Insurance customer acquisition platform MediaAlpha (NYSE: MAX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 18.3% year on year to $306.5 million. On the other hand, next quarter’s revenue guidance of $290 million was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.40 per share was 8.2% above analysts’ consensus estimates.

Is now the time to buy MediaAlpha? Find out by accessing our full research report, it’s free for active Edge members.

MediaAlpha (MAX) Q3 CY2025 Highlights:

- Revenue: $306.5 million vs analyst estimates of $284.9 million (18.3% year-on-year growth, 7.6% beat)

- Adjusted EPS: $0.40 vs analyst estimates of $0.37 (8.2% beat)

- Adjusted EBITDA: $29.08 million vs analyst estimates of $26.7 million (9.5% margin, 8.9% beat)

- Revenue Guidance for Q4 CY2025 is $290 million at the midpoint, below analyst estimates of $293.9 million

- EBITDA guidance for Q4 CY2025 is $28.5 million at the midpoint, above analyst estimates of $27.62 million

- Operating Margin: 6.4%, in line with the same quarter last year

- Free Cash Flow Margin: 7.7%, up from 3.1% in the same quarter last year

- Market Capitalization: $736.4 million

Company Overview

Powering nearly 10 million consumer referrals each month in the insurance marketplace, MediaAlpha (NYSE: MAX) operates a technology platform that connects insurance carriers with high-intent consumers shopping for property, casualty, health, and life insurance products.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.12 billion in revenue over the past 12 months, MediaAlpha is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

