Palo Alto Networks (PANW) reported adjusted free cash flow (FCF) in its fiscal Q2 that was up 27% year-over-year. Moreover, on a trailing 12-month basis, adj. FCF was 37.9% of sales, up from 34.4% a year ago. As a result, its value is significantly higher than today's price.

PANW closed at $150.99 on Thursday, Feb. 19, down from its recent peak of $163.50 on Feb. 17, when its fiscal Q2 ended January 31, 2026. PANW stock is now down $70.39, or -31.8% from its peak of $221.38 on Oct. 28, 2025.

This downfall may have gone too far, especially given its strong results and management's good outlook guidance. For example, has Palo Alto Networks, Inc. really lost almost ⅓ of its underlying true value, as its stock price's drop seems to indicate?

It doesn't seem so, as a reasonable target price based on its FCF margins is $187, or over 24% higher than today's price. This article will show why.

Strong FCF and FCF Margin Results

Palo Alto Networks, a global leader in AI cybersecurity solutions, with over 70,000 clients, makes most of its revenue from SaaS subscriptions. They tend to renew once a year, and it books most of that cash flow in Q1.

As a result, it makes sense to review the company's results on a trailing 12-month (TTM) basis to iron out quarterly lumps.

So, for example, for its fiscal Q2 ending Jan. 31, 2026, Palo Alto Networks generated $3.747 billion in adjusted TTM FCF. That compared to $2.952 billion in the TTM period a year ago, a gain of +27.4% YoY.

That TTM FCF also represented 37.9% of its TTM revenue of $9.894 billion (TTM revenue taken from Stock Analysis).

Not only is that a higher adj. FCF margin than a year ago ($2.952b/$8.570b, or 34.4%), but it's also below management's guidance for 2026.

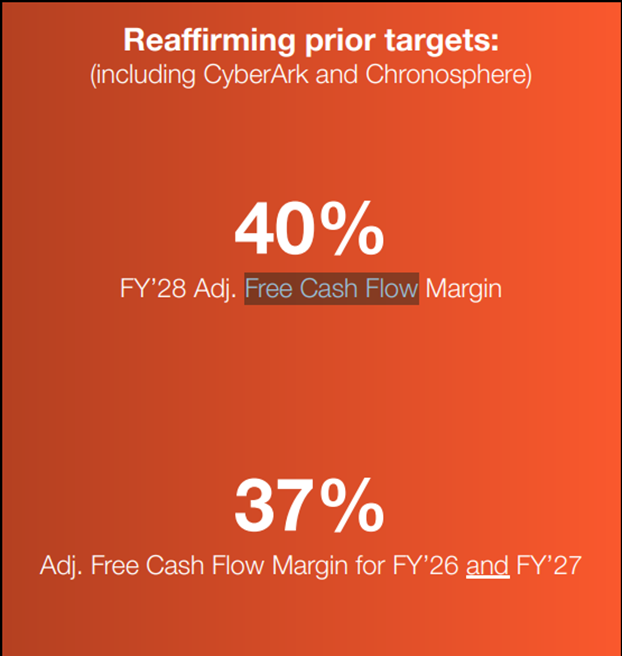

For example, on page 16 of the Feb. 17, 2026, earnings release deck, management has a slide showing they expect the next 2 years to have a 37% margin, eventually rising to 40%:

So, if Palo Alto can continue to make 38% in trailing 12-month (TTM) adjusted FCF margins, it will outperform management's guidance. That should lead to a higher target price (TP).

Forecasting Higher FCF

For example, management projects that revenue for this fiscal year ending July 31 will be between $11.28 billion and $11.31 billion, or $11.30 billion on average. And analysts are forecasting $13.56 billion in revenue next year.

So, for the next 12 months (NTM), revenue could reach $12.43 billion.

So, if Palo Alto Networks can make at least a 37% adjusted FCF margin, based on management's guidance, its FCF could rise 23%. Here's why:

$12.43 billion NTM revenue x 37% = $4.6 billion NTM FCF

$4.6b / $3.7475b TTM FCF = 1.2276 -1 = +22.8%

That implies that its target price could be 23% higher. Let's look at that.

Target Prices for PANW Stock

One way to value a company based on its free cash flow (FCF) is to see what the dividend yield would be if its FCF was 100% paid out to shareholders.

So, for example, PANW now has a market cap of $122 billion, according to Yahoo! Finance. So, its TTM FCF yield is about 3.0%.

$3.747b TTM FCF Q2 / $122 billion = 0.0307 = 3.07%

That implies the market would give PANW stock a 3.0% dividend yield if 100% of FCF were to be paid out as a dividend.

So, let's apply that to our NTM forecast:

$4.6 NTM FCF / 0.03 = $153.33 billion market cap

That is +25.6% higher than its present market cap of $122 billion. In other words, PANW stock could be worth 25.6% more:

$1150.99 x 1.256 = $189.64 target price (TP)

That TP is 25.6% higher than today's price.

Other analysts agree that PANW is undervalued. For example, Yahoo! Finance reports that 56 analysts have an average TP of $210.59. Similarly, Barchart's mean survey TP is $222.51.

AnaChart.com, which tracks recent analysts' write-ups, shows that 36 analysts now have an average PT of $193.36. That is 28% higher than Thursday's close.

The bottom line is that PANW stock is too cheap here. I will show several ways to play this in a future Barchart article.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart