Investment management firm Cohen & Steers (NYSE: CNS) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 6.4% year on year to $141.7 million. Its non-GAAP profit of $0.81 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Cohen & Steers? Find out by accessing our full research report, it’s free for active Edge members.

Cohen & Steers (CNS) Q3 CY2025 Highlights:

- Revenue: $141.7 million vs analyst estimates of $138.8 million (6.4% year-on-year growth, 2.1% beat)

- Pre-tax Profit: $55.56 million (39.2% margin, 17.8% year-on-year decline)

- Adjusted EPS: $0.81 vs analyst estimates of $0.78 (3.8% beat)

- Market Capitalization: $3.39 billion

Company Overview

Founded in 1986 as a pioneer in real estate investment trusts (REITs), Cohen & Steers (NYSE: CNS) is an investment manager specializing in real estate securities, infrastructure, real assets, and preferred securities for institutional and individual investors.

Revenue Growth

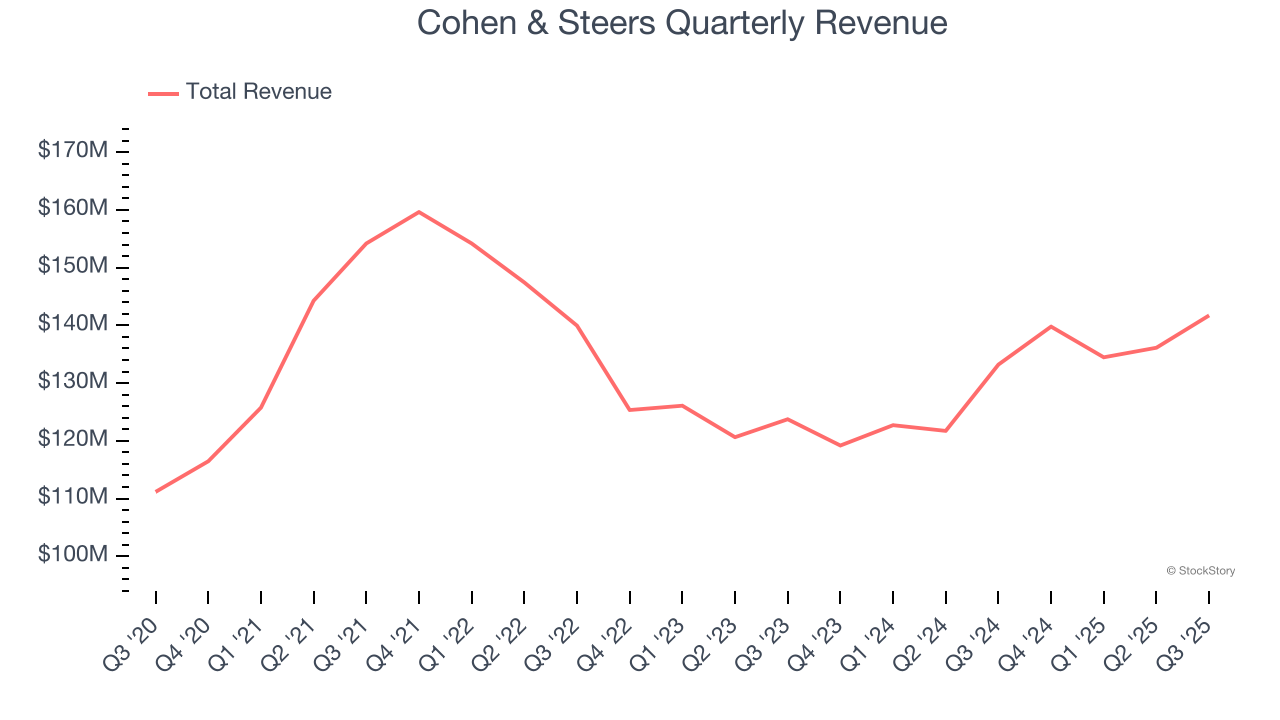

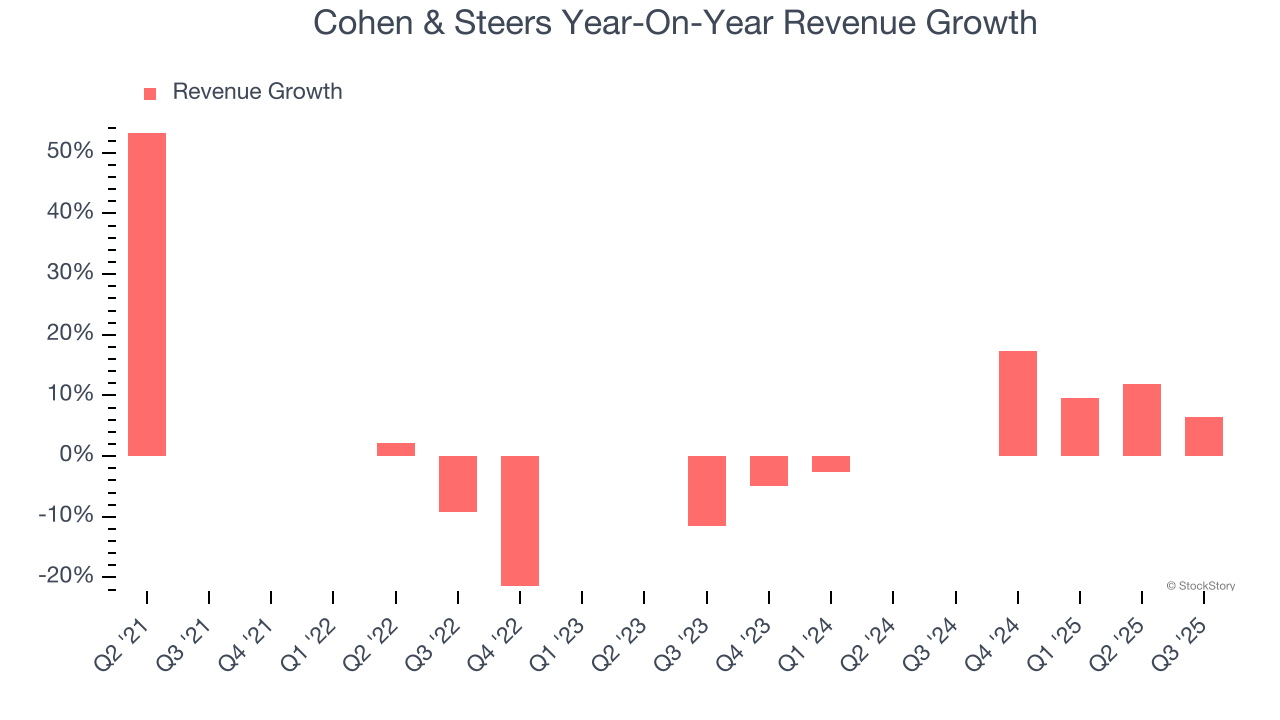

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Cohen & Steers grew its revenue at a mediocre 6.2% compounded annual growth rate. This fell short of our benchmark for the financials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Cohen & Steers’s annualized revenue growth of 5.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Cohen & Steers reported year-on-year revenue growth of 6.4%, and its $141.7 million of revenue exceeded Wall Street’s estimates by 2.1%.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Cohen & Steers’s Q3 Results

It was encouraging to see Cohen & Steers beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2% to $67.12 immediately following the results.

Sure, Cohen & Steers had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.