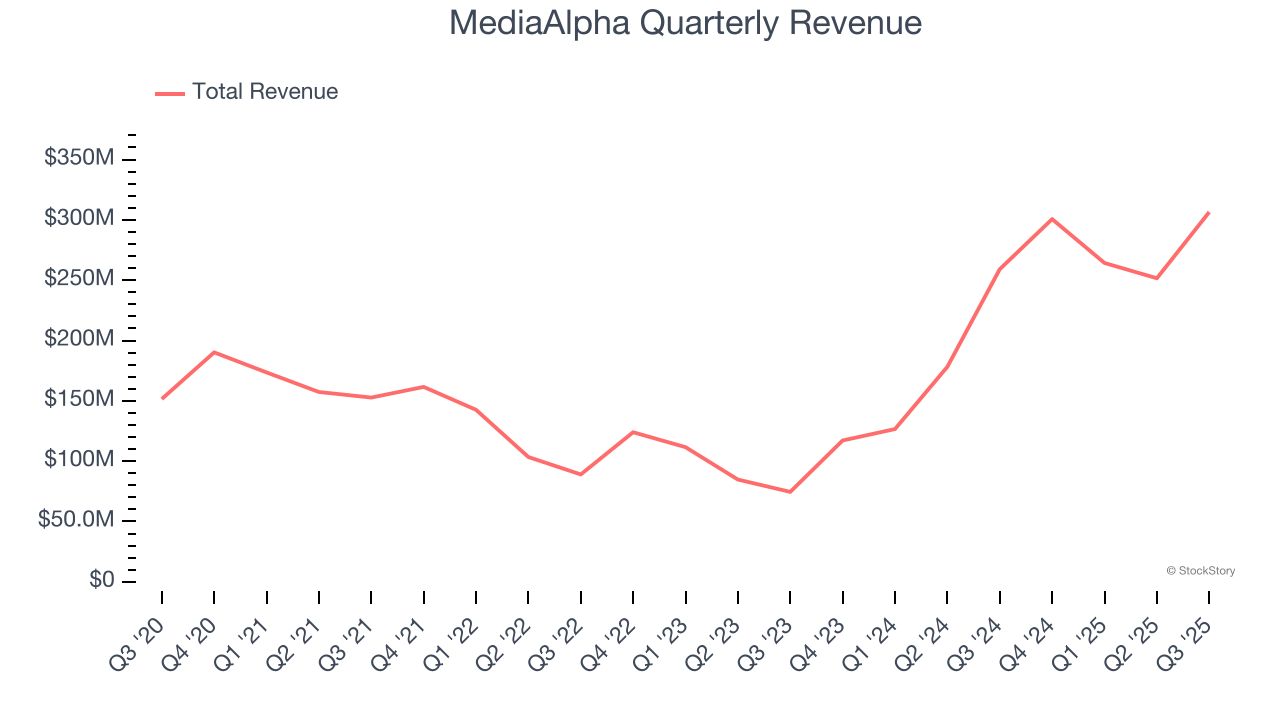

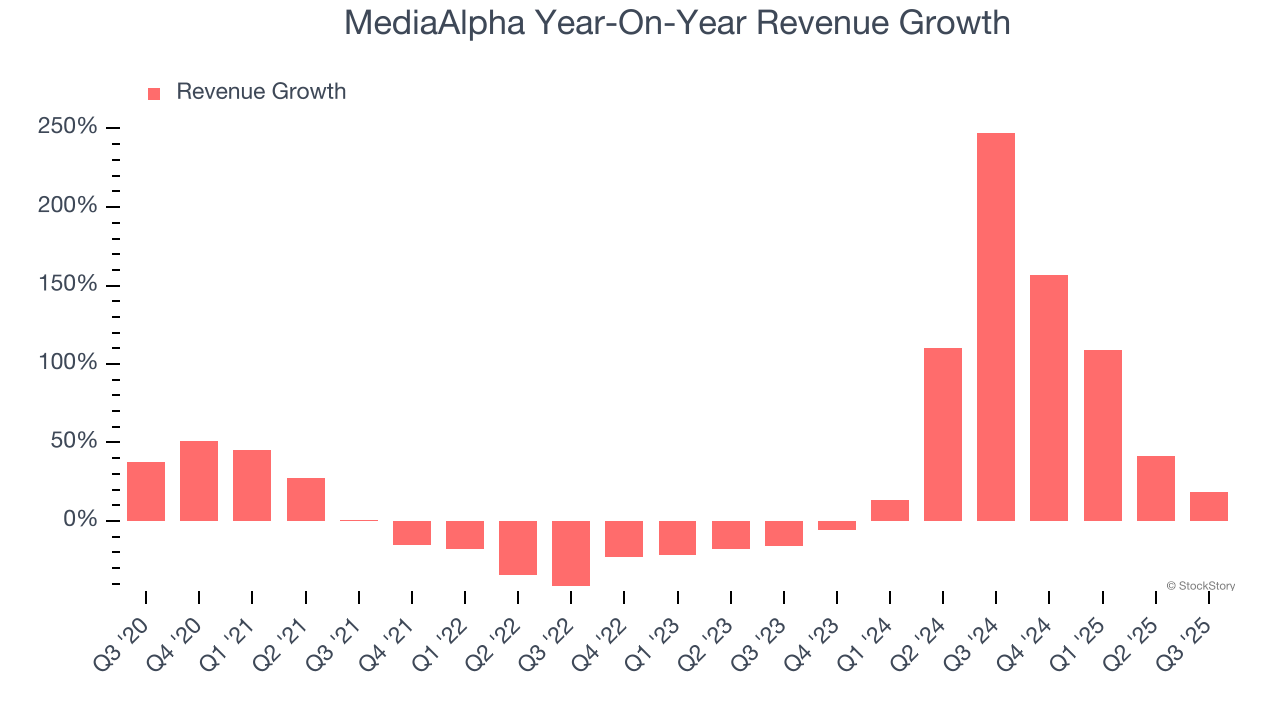

As you can see below, MediaAlpha’s 16.6% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows MediaAlpha’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. MediaAlpha’s annualized revenue growth of 68.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, MediaAlpha reported year-on-year revenue growth of 18.3%, and its $306.5 million of revenue exceeded Wall Street’s estimates by 7.6%. Company management is currently guiding for a 3.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Adjusted Operating Margin

