physical delivery orders ship within 28 business days, fully insured.

The company charges a $230 application fee and approximately $200 annually for storage, insurance, and custodian services, although these fees may be waived for sizable accounts. Storage takes place at top-tier facilities, such as Brinks and Delaware Depository.

AHG's leadership emphasizes customer-first values, reinforced by independent audits and a responsive complaint resolution process.

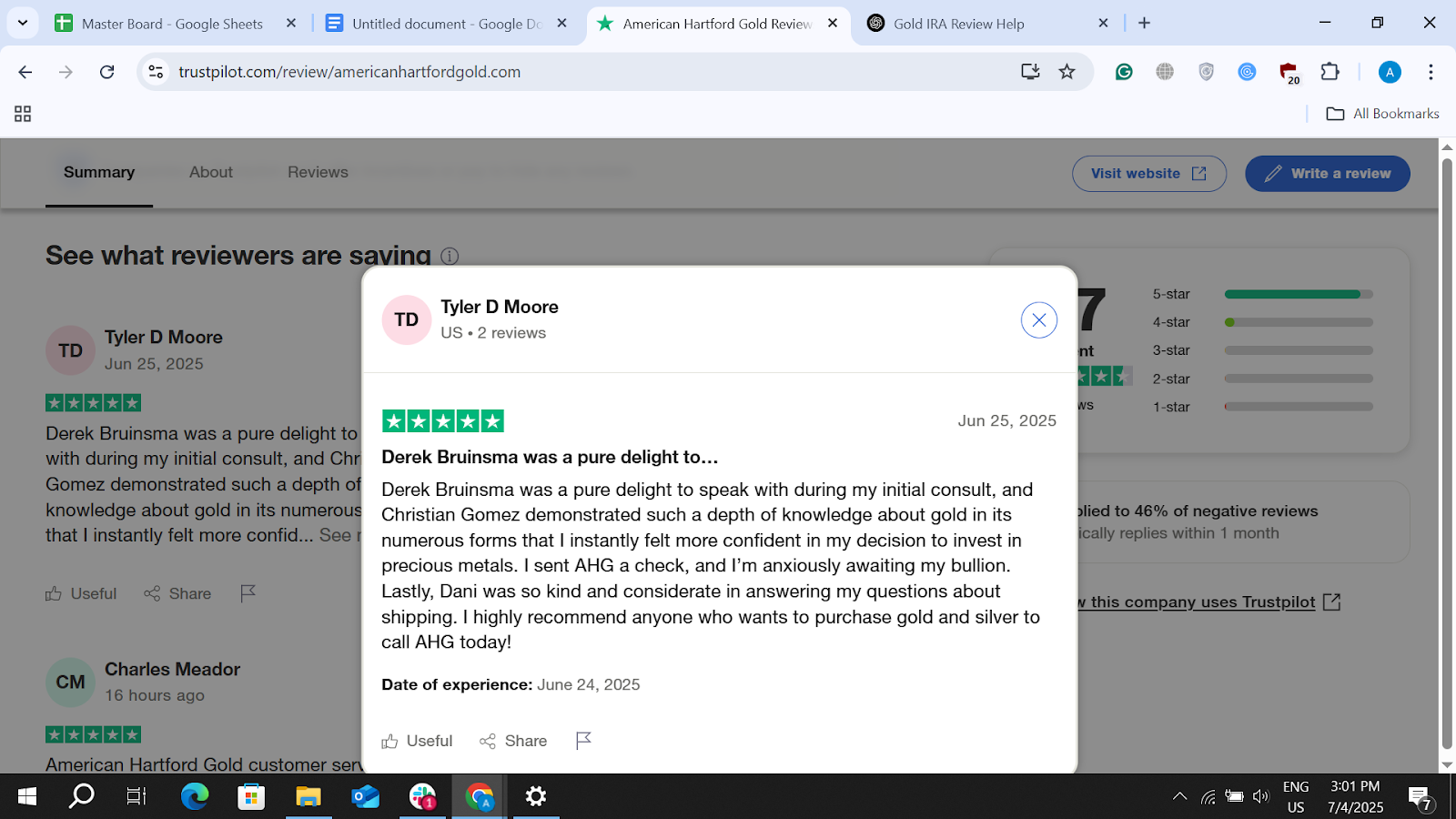

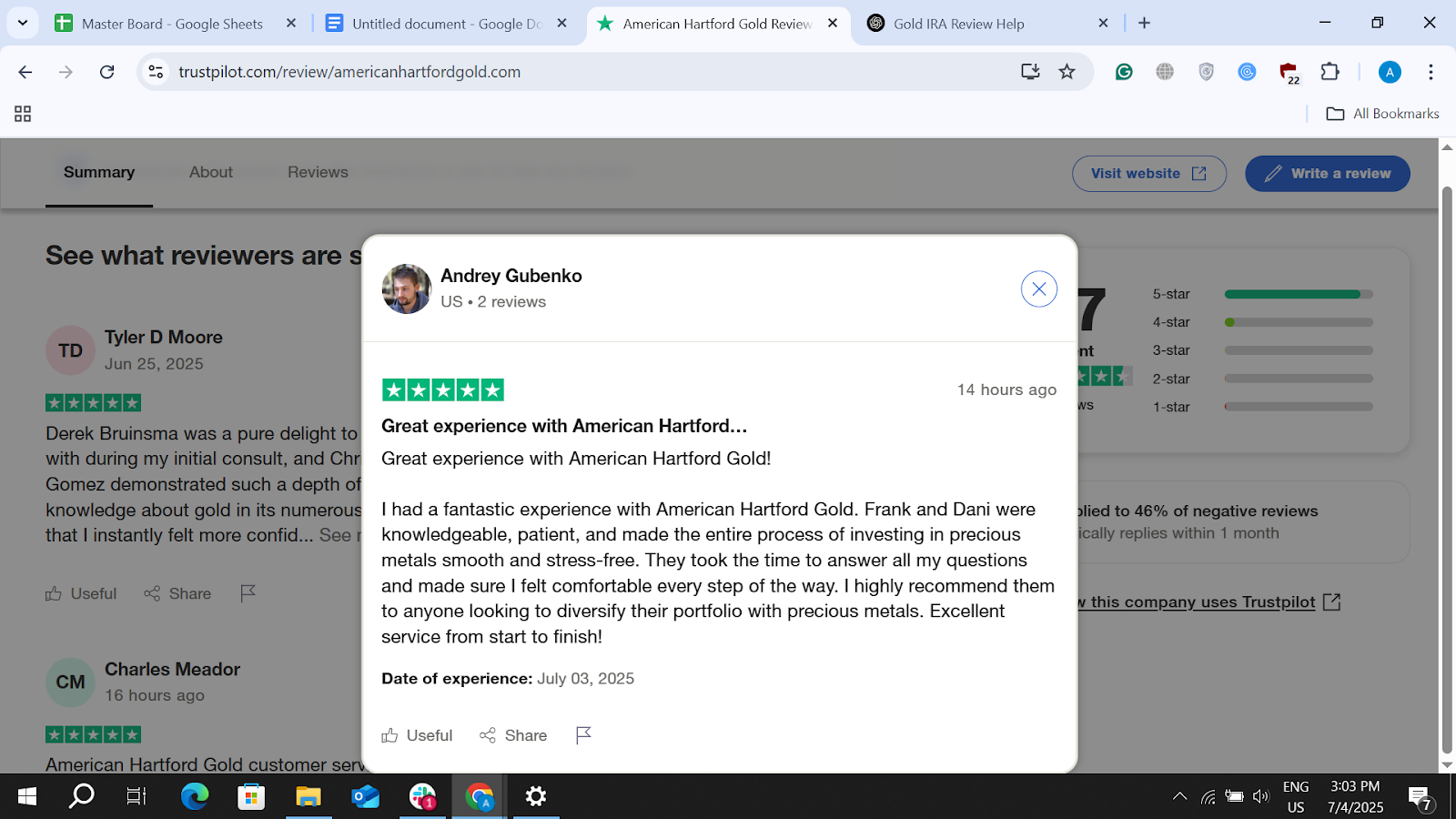

Trustpilot Reviews

On Trustpilot, AHG holds a strong 4.7 average across approximately 1,400-1,500 reviews. Recent praise focuses on helpful, patient staff and seamless investing processes:

Tyler D Moore (June 24, 2025)

Andrey Gubenko (July 3, 2025)

Some concerns arise around pricing, communication, and occasional delivery delays, though such complaints are relatively infrequent. AHG typically responds to negative feedback, maintaining a reputation for transparency and accountability.

How We Made The List Of Best Gold IRA Companies?

Before finalizing our July 2025 rankings, we set out to objectively assess which Gold IRA companies stand out, not just in marketing but in actual performance, transparency, and long-term value. With dozens of providers in the market, we focused on measurable criteria and verified user experiences to build a list that investors can trust.

