Since July 2020, the S&P 500 has delivered a total return of 97.3%. But one standout stock has doubled the market - over the past five years, Meta has surged 195% to $720.98 per share. Its momentum hasn’t stopped as it’s also gained 17.1% in the last six months, beating the S&P by 10.2%.

Is now still a good time to buy META? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Are We Positive On Meta?

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

1. Eye-Popping Growth in Customer Spending

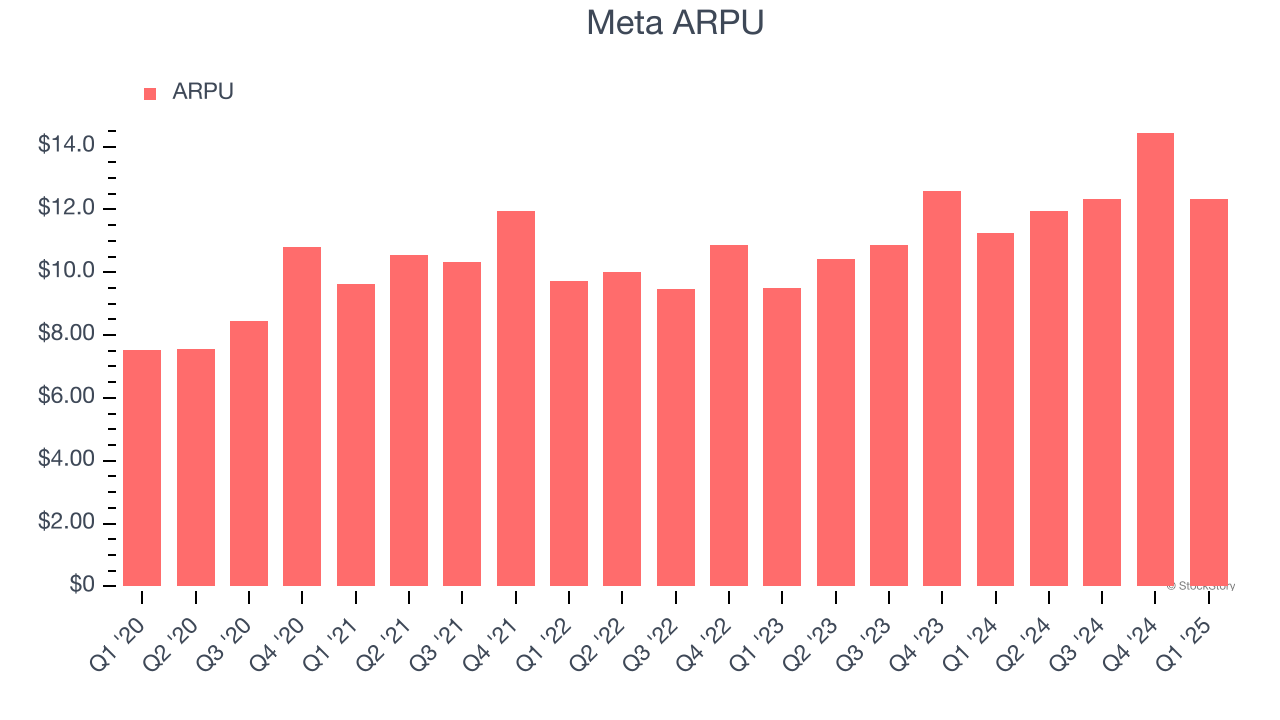

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta’s audience and its ad-targeting capabilities.

Meta’s ARPU growth has been exceptional over the last two years, averaging 13.3%. Its ability to increase monetization while growing its daily active people demonstrates its platform’s value, as its users are spending significantly more than last year.

