What a fantastic six months it’s been for Photronics. Shares of the company have skyrocketed 88.5%, hitting $34.53. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy PLAB? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does PLAB Stock Spark Debate?

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Two Things to Like:

1. Operating Margin Rising, Profits Up

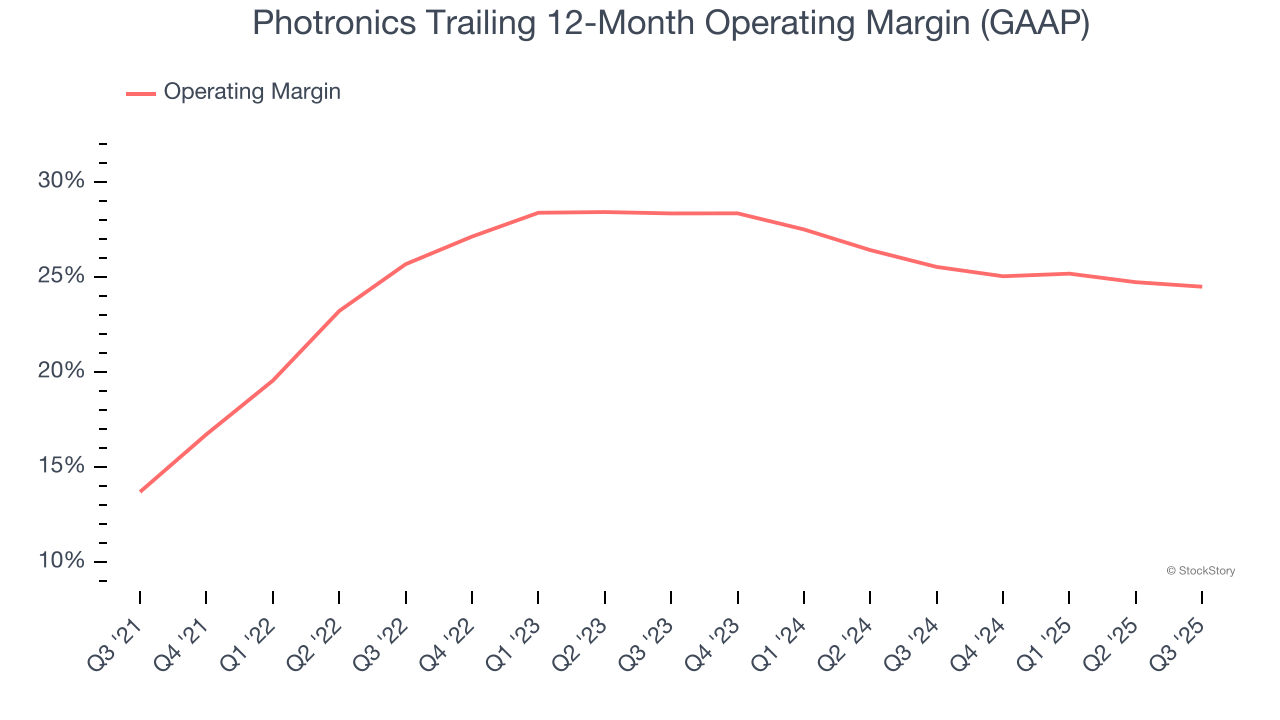

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Photronics’s operating margin rose by 10.8 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 24.5%.

2. Outstanding Long-Term EPS Growth

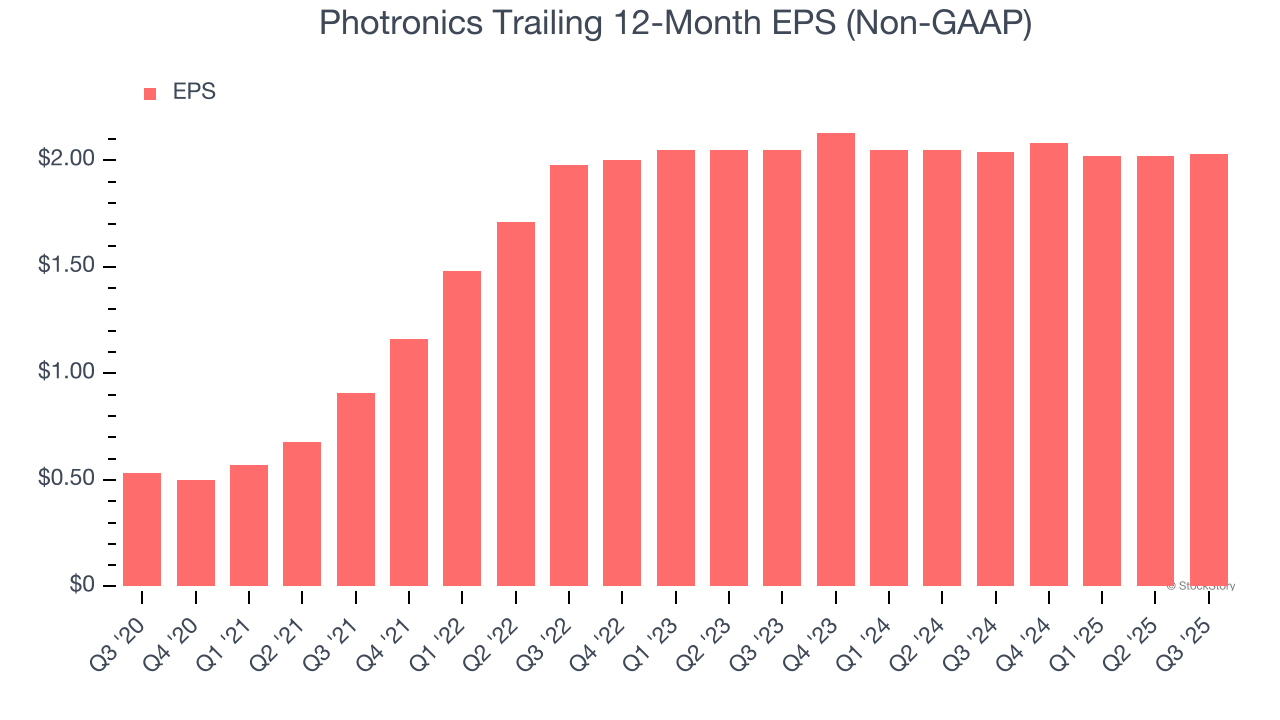

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Photronics’s EPS grew at an astounding 30.8% compounded annual growth rate over the last five years, higher than its 6.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Revenue Tumbling Downwards

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Photronics’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.4% over the last two years.

Final Judgment

Photronics’s merits more than compensate for its flaws, and with the recent rally, the stock trades at 15.7× forward P/E (or $34.53 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.