Wrapping up Q3 earnings, we look at the numbers and key takeaways for the leisure facilities stocks, including United Parks & Resorts (NYSE: PRKS) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 12 leisure facilities stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 4.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.5% since the latest earnings results.

United Parks & Resorts (NYSE: PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE: PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

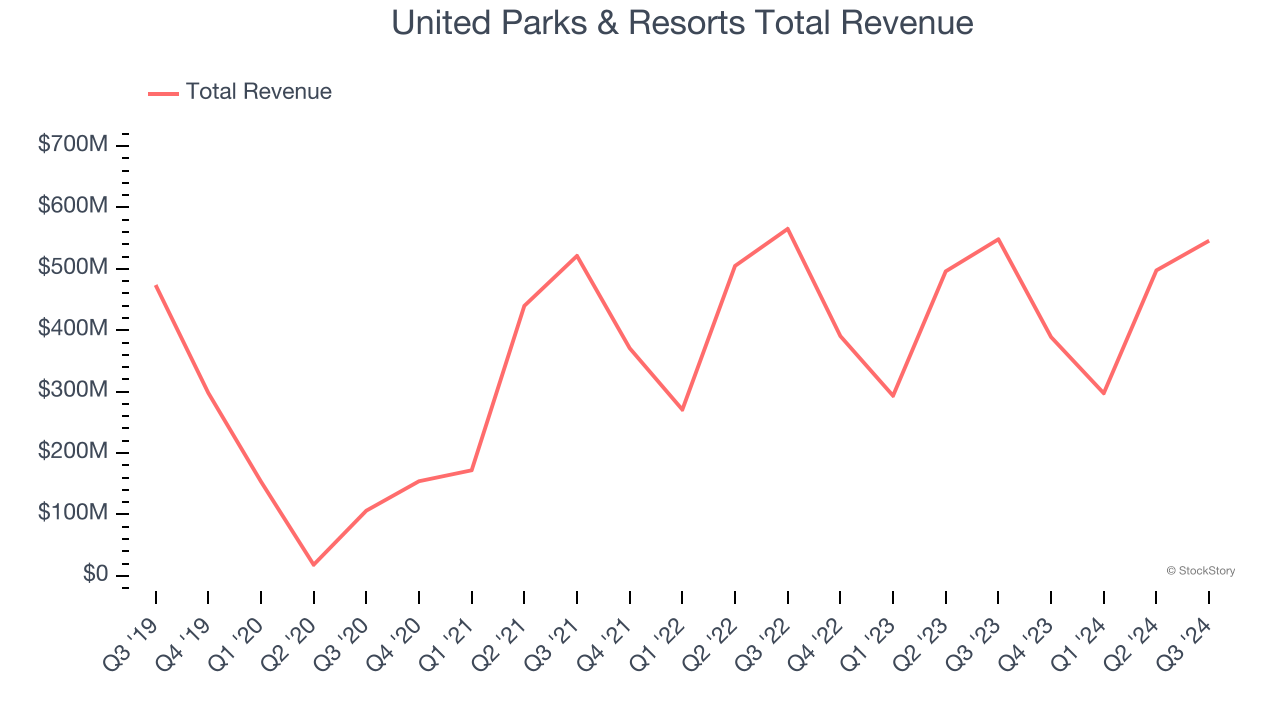

United Parks & Resorts reported revenues of $545.9 million, flat year on year. This print fell short of analysts’ expectations by 0.8%. Overall, it was a slower quarter for the company with a miss of analysts’ visitors and adjusted operating income estimates.

"We are pleased to report another quarter of solid financial results, said Marc Swanson, Chief Executive Officer of United Parks & Resorts Inc. "Third quarter results were impacted by both a negative calendar shift and meaningfully worse weather, including Hurricane Debby in August and Hurricane Helene in September.

Unsurprisingly, the stock is down 4.1% since reporting and currently trades at $54.50.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it’s free.

