Universal Health Services has been treading water for the past six months, holding steady at $182.25. The stock also fell short of the S&P 500’s 6.9% gain during that period.

Is there a buying opportunity in Universal Health Services, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Universal Health Services Not Exciting?

We're cautious about Universal Health Services. Here are three reasons why you should be careful with UHS and a stock we'd rather own.

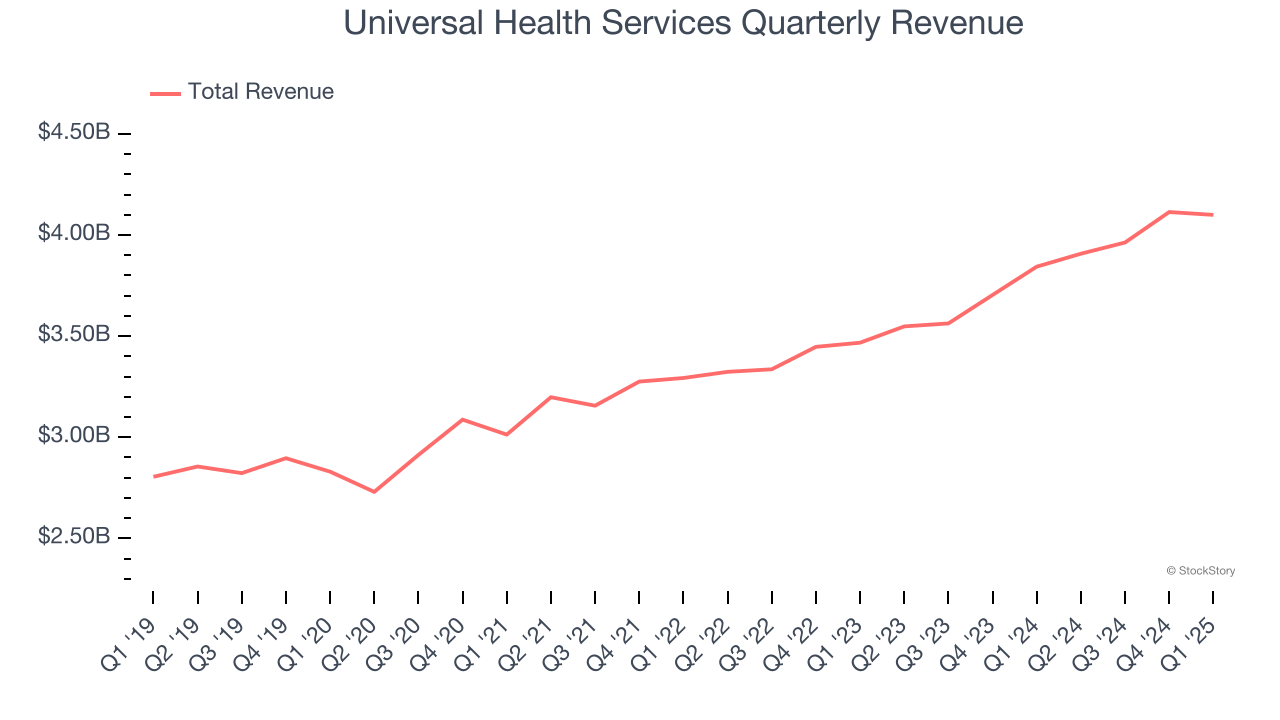

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Universal Health Services’s 7.1% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector.

