Rolling Meadows, Illinois-based Arthur J. Gallagher & Co. (AJG) provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide. With a market cap. of $56.1 billion, it operates through Brokerage and Risk Management segments.

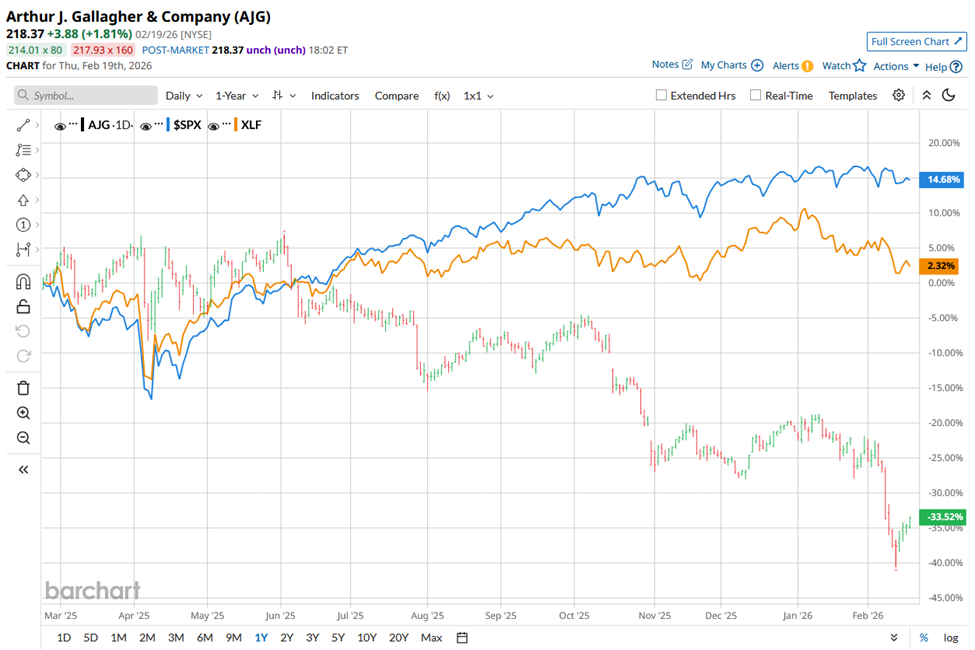

Shares of Arthur J. Gallagher have underperformed the broader market over the past 52 weeks. AJG stock has declined 33.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.4%. Moreover, shares of the company are down 16.2% on a YTD basis, compared to SPX’s marginal gain.

Narrowing the focus, AJG stock has also lagged behind the State Street Financial Select Sector SPDR ETF’s (XLF) 1.1% rise over the past 52 weeks.

AJG shares rose 1.4% following the release of its Q4 2025 results on Jan. 29. Its revenue for the quarter amounted to $3.6 billion and beat the Street’s estimates. Moreover, the company’s adjusted EPS came in at $2.36, which also surpassed Wall Street estimates.

In addition, on Feb. 9, AJG shares dropped nearly 10% after OpenAI launched a suite of insurance-native applications within its ChatGPT App Library, which pose a direct threat to the traditional brokerage model.

For the current year ending in December 2026, analysts expect AJG’s EPS to grow 24% year-over-year to $13.26 on a diluted basis. The company’s earnings surprise history is mixed. It surpassed the consensus estimate in two of the last four quarters while missing on two other occasions.

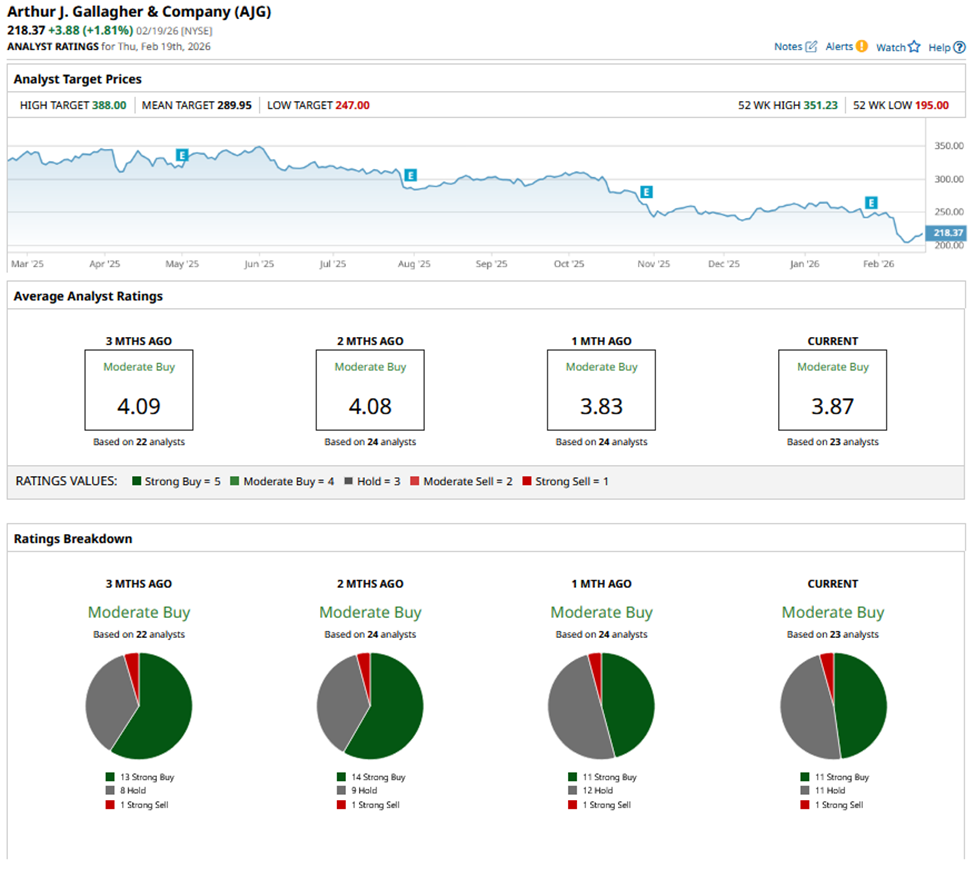

Among the 23 analysts covering AJG stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, 11 “Holds,” and one “Strong Sell”.

On Feb. 2, Citigroup analyst Matthew Heimermann maintained a “Neutral” rating on Arthur J. Gallagher stock and raised its price target from $277 to $280.

The mean price target of $289.95 indicates 32.8% premium to AJG’s current price levels. Its Street-high target of $388 suggests a 77.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump “May Be Required to Refund Billions of Dollars” After Supreme Court Overturns Tariffs, Hurts ‘Trillions of Dollars’ in Trade Deals

- Unusual Options Activity Alert: If You Own These 3 Stocks, It’s Time for a Protective Collar

- Oracle Stock Plunges 55%: Buy the Dip or Stay Away?

- This Indicator Called the Akamai Stock Correction. Now It’s Flashing Buy.