Valued at $39.7 billion by market cap, Comfort Systems USA, Inc. (FIX) is a leading mechanical and electrical contracting company that designs, installs, and maintains HVAC, plumbing, piping, and building automation systems for commercial, industrial, and institutional facilities. Headquartered in Houston, Texas, the company delivers both large project installations and recurring maintenance services across complex end markets, including data centers, semiconductor fabs, healthcare, and manufacturing.

Shares of FIX have outperformed the broader market considerably over the past year. FIX has gained 247% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.7%. In 2026, FIX stock is up 47.2%, surpassing SPX’s marginal rise on a YTD basis.

Zooming in further, have outperformed the State Street Industrial Select Sector SPDR Fund’s (XLI) 27.1% return over the past 52 weeks and 13.7% rally in 2026.

On Feb. 19, Comfort Systems released its fiscal 2025 fourth-quarter earnings, and its shares popped 4.1%. Its revenue rose 41.7% year over year to $2.64 billion, and EPS climbed 129.1% from the year-ago quarter to $9.37, far exceeding expectations and reflecting robust demand across its mechanical and electrical contracting markets. Operating cash flow also surged to $468.5 million, reflecting strong project execution and profitability. The company’s backlog expanded sharply to a record $11.94 billion at year-end, nearly double year over year, highlighting powerful demand momentum and a deep pipeline of future work.

For the current fiscal year, ending in December, analysts expect FIX’s EPS to grow 6% to $30.61 on a diluted basis. The company’s earnings surprise history is solid. It beat the consensus estimate in each of the last four quarters.

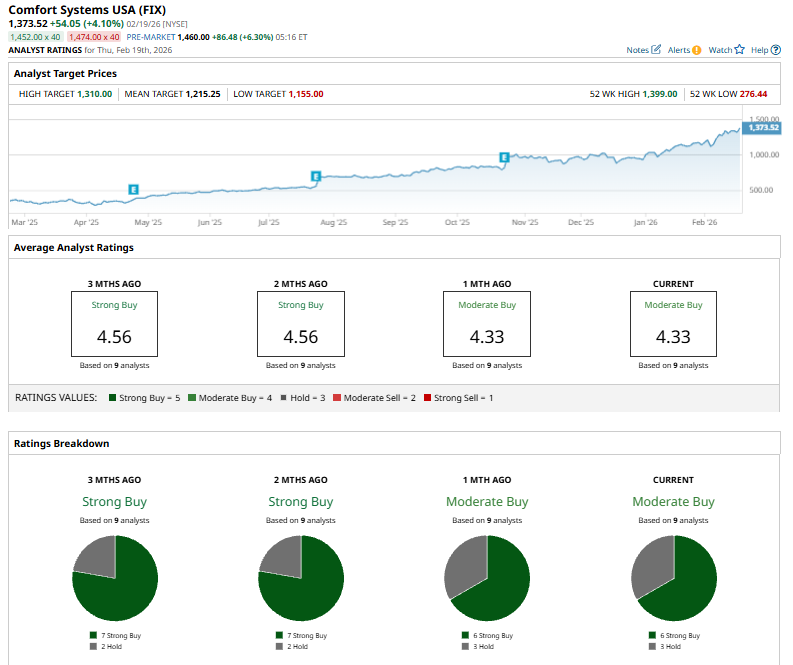

Among the 14 analysts covering FIX stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings and three “Holds.”

The current consensus is bearish than two months ago when the stock had an overall “Strong Buy” rating.

On Jan. 26, Stifel analyst Brian Brophy reaffirmed his “Buy” rating on Comfort Systems and modestly raised the price target to $1,196 from $1,155, reflecting a 3.6% increase and continued confidence in the company’s outlook.

FIX currently trades above both the mean price target of $1,215.25 and the Street-high price target of $1,310.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart