Wellness products company Nature’s Sunshine (NASDAQ: NATR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 12% year on year to $128.3 million. The company’s full-year revenue guidance of $478 million at the midpoint came in 2.3% above analysts’ estimates. Its non-GAAP profit of $0.36 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Nature's Sunshine? Find out by accessing our full research report, it’s free for active Edge members.

Nature's Sunshine (NATR) Q3 CY2025 Highlights:

- Revenue: $128.3 million vs analyst estimates of $120.3 million (12% year-on-year growth, 6.7% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.16 (significant beat)

- Adjusted EBITDA: $15.19 million vs analyst estimates of $10.49 million (11.8% margin, 44.8% beat)

- The company lifted its revenue guidance for the full year to $478 million at the midpoint from $467.5 million, a 2.2% increase

- EBITDA guidance for the full year is $48 million at the midpoint, above analyst estimates of $43.8 million

- Operating Margin: 7%, up from 4.6% in the same quarter last year

- Free Cash Flow Margin: 13.1%, up from 6.9% in the same quarter last year

- Market Capitalization: $249.2 million

“The momentum in our business continued to accelerate in the third quarter, with record net sales of $128 million and adjusted EBITDA of $15 million, representing year-over-year growth of 12% and 42%, respectively,” said Shane Jones, CFO of Nature’s Sunshine.

Company Overview

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $474.5 million in revenue over the past 12 months, Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

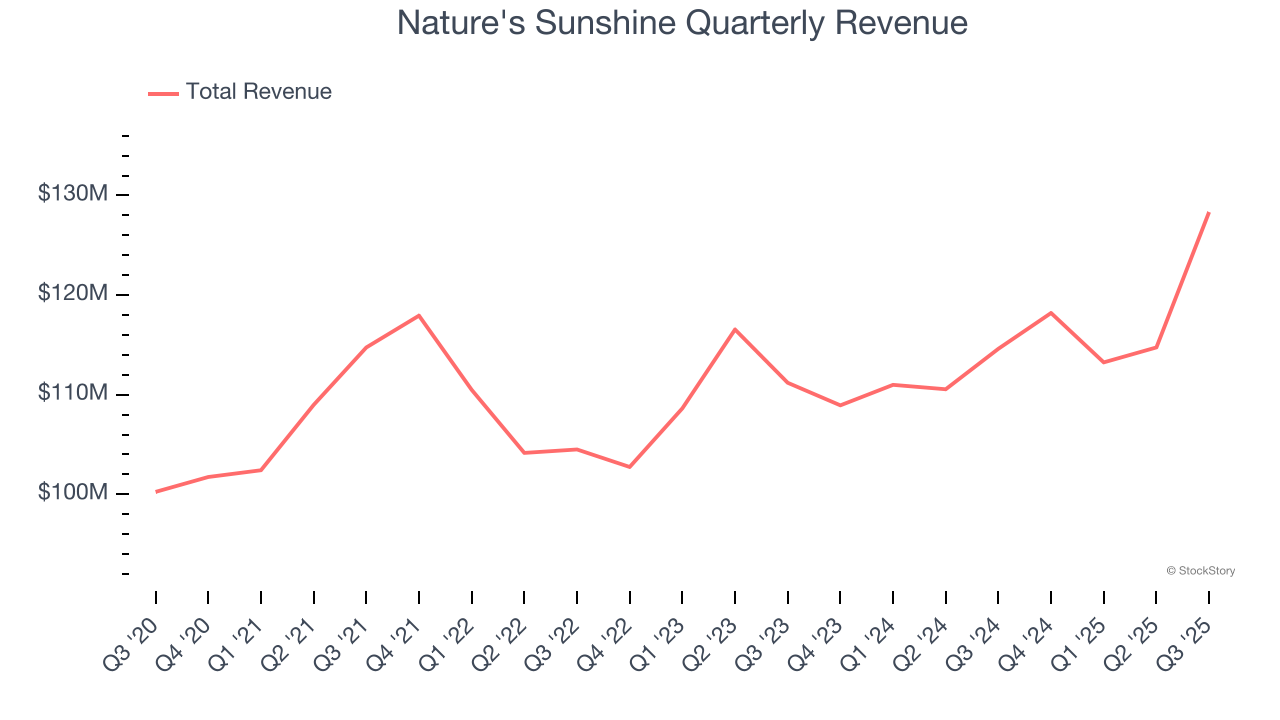

As you can see below, Nature's Sunshine grew its sales at a sluggish 2.8% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Nature's Sunshine reported year-on-year revenue growth of 12%, and its $128.3 million of revenue exceeded Wall Street’s estimates by 6.7%.

