Over the last six months, ServiceNow’s shares have sunk to $821.52, producing a disappointing 19.6% loss - a stark contrast to the S&P 500’s 11.3% gain. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for NOW? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On ServiceNow?

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE: NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

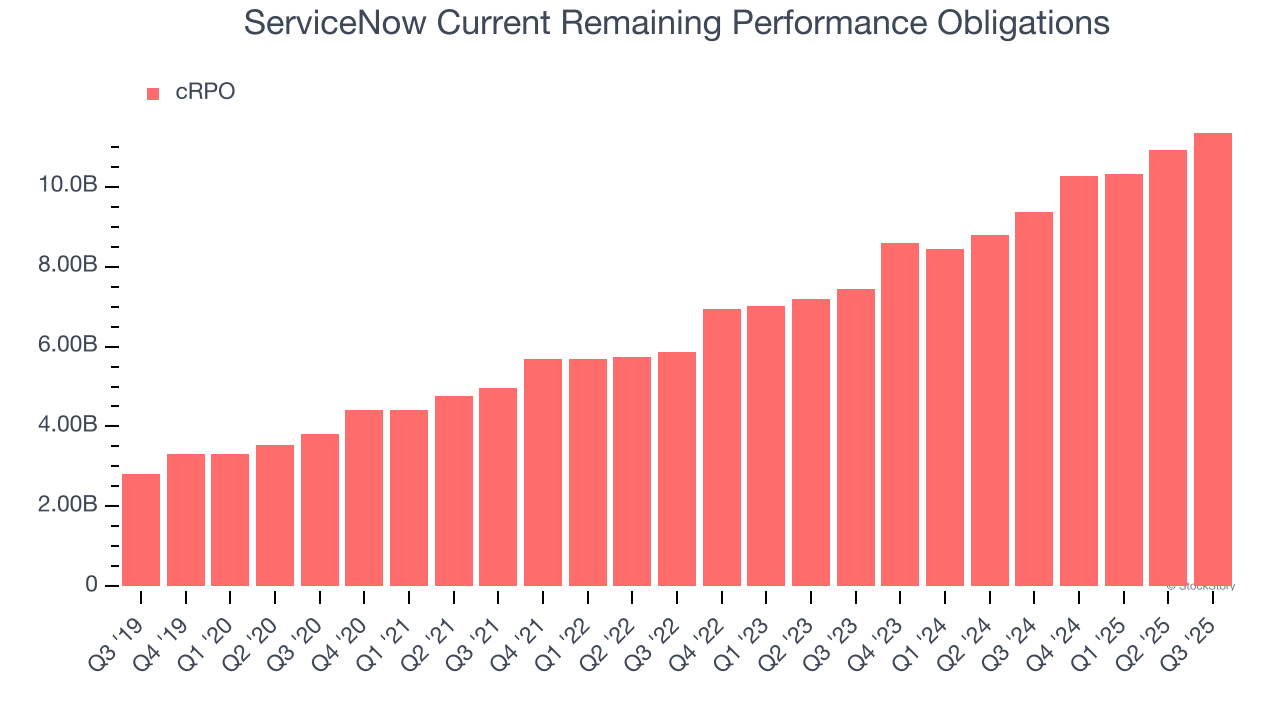

1. Surging cRPO Locks In Future Sales

In addition to reported revenue, it is useful to analyze cRPO, or current remaining performance obligations, for ServiceNow because it shows the value of contracted services to be delivered over the next year. It therefore gives visibility into future revenue.

ServiceNow’s cRPO punched in at $11.35 billion in Q3, and over the last four quarters, its year-on-year growth averaged 21.8%. This performance was impressive and shows the company has a robust pipeline of undelivered services. Its growth also suggests that customers are committing to long-term contracts, enhancing ServiceNow’s predictability and providing a tailwind to its valuation.