Best Q3: Live Nation (NYSE: LYV)

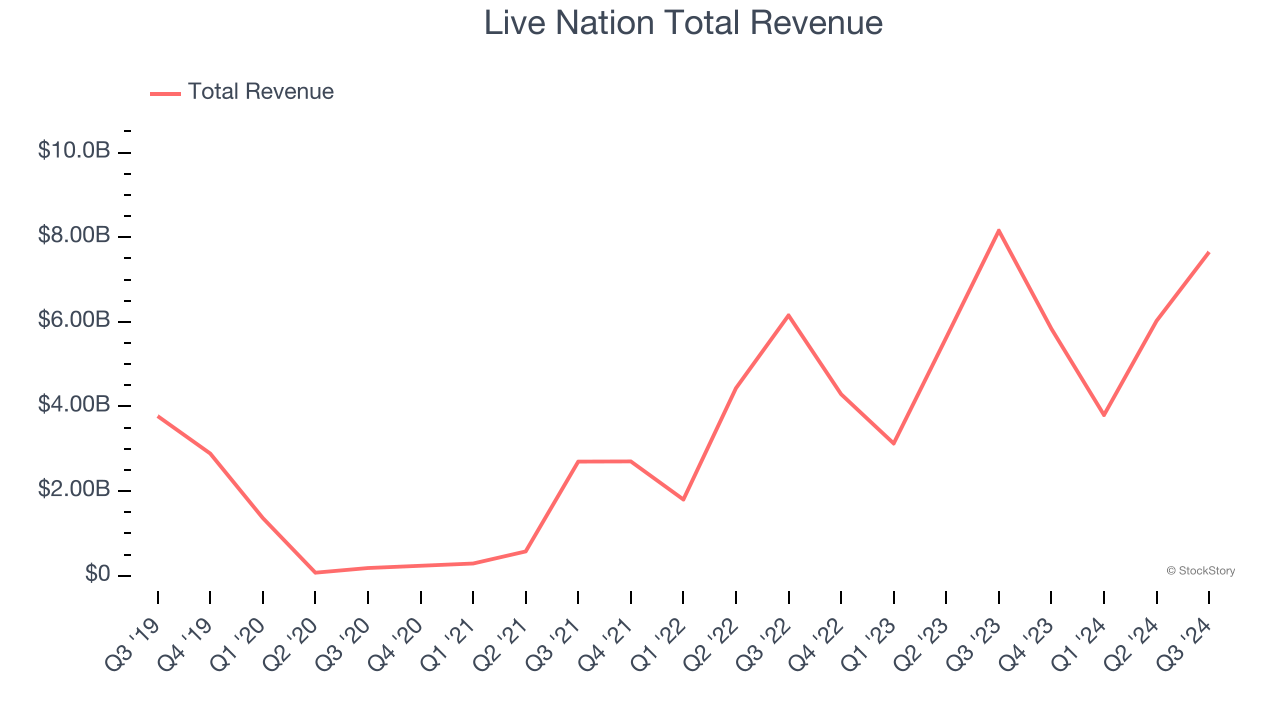

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $7.65 billion, down 6.2% year on year, falling short of analysts’ expectations by 2.1%. However, the business still had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 7.6% since reporting. It currently trades at $133.32.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Dave & Buster's (NASDAQ: PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $453 million, down 3% year on year, falling short of analysts’ expectations by 2.3%. It was a softer quarter as it posted a significant miss of analysts’ EPS and adjusted operating income estimates.

Dave & Buster's delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 19.1% since the results and currently trades at $29.79.

Read our full analysis of Dave & Buster’s results here.

Bowlero (NYSE: BOWL)

Operating over 300 locations globally, Bowlero (NYSE: BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

Bowlero reported revenues of $260.2 million, up 14.4% year on year. This result topped analysts’ expectations by 4.3%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates and full-year revenue guidance slightly topping analysts’ expectations.

Bowlero delivered the highest full-year guidance raise among its peers. The stock is up 13.8% since reporting and currently trades at $11.80.

Read our full, actionable report on Bowlero here, it’s free.

Topgolf Callaway (NYSE: MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $1.01 billion, down 2.7% year on year. This print surpassed analysts’ expectations by 3.2%. More broadly, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is down 17.4% since reporting and currently trades at $7.80.

Read our full, actionable report on Topgolf Callaway here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.