Looking ahead, sell-side analysts expect revenue to grow 1% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

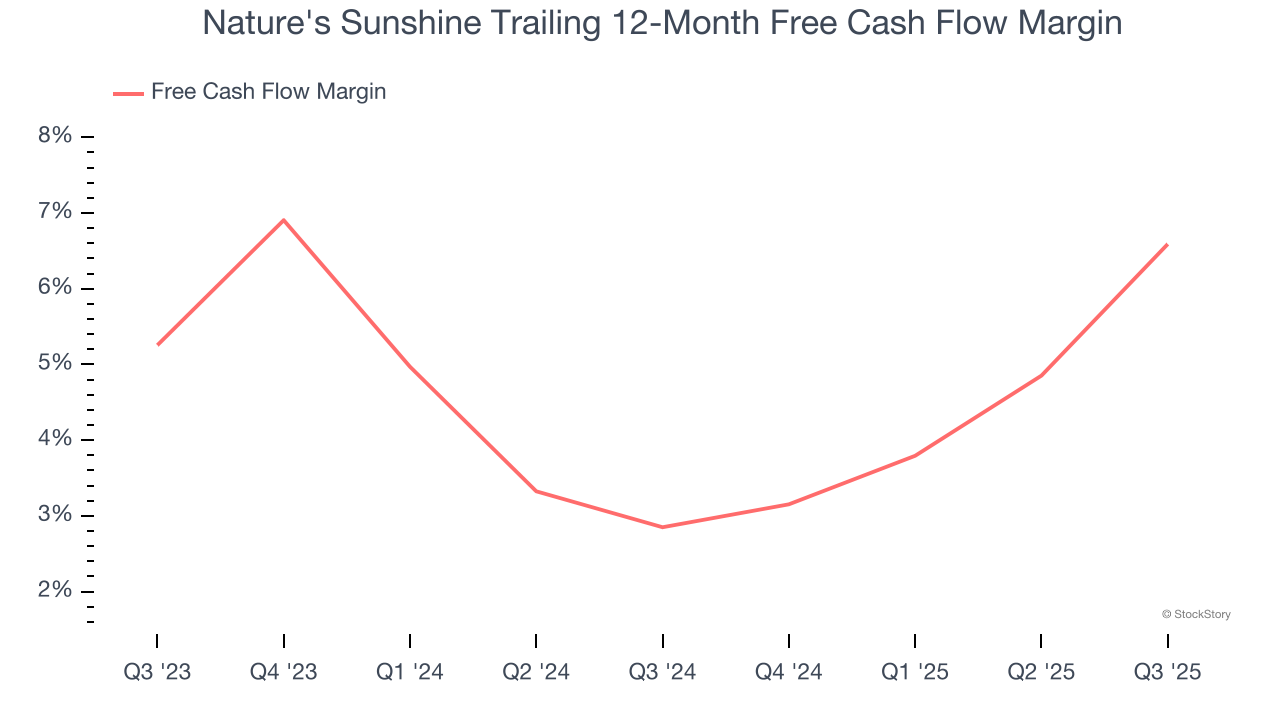

Nature's Sunshine has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.8%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Nature's Sunshine’s margin expanded by 3.7 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Nature's Sunshine’s free cash flow clocked in at $16.79 million in Q3, equivalent to a 13.1% margin. This result was good as its margin was 6.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Nature's Sunshine’s Q3 Results

It was good to see Nature's Sunshine beat analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited it lifted its full-year revenue and EBITDA guidance. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.8% to $14.25 immediately following the results.

Nature's Sunshine put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.