The New York-based KKR & Co. Inc. (KKR) is a global investment firm that offers alternative asset management, capital markets expertise, and insurance solutions. Holding a market cap of roughly $93.4 billion, it allocates capital across real assets, credit, and liquid strategies while serving institutional and individual clients with retirement, life, reinsurance, and bespoke capital solutions.

Market performance, however, has tested investor patience. Over the past 52 weeks, KKR & Co.’s shares fell nearly 35.5%, even as the S&P 500 Index ($SPX) advanced 12.2%. Year-to-date (YTD), the stock declined 22.2%, while the broader benchmark experienced only a modest pullback.

Sector comparison sharpened the contrast as the State Street Financial Select Sector SPDR ETF (XLF) gained 3.1% over the past year and slipped 2.7% YTD. Although hardly stellar, the results are still better than KKR & Co.’s steeper declines.

On Feb. 5, KKR & Co.’s shares dropped 5.4% after the company unveiled its fourth-quarter 2025 results, wherein adjusted EPS declined 15.2% year over year to $1.12, missing the Street’s forecasts of $1.16.

There was good news, too. Management crowned 2025 a record fundraising year, hauling in $129 billion, nearly twice what it raised two years earlier. Credit strategies alone set a $68 billion record. Infrastructure swelled from $17 billion to $100 billion, and private equity assets under management (AUM) doubled, mocking gloomy headlines.

The longer-term picture reads far better than the quarter suggests. With $118 billion of dry powder, management believes KKR & Co. is exceptionally positioned to shape its future portfolio.

Analysts also see acceleration ahead. For fiscal year 2026, ending in December, Wall Street projects diluted EPS of $6.11, implying 38.9% year-over-year growth. Notably, KKR & Co. has beaten EPS expectations in two of the past four quarters while missing in the remaining two.

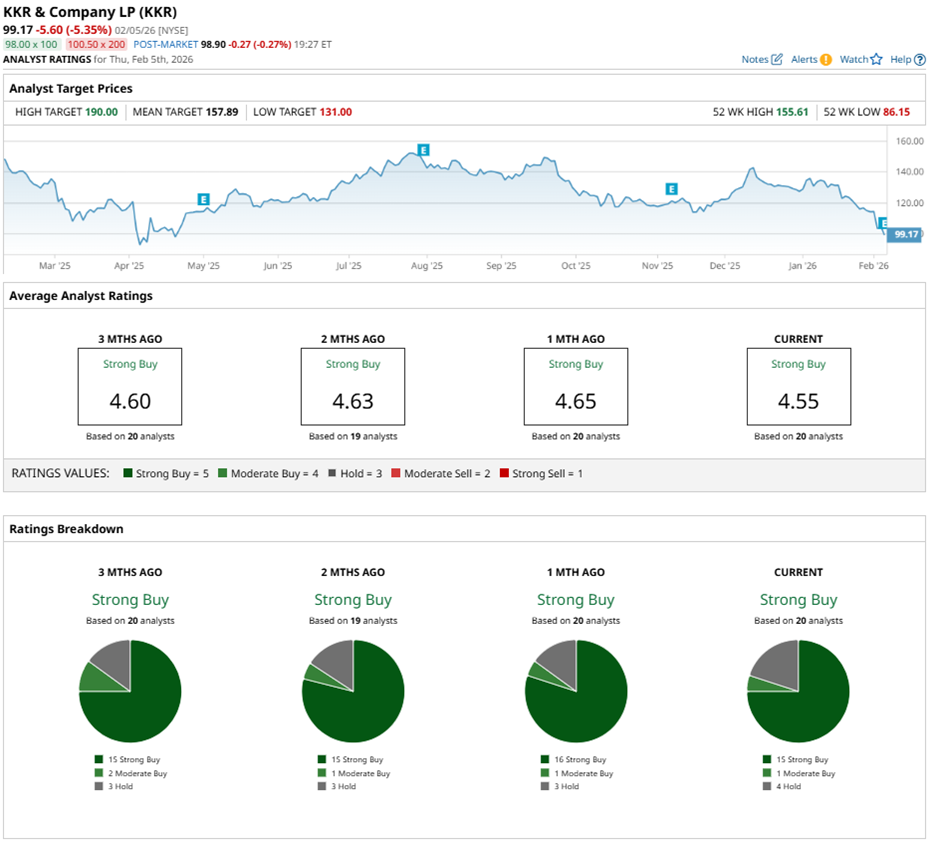

Wall Street is optimistic despite recent pressure on KKR stock, assigning it an overall “Strong Buy” rating. Out of 20 analysts, 15 recommend a “Strong Buy,” one favors a “Moderate Buy,” and four advise a “Hold.”

The current sentiment mirrors views from three months ago, when 15 analysts also labeled the stock a “Strong Buy.”

That backdrop of steady analyst conviction and management’s growth outlook has strengthened the upside narrative. KKR’s average price target of $157.89 implies potential upside of 59.2%. Meanwhile, the Street-high target of $190 suggests a gain of 91.6% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Dividend Stock to Buy Now as Trump Tackles Housing Affordability

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.