2. EBITDA Margin Reveals a Well-Run Organization

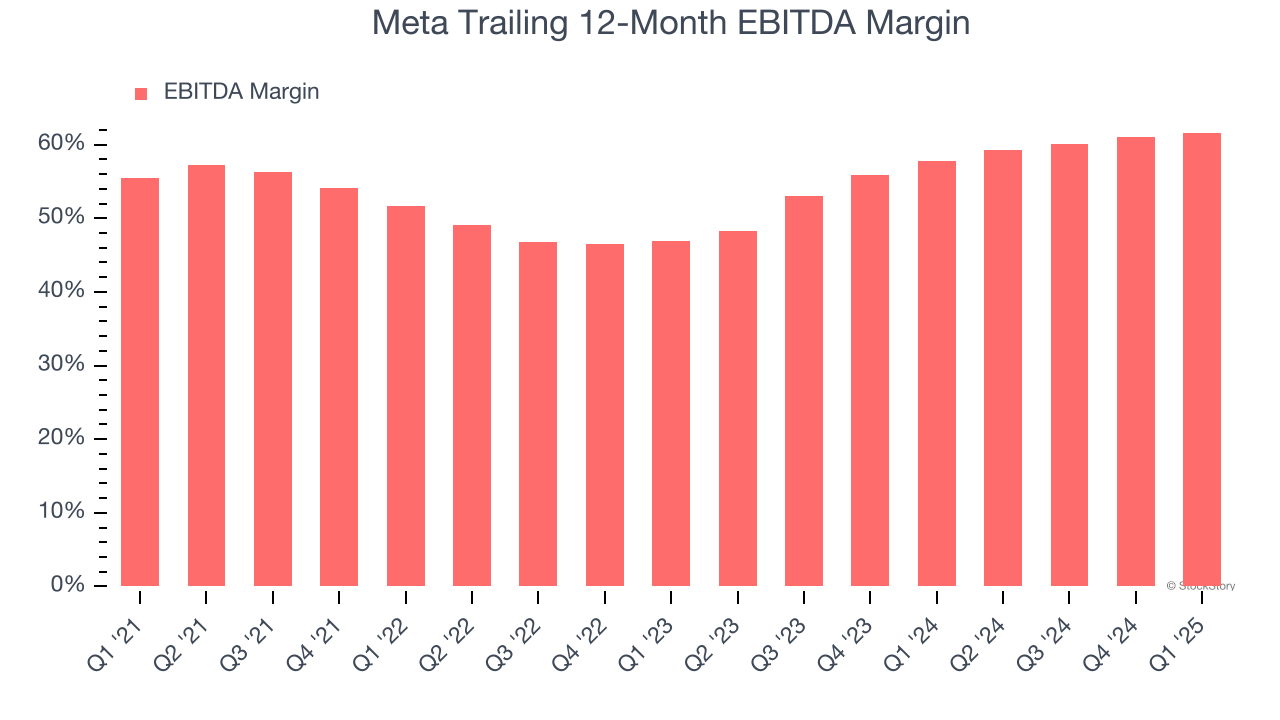

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Meta has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 59.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

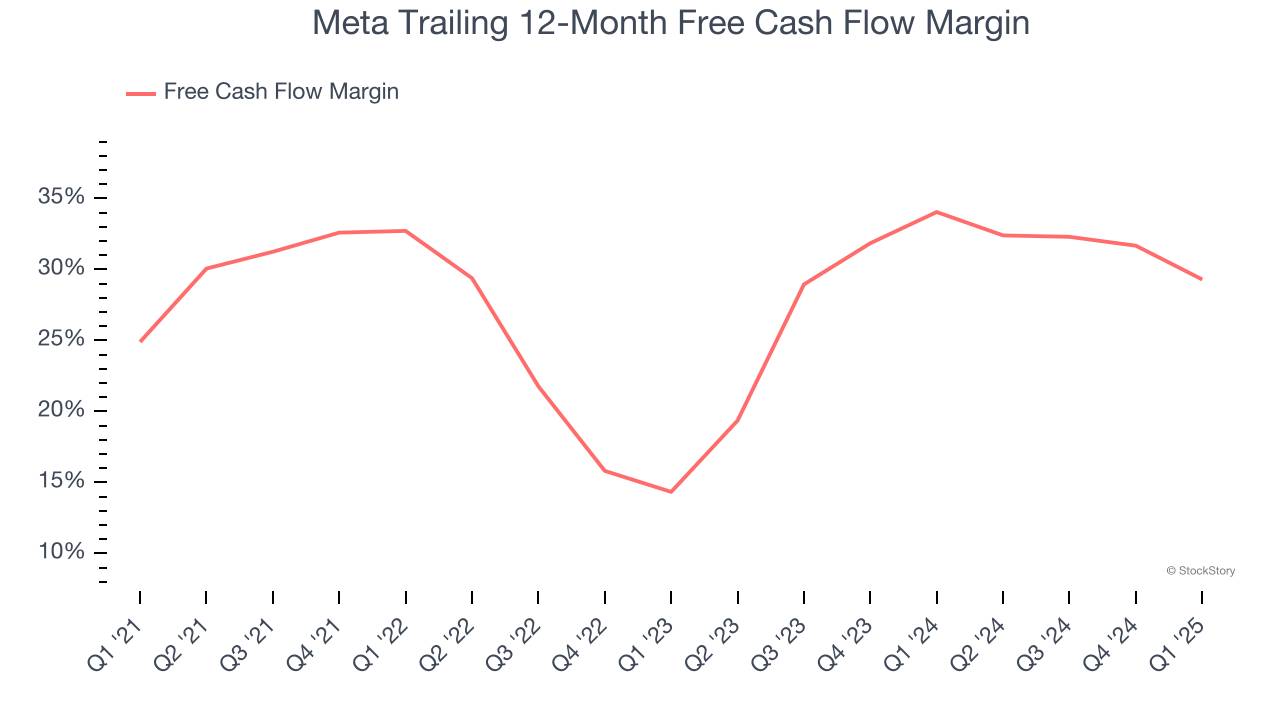

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Meta has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 31.5% over the last two years.

Final Judgment

These are just a few reasons why we think Meta is a great business, and with its shares outperforming the market lately, the stock trades at 16.3× forward EV/EBITDA (or $720.98 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Meta

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.