Here are the factors we considered when selecting and ranking each company:

1. Reputation & Ratings

We evaluated third-party ratings from trusted sources like the Better Business Bureau (BBB), Business Consumer Alliance (BCA), and Trustpilot. Companies with consistently high scores and few unresolved complaints stood out. We also looked at how they handled negative feedback and whether issues were addressed publicly and professionally.

2. Fee Transparency

Hidden fees can quickly erode the value of a retirement account. We prioritized companies that clearly disclose all costs, including account setup, storage, maintenance, and any ongoing fees. Those offering flat-rate structures or waiving fees for larger accounts received favorable consideration.

3. Storage & Security

Physical gold must be stored in IRS-approved depositories, so we reviewed each company's storage partners. We considered whether they offered segregated storage, insurance coverage levels, and compliance with security standards through facilities like Brinks and Delaware Depository.

4. Customer Support & Investor Education

We gave weight to companies that offer strong educational resources, one-on-one guidance, and responsive support. Firms that avoid high-pressure sales tactics and instead focus on helping investors understand the risks and benefits of gold IRAs ranked higher on our list.

5. Minimum Investment Requirements

We included companies with both high and low minimums but gave additional points to those that provide flexibility for a wider range of investors, especially those starting with modest rollovers.

6. Buyback Programs

Reliable exit options are just as important as entry. We looked at whether companies offered written, no-fee buyback policies and how easy it was to sell back metals when needed.

Gold IRA Companies: FAQs

What is the most trusted gold IRA company?

Several firms are well-regarded, but Augusta Precious Metals consistently ranks high for its transparent pricing, educational support, and A+ BBB rating. Birch Gold Group and American Hartford Gold also maintain strong reputations and client satisfaction based on third-party reviews and industry ratings.

What is the best money gold IRA?

The "best money" Gold IRA typically offers a balance of low fees, strong customer service, and reliable storage options. Birch Gold Group is often recognized for flat fees and low minimums, while Augusta appeals to higher-cap investors seeking comprehensive support. Value depends on your budget and long-term goals.

Are gold IRAs a good investment?

Gold IRAs can be a strategic hedge against inflation and market volatility, especially for diversification. However, like all investments, they carry risks, such as premium markups and lower liquidity. They're generally best suited for long-term investors seeking asset protection rather than aggressive growth.

How to choose a gold IRA custodian?

Look for a custodian approved by the IRS with a solid track record, transparent fees, and strong reviews. Also, consider their storage options, customer service responsiveness, and whether they offer segregated storage. Equity Trust and STRATA Trust are two widely used Gold IRA custodians.

Are gold IRAs worth it?

Gold IRAs can be worth it if you're seeking to diversify a retirement portfolio with tangible assets. They help mitigate exposure to traditional market swings but may involve higher fees and slower liquidity. Their value depends on individual risk tolerance and long-term financial goals.

What is the best way to buy gold with my IRA?

The best method is through a self-directed IRA managed by an IRS-approved custodian. After funding your account, you can select approved gold products through a reputable dealer. Ensure metals are stored in a compliant depository, not at home, to meet IRS requirements.

Can you make money on a gold IRA?

Yes, but profits depend on the movement of gold prices over time and your purchase premiums. While gold doesn't generate income like stocks or bonds, it can appreciate in value and protect against inflation, making it a potentially profitable long-term store of wealth.

Concluding Thoughts On The Best Gold IRA Companies Of July 2025

Due to persisting economic uncertainty and concerns about inflation in 2025, the appeal of physical assets, such as gold, remains strong, especially for retirement-focused investors seeking stability beyond stocks and bonds.

Gold IRAs provide a regulated, tax-advantaged way to hold tangible assets in a retirement account; however, not all providers operate with the same level of transparency, cost efficiency, or investor support.

This review aims to highlight companies that combine credibility, transparent pricing, and secure custodial practices. Looking ahead, the role of alternative assets in retirement planning is likely to grow. Staying informed, asking the right questions, and choosing vetted partners will be key to navigating that shift with confidence and clarity.

Disclaimer: The companies featured in this article have been independently reviewed by Radcred, a team of finance experts who regularly research and evaluate various investment opportunities and assets. These reviews are for informational purposes only and do not constitute financial advice. Please conduct your own due diligence before making any investment decisions.

Contact Information:

RadCred Press Office

Phone: (818) 555-1234

Email: press@radcred.com

Website: www.radcred.com

SOURCE: Radcred

View the original press release on ACCESS Newswire