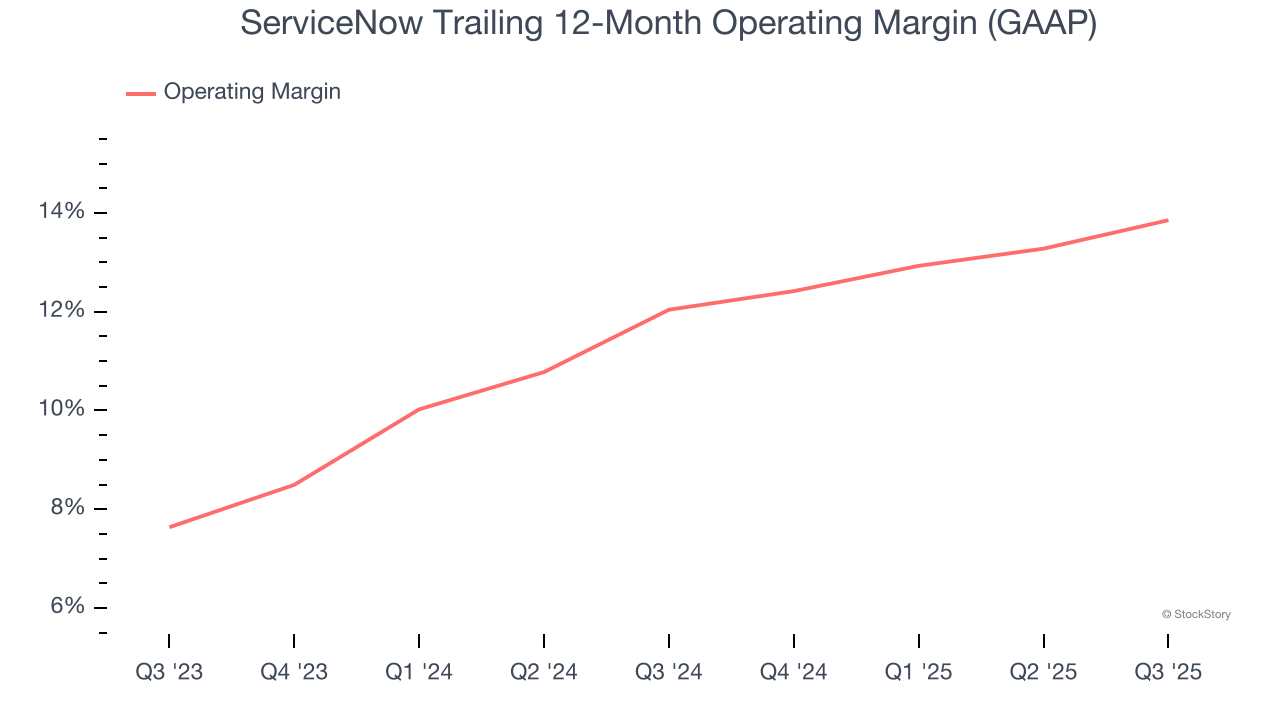

2. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

ServiceNow has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 13.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

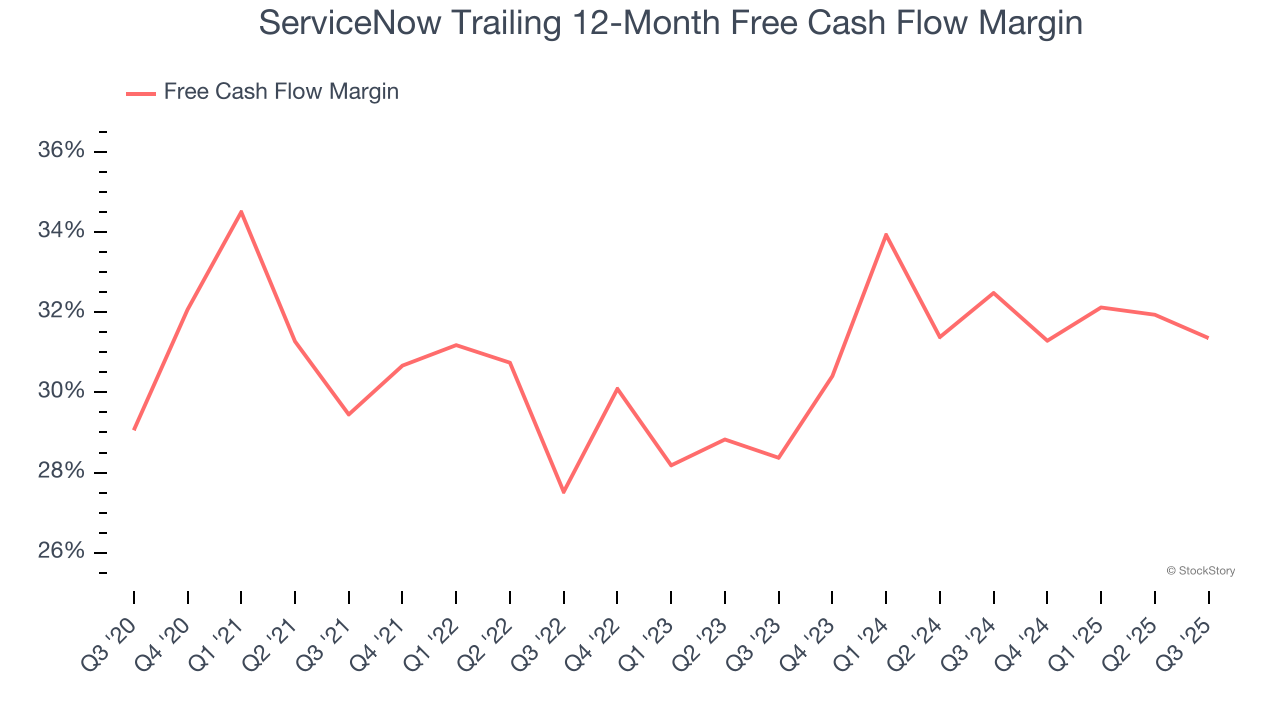

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

ServiceNow has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.4% over the last year.

Final Judgment

These are just a few reasons why we're bullish on ServiceNow. After the recent drawdown, the stock trades at 11.4× forward price-to-sales (or $821.52 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.