2. Same-Store Sales Falling Behind Peers

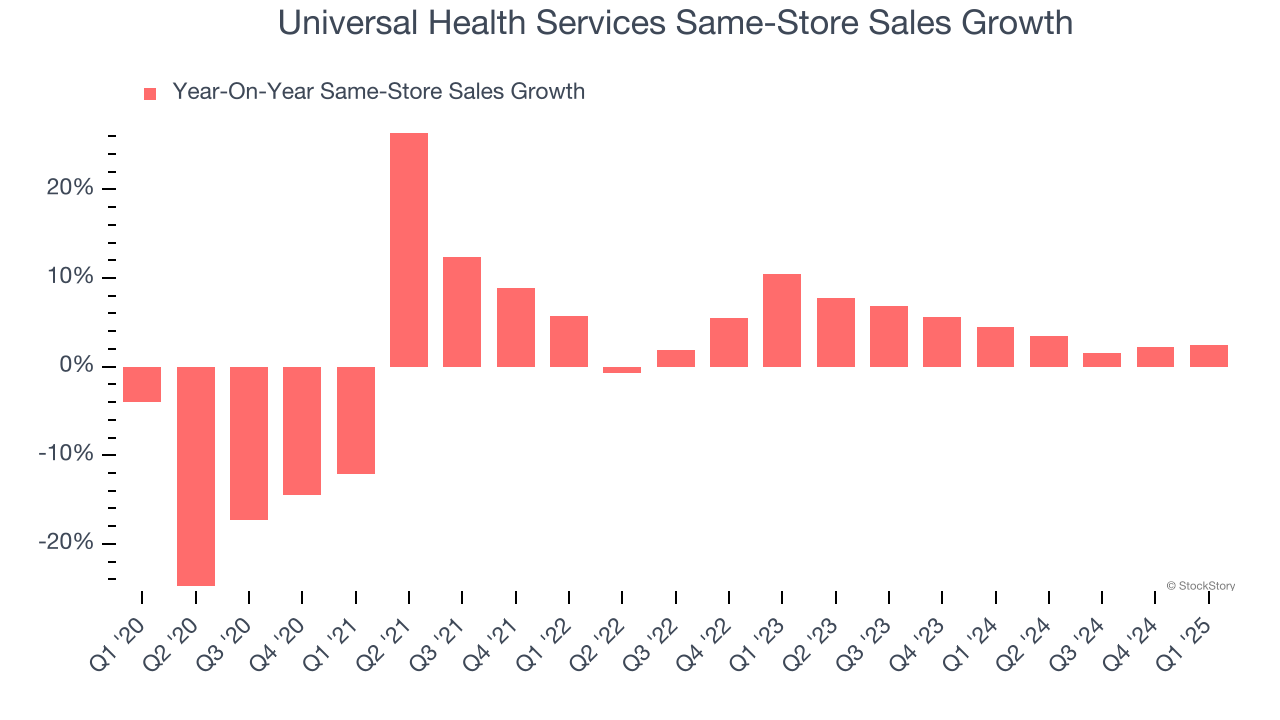

Investors interested in Hospital Chains companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Universal Health Services’s underlying demand characteristics.

Over the last two years, Universal Health Services’s same-store sales averaged 4.3% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

3. Free Cash Flow Margin Dropping

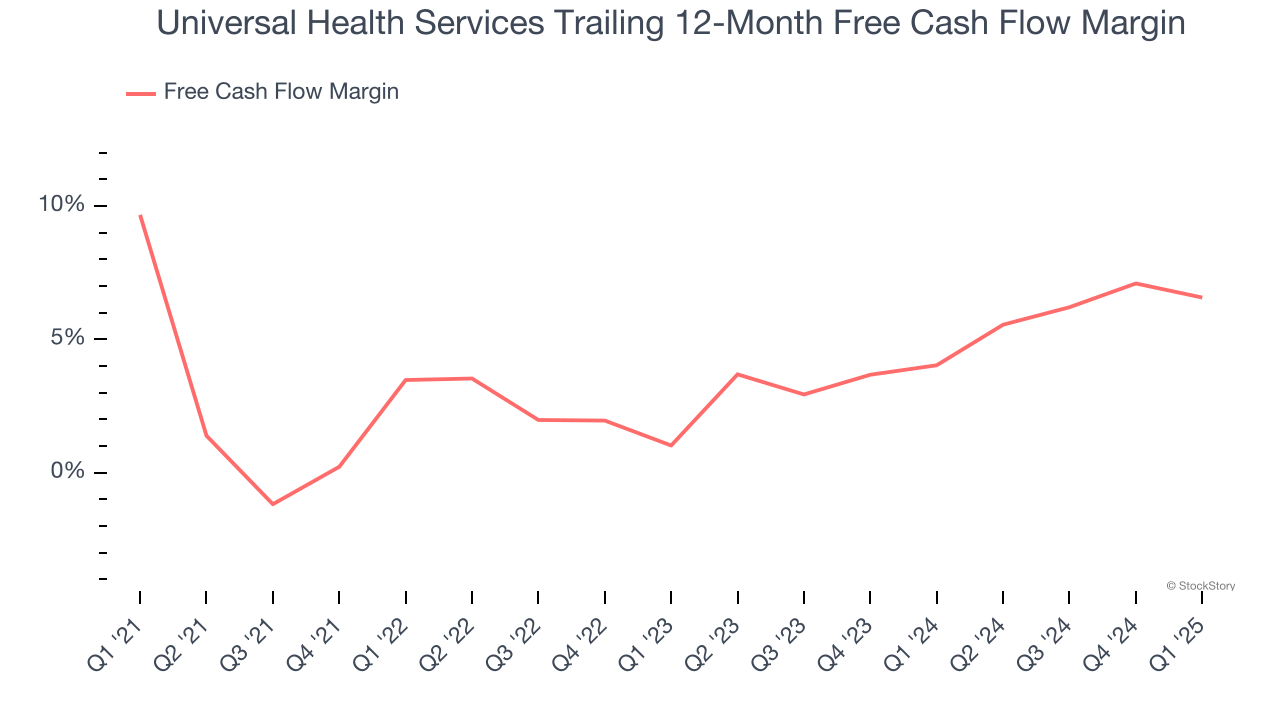

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Universal Health Services’s margin dropped by 3.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Universal Health Services’s free cash flow margin for the trailing 12 months was 6.6%.

Final Judgment

Universal Health Services isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 9.2× forward P/E (or $182.25 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Universal Health Services

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.