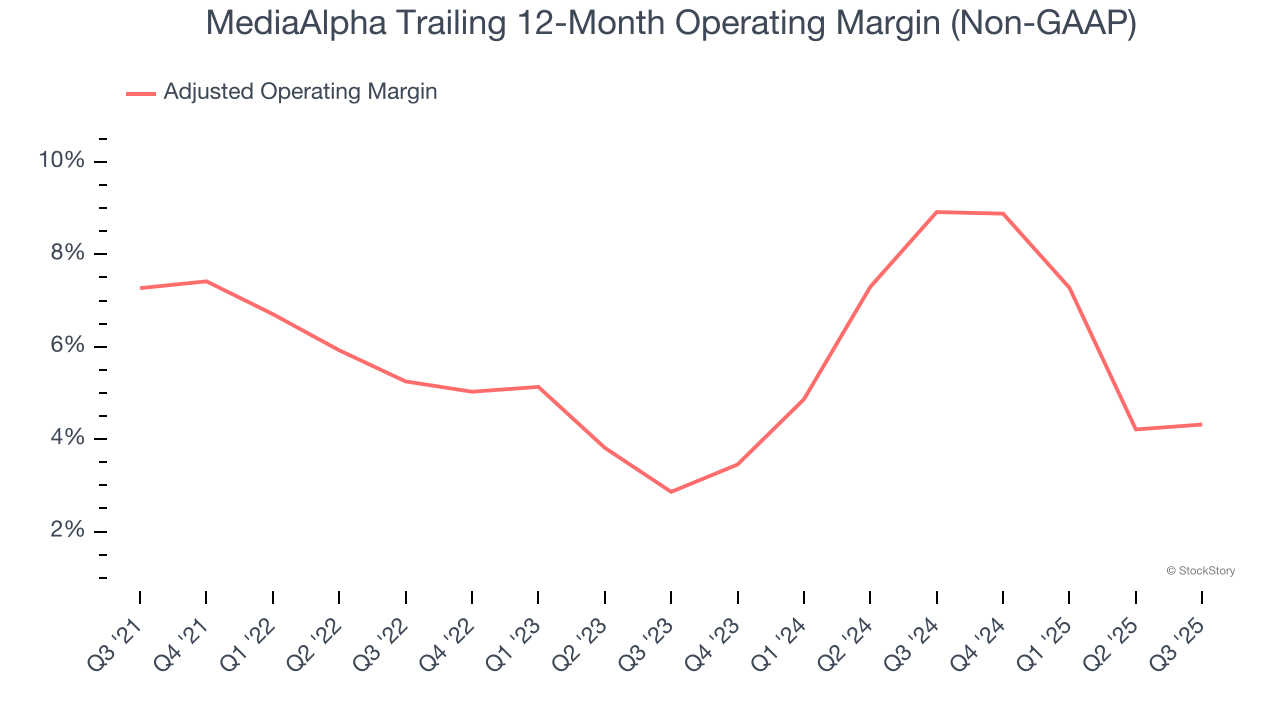

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

MediaAlpha was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 5.8% was weak for a business services business.

Looking at the trend in its profitability, MediaAlpha’s adjusted operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. MediaAlpha’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, MediaAlpha generated an adjusted operating margin profit margin of 8.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

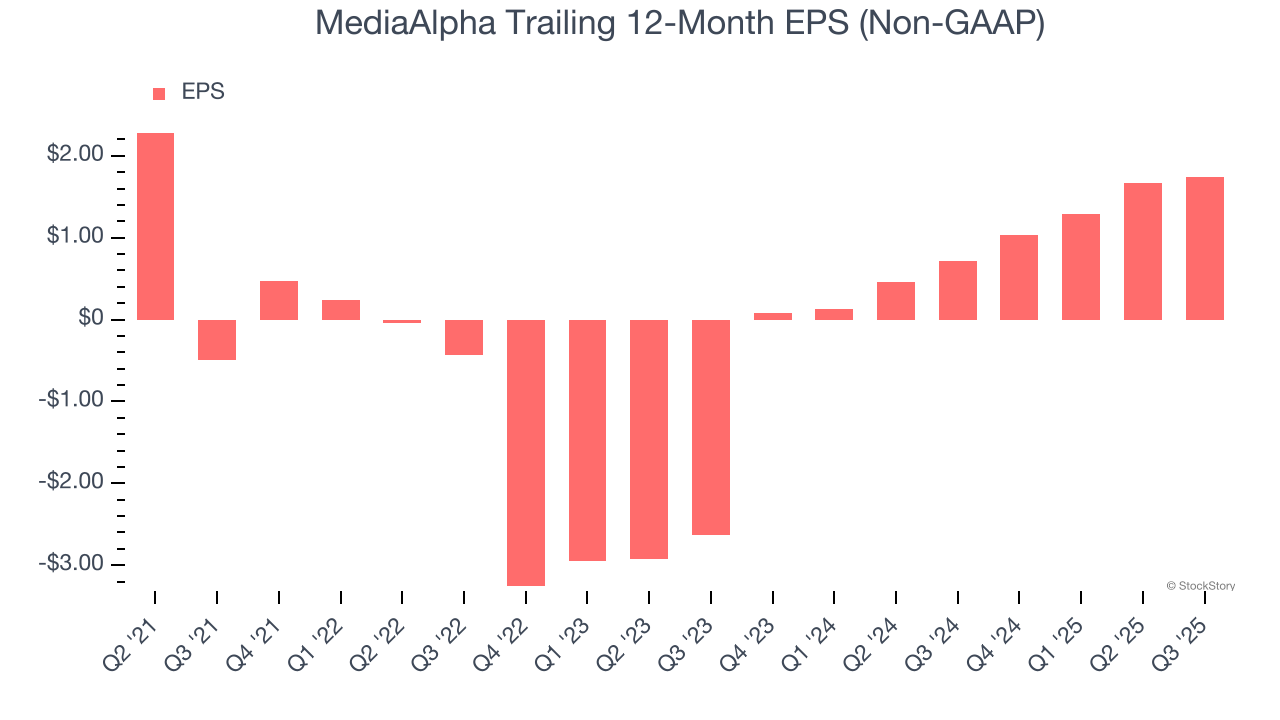

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

MediaAlpha’s full-year EPS flipped from negative to positive over the last four years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For MediaAlpha, its two-year annual EPS growth of 63.1% was higher than its four-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, MediaAlpha reported adjusted EPS of $0.40, up from $0.33 in the same quarter last year. This print beat analysts’ estimates by 8.2%. Over the next 12 months, Wall Street expects MediaAlpha’s full-year EPS of $1.74 to shrink by 21.5%. This is unusual as its revenue and operating margin are anticipated to increase, signaling the fall likely stems from "below-the-line" items such as taxes.

Key Takeaways from MediaAlpha’s Q3 Results

We were impressed by how significantly MediaAlpha blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print had some key positives. The stock remained flat at $12.95 immediately following the results.

Is MediaAlpha an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.